Is it a good time to buy now?

Anonymous

The dimwit here is obvious |

Anonymous

|

The standard realtor advice is that it's always a good time to buy.

Coincidentally, it's also always a good time to sell. Have to keep that commission gravy train going. |

Anonymous

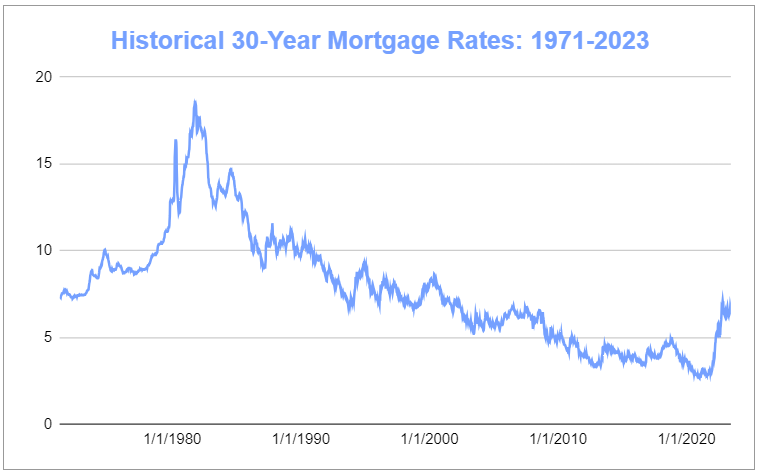

The graph is for 52 years. So yes bad time to buy. |

Anonymous

1)the graph isn’t updated showing the current rates 2)current rates are worst in over 21 years 3) historically high rates, going back multiple decades as shown in the graph, occurred at much much lower home prices when adjusted for inflation. Home prices today are high to reflect a low interest rate environment, which is no longer true, but home prices remain high. |

Anonymous

Realtors are predatory |

Anonymous

| There is a NYT home buying calculator that is quite good. Google that, adjust it for your numbers, then decide. |

Anonymous

Except when they were 17 percent |

Anonymous

You betcha. Suckers |

Anonymous

Home prices were dirt cheap when rates were 17% You could easily argue the combination of mortgage rates and home prices today makes cost of new purchase ownership an all time high |

Anonymous

|

Buying a house now would be like buying a house right before a real estate crash.

With mortgage rates so high, home prices have to drop but that hasn’t happened yet. |

Anonymous

|

Commercial real estate is about to bring down the entire economy. Just wait. Many articles in the past week about credit downgrades at major banks because of CRE. And banks trying to offload huge amounts of CRE loans at a fraction of their original value, and there are no buyers.

Remember how people thought any crash in residential real estate around 2008 wouldn't have a big effect because the economy is so much bigger than just residential real estate? Those people were wrong. Same thing now. |

Anonymous

+1 grab your popcorn and watch the real estate market crash. Sustaining these high rates makes it just a matter of time. |

Anonymous

Why are rates high? To combat inflation. Housing prices will remain stagnant or increase either due to higher inflation or the lower rates that accompany lower inflation. There won’t be a real estate crash because the Fed will lower rates before that happens. The Fed wants to slow the economy, not crash it, and they will lower rates to keep it afloat. |

Anonymous

Real estate is extremely sensitive to interest rate hikes by the fed. The real estate market could easily crash while the rest of the economy is perfectly fine. The fed doesn’t care about real estate at all. |

Anonymous

+1 The fed will just let real estate crash and burn. |

"over 21 years" such a dimwit

"over 21 years" such a dimwit