schools w/ no merit aid

Anonymous

It’s because there is a subset of people who really truly believe their kids are entitled to graduate debt-free from the very most elite school that will take them and cannot wrap their mind around the fact there never has been such an entitlement. It’s hard for them to accept because they have long believed their school was a great accomplishment and not merely a reflection of their privilege. |

Anonymous

And guessing PP's history books ended around early 1940s as they also missed out on school integration efforts by Blacks and Latinos in the South, SW, and California post WWII. |

Anonymous

+1000 People feeling entitled to so many "luxuries" is likely why many do not have the income saved for the luxuries they want (not everyone, but many). Life is about choices---everyone has to make them all the time. Life isn't fair. It's not fair that engineers make more than teachers---both have to get a 4 year degree. But you know what, you know what the approximate salary will be for a career choice when you enter college, so if you really want a certain lifestyle, then you should pick a major/career that will support it. Or you adjust your desired lifestyle to support the career you will love. If you want to be a teacher, that is awesome. We need people to pick careers that they will love. But also know that currently you are not going to make 6 figures as a teacher in most places (if you are the COL is so ridiculously high that it doesn't matter). So if you really feel it's important to drive luxury cars, take $10K vacations yearly, live in a mansion, etc. then perhaps you shouldn't be a teacher. Basically, people need to learn to live within their means and make choices to support their lifestyle. Same goes for colleges. If you value education, start saving for kids at a young age. Put a plan in place for what you will be able to afford. For some that means CC while living at home then transferring to a 4 year to finish. For others that means an affordable state U. For others it means completing your AA while in HS with DE so you only need2-3 years in undergrad at the 4 year college. For others it means seeking out as much merit as you can find---that will entail finding a school where you are at the 75%+ in stats and typically a school with an admission rate over 35-40%. Our system is far from perfect but there are plenty of reasonable, affordable ways to attend college, if you truly desire to get an education and not have high debt. |

Anonymous

please name the school! |

Anonymous

|

Anonymous

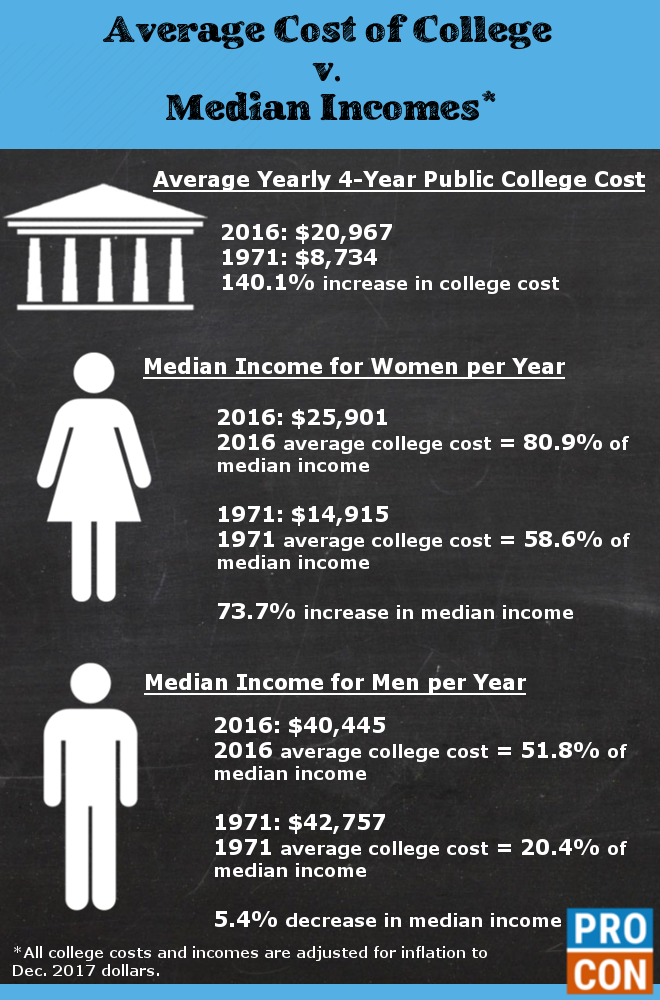

The reality is a family of four making $65k will get great aid. It’s the strivers, the job slaves with newish cars and houses within a decent commute to DC that will be expected to pay $80k a year out of a $170k salary. |

Anonymous

Yes, I fall into that category. I think it is because we paid for our own down payments on houses, supporting our elderly parents, expecting no “generational transfer of wealth,” while we see the majority of our DC friends and colleagues not in that situation at all. |

Anonymous

If you are doing better than your parents, why did you think you were entitled to aid? I'm in a similar boat - no down payment gift, no wealth transfer, etc - but I was under no illusion that college finance was suddenly meritorious, especially at the T25s. |

Anonymous

T 100 is Marquette. The T120 is an east coast jesuit university. Both excellent schools, plenty of really really smart kids at both (I know kids at the other school). So private school education for only $40K/year, maybe a bit more the final 2 years as tuition costs do rise. All from a kid with a 26 ACT. |

Anonymous

“Careful who you come for”? What? |

Anonymous

If you make enough to not qualify for FA at Wellesley (should get something under 200k income) and hava 160k saved already, you can afford it. Save more, pay as you go, take out a few loans, try for 3rd party scholarships. You should make it. |

Anonymous

So it’s because you are so fixated on the people more privileged than you (and me too) that you don’t see you’re privileged now. That was the point of the FA. To launch you into the world to become a full pay parent. |

Anonymous

But who should be paying this for you? The government? The government needs to allocate its scarce resources to the highest need. The school? The school also needs to consider what is good stewardship of its funds. Merit is by definition not based on need. If all students are meritorious (‘meaning you don’t have to buy higher stats kids with merit aid), what is the good reason to give merit aid to some and not others. Schools like Duke have a few scholarships, UVA has Echols, UNC Chapel Hill has Morehouse, but these are for tippy top academic students. Some student on another thread got a full ride at University of Chicago, probably an exceptional student among exceptional students. But the discounting you hear about, that is to lure desirable (relative the the general student body) students to attend schools most would consider safety or likely schools for those students. I did not have a generational transfer of wealth other than my parents paid for my undergraduate education at a state school. You can do that for your kids. That is an amazing gift. |

Anonymous

So, dump your money in now. Bear market is a great time to start investing. |

Anonymous

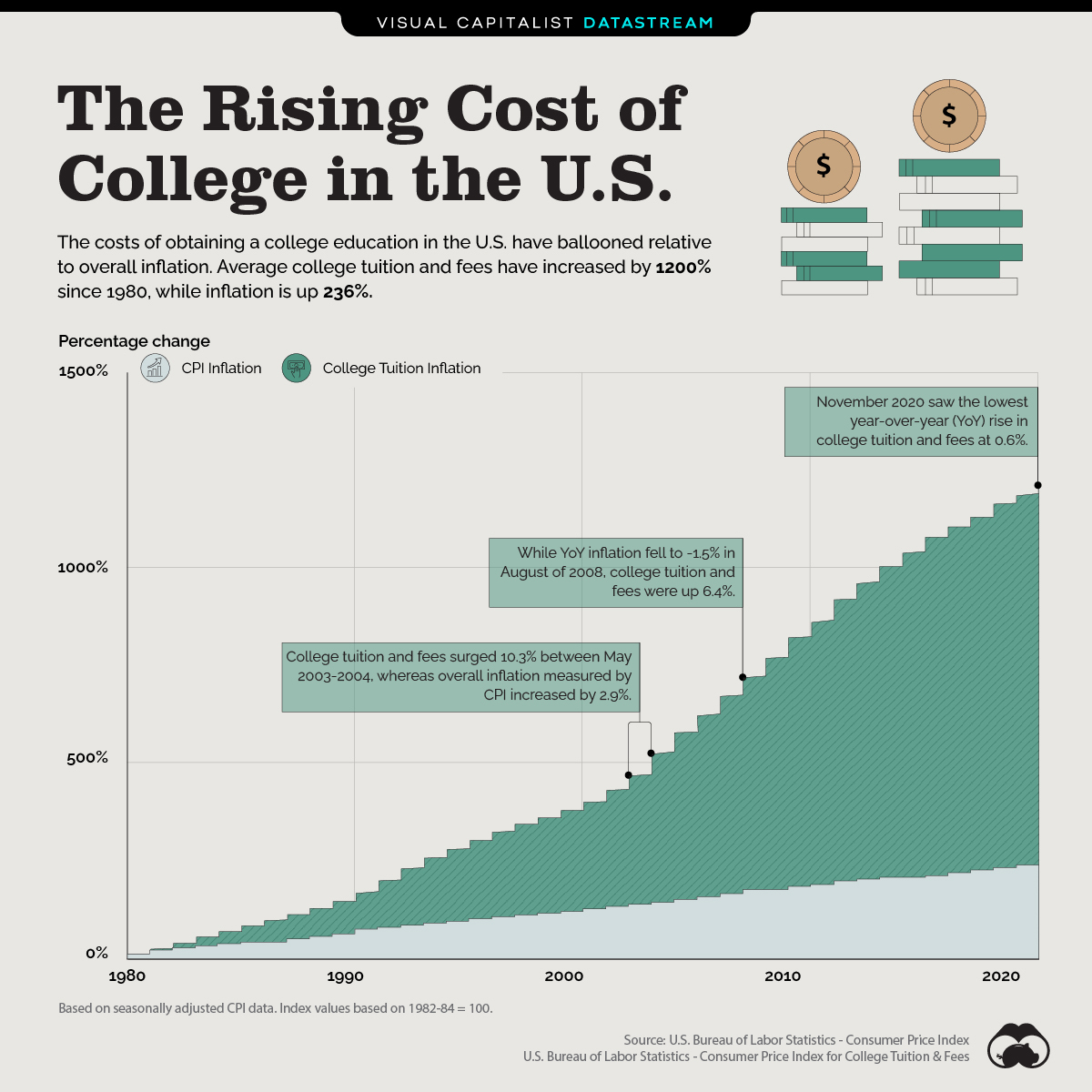

It should not cost so much. Tuition rises should not be exceeding inflation. It’s wrong. |