The worst presidents in the post WWII era

Anonymous

who do you think those banks were selling their loans to?

|

Anonymous

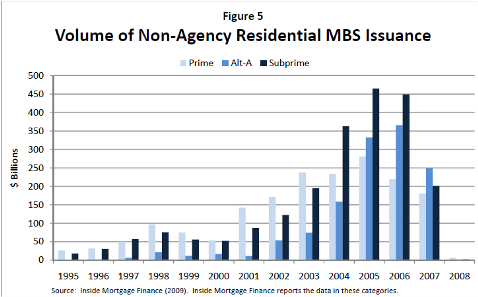

My, what short memories we have. Have you already forgotten about the unregulated mortage backed securities?

|

Anonymous

Shh. PP's got a "truth" that flatters his political inclinations. It would be unkind to disabuse him of it. |

Anonymous

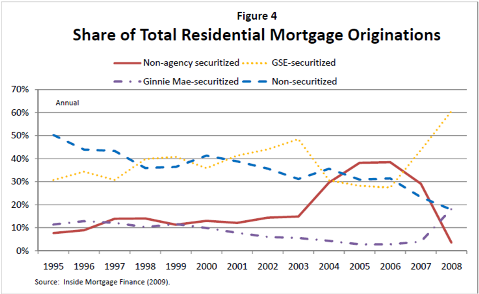

| And I would add that F&F actually held *less* of these toxic MBS than other banks. |

Anonymous

yet were the largest individual holders. moreover, they set and legitimized the market. |

Anonymous

|

Anonymous

| yeah, 30% is a small part of the market. how retarded are you? seriously. |

Anonymous

Since when has "sitting on your hands" been interpreted as "hands were tied"? |

Anonymous

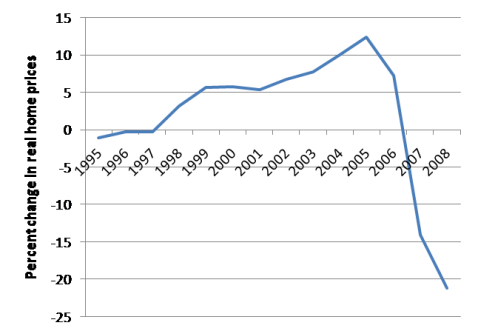

I think the point is that the private market share quadrupled while ff share went down by 1/4 prior to the meltdown. It is therefore difficult to argue that ff led or made the market In any other environment we would look at that graph and say that a new competitor (the private mbs) entered the market and drove down prices (rates and credit terms in this case). I think ff should be held accountable like any other institution that did bad lending. But to pretend that they set the market price is silly. |

Anonymous

http://krugman.blogs.nytimes.com/2011/12/20/fannie-freddie-follies In any case, two further points: first, the main problem with F&F is that they were two government entities that were privatized during the privatization craze, but of course, were still given GSE status. Just more privatizing gains and socializing risk a la post-Reagan conservative consensus. Secondly, as bad as F&F were, there were markedly more responsible than any of the private players. Had they not existed, the economic damage would've been just as bad if not worse. As far as the current SEC case:

http://www.nytimes.com/2011/12/20/opinion/nocera-an-inconvenient-truth.html |