Why so much anger towards people on welfare?

Anonymous

| If people aren't paying taxes because they are poor, so earn so little they aren't taxed, is that something I should be upset about? How shitty of a person do you have to be to let a poor person's plight anger you? Sweep around your own front door. |

Anonymous

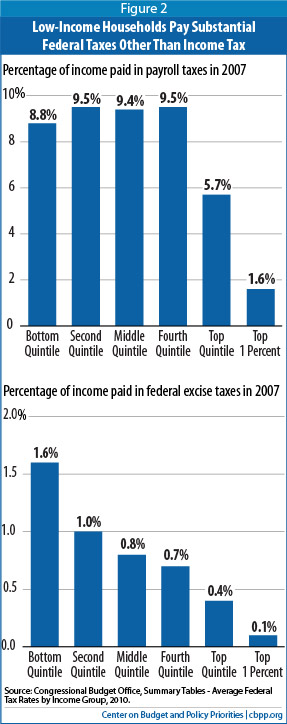

Another fabulous graph from PP’s article!

The poor pay taxes! They pay more payroll tax. SNAP and Aid for needy families, which have work requirements (and subject to payroll tax!!) should be seen as hard working people getting their pay back. Just like the mortgage deduction, or 529s or 401Ks! Some of you are really living a big lie. |

Anonymous

| I have contempt for corporate welfare but not poor people OP. |

Anonymous

Those are not income tax, and other people pay those too. Do you think the poor shouldn’t pay sales tax or property tax either? |

Anonymous

Poor people generally don’t own homes. |

Anonymous

They pay a payroll tax, isn’t that income?! |

Anonymous

True but the argument is that poor people do not pay taxes. Oh wait, did you move the goalpost ?! |

Anonymous

NP. Shockingly, people can have things happen in their lives that cause them to fall into poverty after previously being able to afford a home. (It could even happen to you.) |

Anonymous

| Let’s not punch down. |

Anonymous

No. That’s the tax that funds social security. |

Anonymous

PP above me mentioned property tax as a tax poor people pay. It’s not an income tax. |

Anonymous

But it’s still based on income. It’s still a tax. |

Anonymous

|

The focus on federal income tax ignores State and Local taxes. Low-income families also pay substantial state and local taxes. Most state and local

taxes are regressive, meaning that low-income families pay a larger share of their incomes in these taxes than wealthier households do. The bottom fifth of taxpayers paid 12.3 percent of their incomes in state and local taxes in 2011, according to the Institute on Taxation and Economic Policy (ITEP). That was well above the 7.9 percent average rate that the top 1 percent of households paid. Poor people are not takers. They pay too! |

Anonymous

|

Reasons why we hate the poor:

Life time on state aid.. Health insurance Food stamps Housing Education Monthly cash Add anything I miss on my list. Then you wonder why people have such hatred toward a group of people or we feel obligated to support for life. GTFO |

Anonymous

Right, I think the first couple of million dollars of taxes have covered that… |