schools w/ no merit aid

Anonymous

Put that info into css. Health expenses are deducted. Even if it wasn't the base tax year, you can always add a statement of special circumstances. |

Anonymous

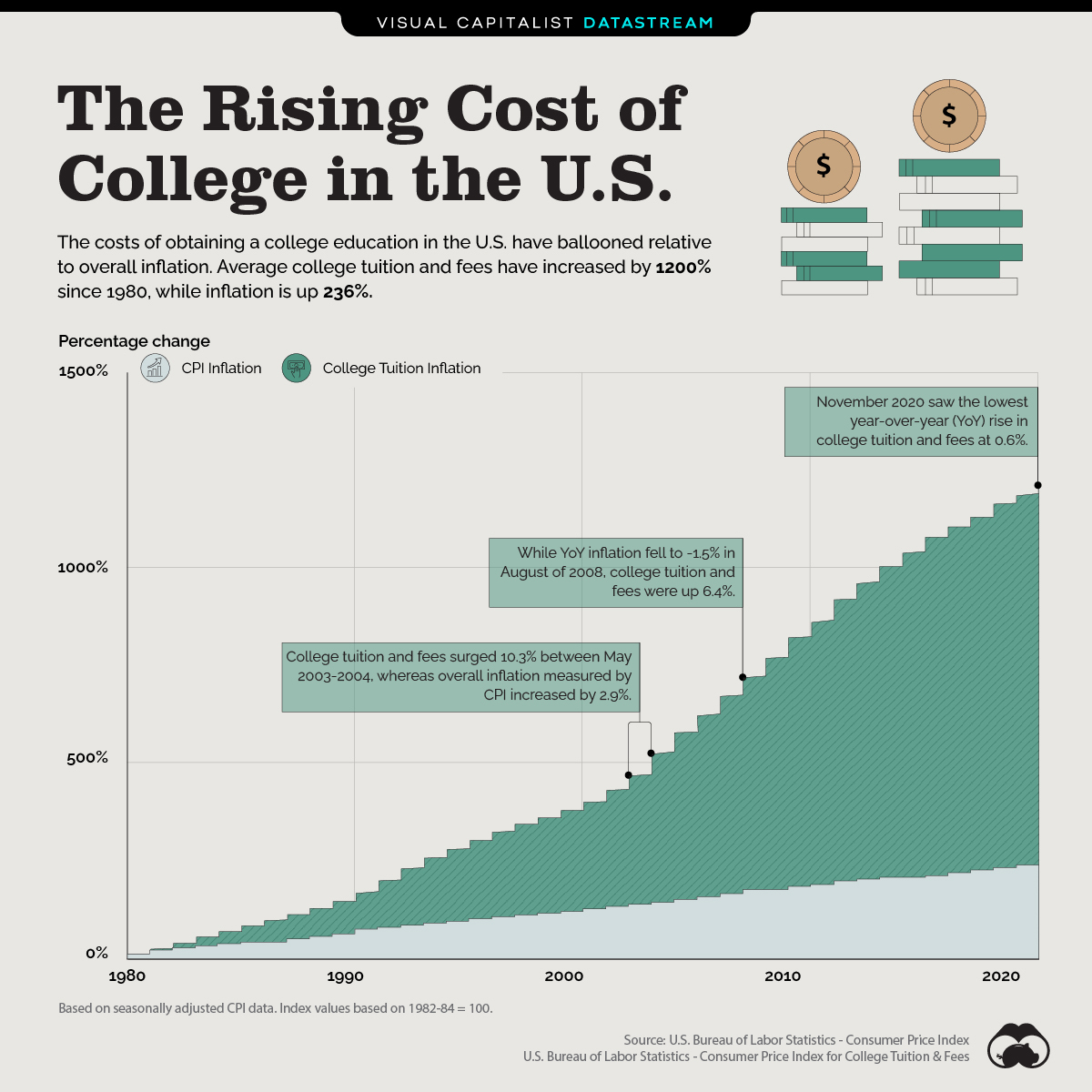

As I already said in this thread, that reflects growing income inequality. The top 10% can afford much more tuition than they could when your parents were paying for college. |

Anonymous

Of course merit money and FA come out of the tuition that others are paying. Where else would the money come from? At most schools, tuition is the main component of the operating budget. Very few schools have the kind of endowment that can cover all the need-based financial aid they give, and those schools are usually ones that don’t give merit aid. I sympathize with the OP’s frustrations, but the folks who have said that competitive elite schools are luxury goods are correct. It’s best just to think of them that way and move on. |

Anonymous

OP managed to save $160K or so for one child. They clearly have a very high income. |

Anonymous

https://www.acenet.edu/Documents/Understanding-College-and-University-Endowments.pdf How are endowments used? For private nonprofit colleges and universities—and increasingly for public institutions—endowments provide stability, flexibility, and a degree of confidence for the future. … The reliable long-term support from an endowment enables institutions to increase student financial aid, make commitments to senior faculty, initiate pioneering research, develop stronger teaching programs, invest in new technologies, and maintain their libraries, laboratories, and other physical assets. According to NACUBO, institutions are overwhelmingly spending their endowments on supporting their students; for fiscal year 2020, 65 percent of spending was on student financial aid and academic programs. https://www.usnews.com/news/education-news/articles/2019-01-31/half-of-all-endowment-spending-by-colleges-supports-financial-aid Amid a national outcry for higher education institutions to do more to increase access for poor students – especially elite schools with billion-dollar endowments – new data show that nearly half of all endowment spending by colleges and universities supports financial aid. "This was the largest single area of endowment spending," Susan Whealler Johnston, president and CEO of the National Association of College and University Business Officers, said this week in a call with reporters. "This clearly demonstrates the deep commitment colleges and universities make to support financial aid and student success." |

Anonymous

PP here. This quote says that universities use their endowments for financial aid, but it doesn’t say that they cover all of their financial aid spending through their endowments. I would bet that very few universities are able to do that. Except for the schools at the very top of the endowment heap, every university is tuition-dependent. At most private universities, people paying full tuition are subsidizing people who are paying less. And at public universities, people paying out-of-state tuition are subsidizing in-state students. |

Anonymous

NP. You must be a white man. |

Anonymous

| You are seeing it wrong. Merit is not meant to reward a student for their hard work. Merit is used by schools as a strategy to increase yield of students they want at their school. Who these students are is determined by each school. Most typically it is students who are at the top of their applicant pool who would likely get into more prestigious schools. So yes, your daughter might get into Wellesley but they don’t need her to increase yield. Set your budget and plan accordingly. Do your research. That you are just realizing this shows you have not done the work as a parent with a budget to set realistic expectations for your child. |

Anonymous

| If DD really wants this school, there is always ROTC |

Anonymous

These quotes are from press releases. Of course they say that colleges are wonderful and caring. These are promotional advertisements. |

Anonymous

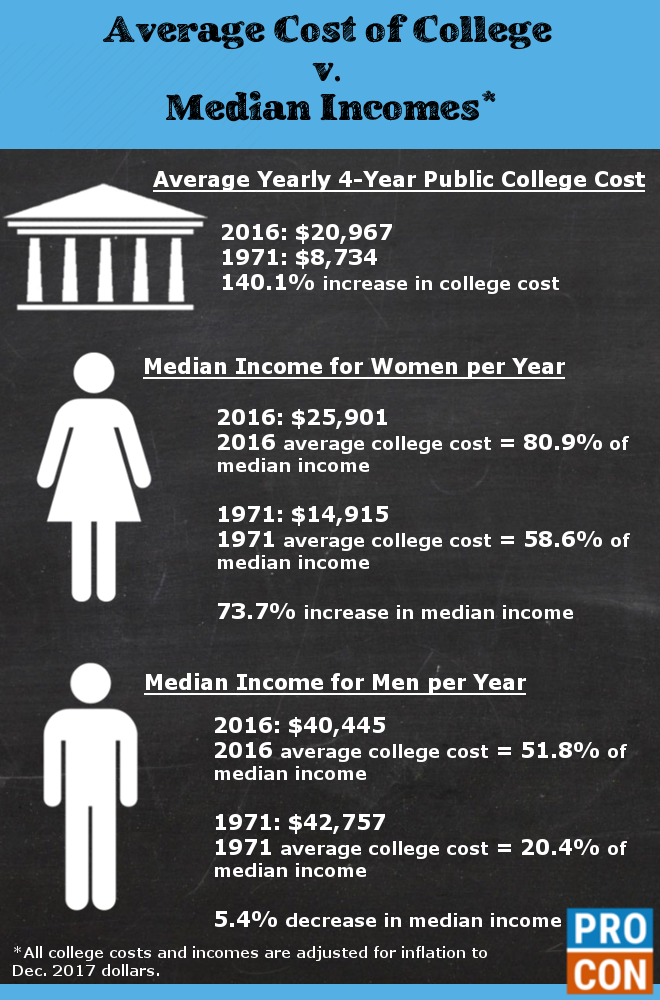

We are in vehement agreement. It's wrong. Studies all show that education is critical to a productive life and economic security just as healthcare, housing, and food are. Comparing it to luxury cars and vacations is a false equivalence. |

Anonymous

|

A little tough love.

My perfect house would be a $3 million mini mansion on an acre of land but I'm ok with my 70s split level. My perfect vacation would be Hawaii, but we're going to Rehoboth instead. Colleges that you can't afford are NOT "perfect fits." It doesn't mean that you've failed your child by not saving more, but it also doesn't mean that the system is inherently unfair--some things are just out of your price range. There's a reason why the vast majority of students look at their public in-state options. |

Anonymous

THIS^^^ That is privilege. They are just upset that others have more than them. They can likely find a way to pay 80K/year with minimal loans with a HHI of 200K+. If they really wanted to. Cash flow 20-25K/year and take the rest in loans and pay it off once kid graduates. Personally, I wouldn't take loans or try to cash flow that much, I'd send my kid to a school I could afford, because there are literally hundreds of excellent schools that met their financial criteria. But if they really desire a "top" school, they could afford it. |

Anonymous

Exactly! Without the Full Pay students, there would be less merit available at most schools. It's a balancing act of kids who get FA, kids who get only merit and Full Pay kids. Even if we got rid of ED (where many are full pay), schools would still aim to fill X% of their slots with Full pay kids (and it's easy to figure out who will be FP). Universities are a business, their goals will be to function out of the Red. |

Anonymous

No it's not a false equivalence. Of course education is critical. Nothing is preventing you from getting a great education (except maybe your own false notions). There are LITERALLY Hundreds of excellent schools that do not cost $80K/year. Nobody is stopping your kid from getting an education, except you who sets up the mentality that it's "IVY/Stanford/T20 or bust". If you have stats for a T20/Top SLAC, you will find plenty of universities that will provide that education at a rate you can afford. |