schools w/ no merit aid

Anonymous

OP here. I guess I should have been smart enough not to acquire nearly $150K in medical bills due to cancer, as well? Why don't you just stop with the speculation about what I should have done. We did all we could. And we saved a lot, notwithstanding that. I never said my child did not have other options and wasn't considering other options. As I said, I grew up dirt poor and went to a non-elite school. I simply lamented HAVING to cross off schools -which are a perfect fit for her- solely based on finances. Especially when we saved aggressively for it. It sounds like people in the middle (too much money, but not enough) just can't go to these schools. |

Anonymous

Curious how you got that from my posts. I have been aware for awhile that we would get no FA. We are not even asking for "need based" aid. I was expecting -based on what our counselor says and other kids experiences at very good schools- that most would give some sort of other aid for high performing kids. Most "regular" families cannot afford these sticker prices. Clearly, that is not the case and my information was wrong about that. |

Anonymous

It's not a burden when said kid can afford a less expensive option based on merit aid and parents' savings. I shared a bedroom with 4 siblings and 8 people shared one bath growing up - you are just not gonna persuade me to feel bad for someone who can attend a school wildly better and more expensive than broad swaths of their peers. And probably grew up in a completely fine home along the way. |

Anonymous

This x100 this is my observation as well |

Anonymous

We do not have anywhere close to $120K in discretionary income. |

Anonymous

Good Lord OP. That's life! Obviously you haven't saved aggressively enough. |

Anonymous

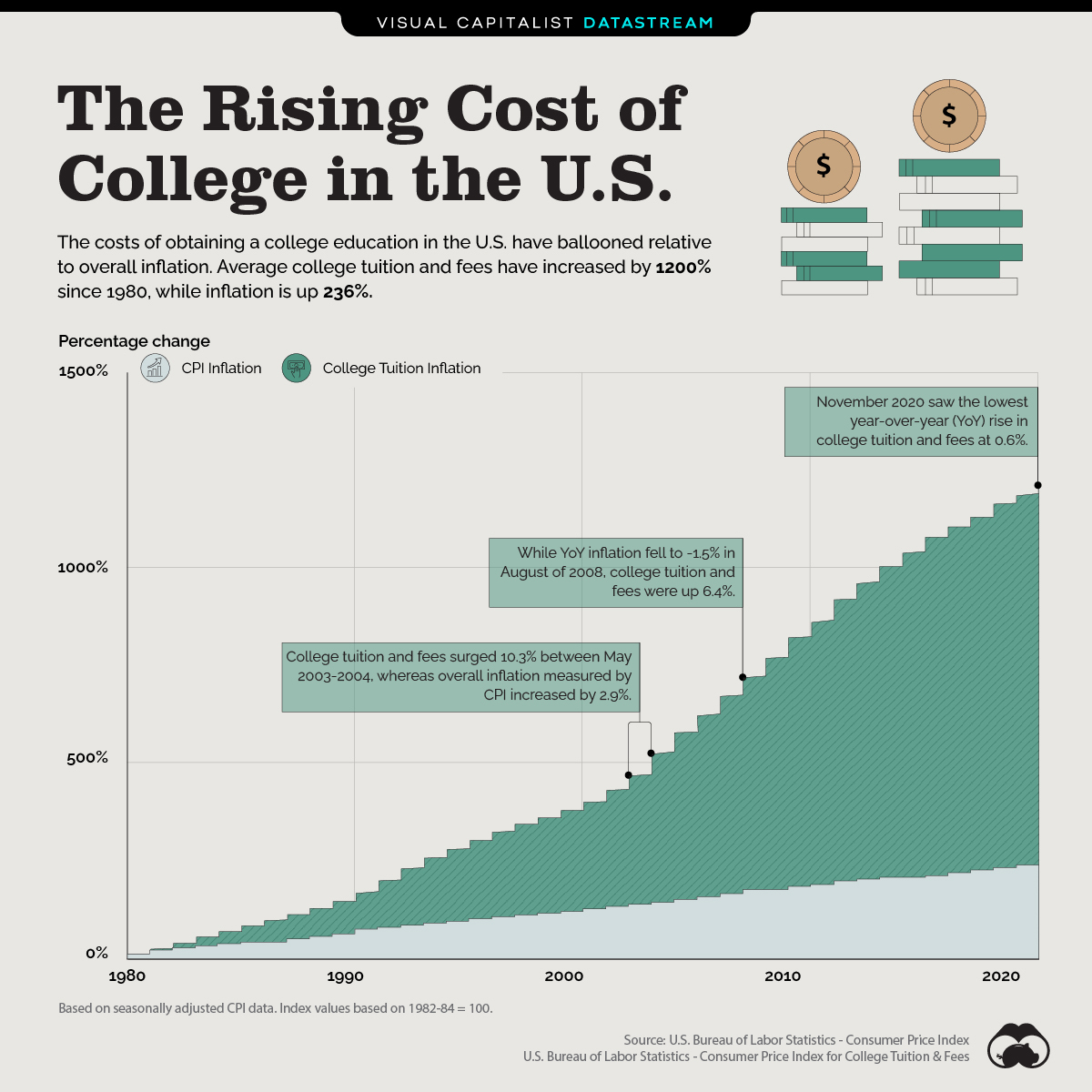

NP.. ITA with you. College costs like healthcare costs have vastly surpassed inflation and wage growth. There is something wrong with our society. I'm 52. We don't qualify for FA, and some of the colleges DC is looking at for their major don't provide any merit aide. I grew up lower income; I'm frugal. I drove my last car for 15 years and only had to give it up because it was smoking a lot. I bought a $30K car. Some of those colleges cost almost 3x my car, per year. It's ridiculous. I saved, but not $80k/yr for college, and also I have a younger child. Maybe I should've not been so frugal and not saved. Maybe I should've bought a more expensive car every 3 years, buy name brand clothes (I shop at Target and Kohls), and all kinds of jewelry (only have my engagement ring and sapphire studs that DH bought me when I had our second child). Then maybe we would qualify for some FA, and then taxpayers can pay off my Dc's college loans some time in the future. |

Anonymous

It is good that you are realizing how the pricing works now rather than a year from now. Yes, if you aren't hugely wealthy, most people have to deal with financial limits when it comes to college selection. Like everything else in life -- are you super bummed to have limited her to riding in a particular type of car or living in a particular house/neighborhood or going on certain types of vacations because of cost? College is no different. My kids only applied to reaches that were in-state publics (UVA, W&M) for this reason. One is now at VT and the other (while waiting on an answer from W&M) has acceptances from multiple LACs with large merit awards and is very happy with her choices, even if she doesn't get in to W&M. Possibly, in part, because we never even toured schools we knew we could never afford. Shopping for reaches you can't afford is such a waste of time and mental/emotional energy. Again, no different than shopping for a house or car I can't afford. Wellesley is NOT a "perfect fit for her in every way" because it is not also a financial fit. So, she needs to think what were the specific aspects of Wellesley that she liked (and ranking doesn't count) and do the research to figure out what schools offer that and are generous with merit aid. There definitely are other schools out there and she won't be alone in being a strong student at a college a tier or two down. Plenty of people with great students have to make the same choices based on finances. Here's one place to start -- this data visualization tool from the Chronicle of Higher Education can show you which colleges listed Wellesley as a "peer". Some of these are less selective and offer merit aid. https://www.chronicle.com/article/who-does-your-college-think-its-peers-are |

Anonymous

Thanks. Many of these are on her list. |

Anonymous

You sound nice. |

Anonymous

|

I clicked on this post because it reminded me very much of the situation I was in when I was picking colleges. Granted, it was in 2004 so a very very different time, but there were still a number of fairly prestigious colleges that I was a good fit for stats-wise that didn't offer merit aid.

My dad took me on a bunch of tours and info sessions for these schools and others that would offer me significant merit aid and very adamantly advised me to take the scholarships and not go into debt. They had some money in a 529 but definitely not enough to cover four years full ticket at Georgetown or Cornell, even back then. I ended up taking a full tuition scholarship to a DC private university where I was more of a big fish in a small pond, and it was an amazing fit for me. As an adult, I am so incredibly grateful that I was pushed in that direction. It would have been much easier for him, I think, to agree that I "deserved" to go to these brand-name schools, because on paper, I really did! But that kind of debt would have crippled me as a young adult, and I also think I would have been unhappy as an 18-year-old surrounded by kids from a much different SES than I came from. I experienced enough of that in law school, but at least I was a more fully-formed adult.. kind of.. at that point. Your kid will bloom where they are planted, OP! I hope that they are able to understand the financial impact longterm that some of these decisions have on them/their family and make positive choices from there. |

Anonymous

Anytime, good luck with the process! She sounds like a good kid, so it'll work out in the end. If there's anything she's specifically looking for in terms of academics, fit, location or campus culture, let us know and we'll see if we can chip in with some more ideas. |

Anonymous

With current loan limits, probably very little impact. You can not got to Wellesley on student loans, you can't even afford room and board on loans |

Anonymous

You just breezed past this part. You think it's A-OK that college costs are crazy and continue to be crazy for the indefinite future? You're good with that? |

Anonymous

I'm a PP, and ITA with what you wrote, and I am advising my DC to NOT go into debt. I have a 26 yr old niece who had the option of going to a well known slac but being $80K in debt when they graduated or going to the in state honors college with some merit aide. It's not a public ivy, but a decent school. She is now so glad she made that choice, although, originally she was unhappy about it. She is seeing so many of her friends who had to take out loans. They are of course still paying it off while my niece is now saving to buy her first place. But it's still so incredibly ridiculous how out of control college costs have become. |