Why so much anger towards people on welfare?

Anonymous

+1 million, leeches on city budgets to make money through violence |

Anonymous

Fired for what? For relating to the customer the store policy? |

Anonymous

|

Anonymous

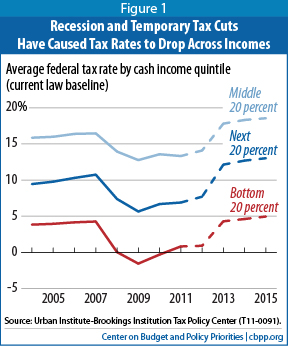

| 40% of Americans pay no federal tax at all, while receiving a ton of benefits. |

Anonymous

Because they don’t make enough money to pay federal taxes. Pay them better. |

Anonymous

— low-income households as a group do, in fact, pay federal taxes. Congressional Budget Office data show that the poorest fifth of households paid an average of 4.0 percent of their incomes in federal taxes in 2007, the latest year for which these data are available — not an insignificant amount given how modest these households’ incomes are; the poorest fifth of households had average income of $18,400 in 2007. The next-to-the bottom fifth — those with incomes between $20,500 and $34,300 in 2007 — paid an average of 10.6 percent of their incomes in federal taxes. |

Anonymous

Awww. It’s precious that you think that’s why people with money have money. |

Anonymous

Elderly and people on disability fall into this group. But when all federal, state, and local taxes are taken into account, the bottom fifth of households pays about 16 percent of their incomes in taxes, on average. The second-poorest fifth pays about 21 percent. |

Anonymous

No. Not income taxes. https://www.npr.org/sections/thetwo-way/2012/09/18/161333783/romneys-wrong-and-right-about-the-47-percent |

Anonymous

| The utter contempt and loathing for the working poor on this thread is really something else. |

Anonymous

From the article you posted: "many of those who don't pay income tax do pay other taxes — federal payroll and excise taxes as well as state and local income, sales, and property taxes." |

Anonymous

Just another Republican lie. |

Anonymous

It’s sadly ubiquitous in America. It’s gross. |

Anonymous

It's absolutely disgusting. |

Anonymous

This stat comes from the Great Recession when our economy almost collapsed.

(From the article PP posted) |