schools w/ no merit aid

Anonymous

The point of this thread is that OP is upset to learn that no one will be subsidizing her child’s education at an elite college, effectively a luxury good. OP has no interest in understanding how well off her very privileged child is and what options there are. In her mind it is just not fair. I would ask fair to whom? If the cost of providing the education is reflected in the tuition room and board, why should the school pay for her student to go there? The reality is that the schools she wants her child to attend don’t need to buy high stats students with merit money. They have a made a decision that they will use their financial aid dollars to support students from families with lower incomes. It is a public policy call and I am not particularly sympathetic to OP given that her student has plenty of resources to obtain an excellent education debt free. She just wants the Mercedes. Oh well. |

Anonymous

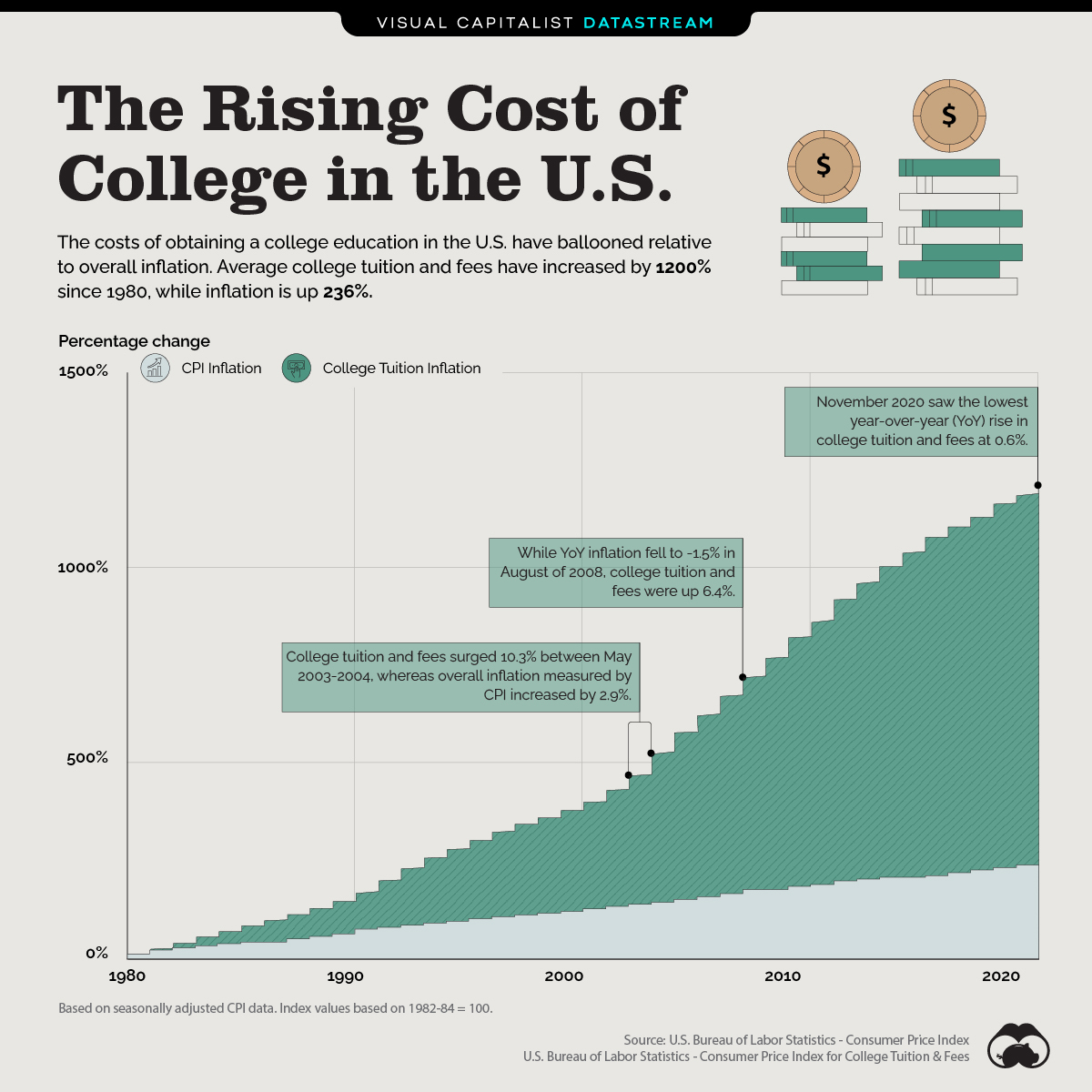

No one asked you to feel bad for anyone. I shared a bedroom too but this isn't the hard-luck story sweepstakes. It's in part a discussion of how college costs have far outpaced inflation - and that includes at public universities FYI. It is reasonable to be outraged and it's reasonable to perceive that as a burden. |

Anonymous

OP has not expressed any of what you say she has communicated. She has not expressed interest in having her child's college costs be "subsidized" (and FYI, merit money and FA do not come out of other students' tuition so settle down there on that point). OP is outraged and disappointed that despite having saved since her child's birth, she cannot pay for her child's education at a school that would suit her better than other, less expensive options. Outrage and disappointment are appropriate responses to the rising costs of higher education, regardless of whether you and your child are privileged or well-off or otherwise well-situated relative to the general population. And FYI: Universities' choices re: where to allocate their money are not "public policy" decisions, unless you are talking about public institutions. They are decisions made by private institutions and they can be changed without action from any legislative body. |

Anonymous

Actually, this started with a whine that elite D3 schools like Wellesley don’t offer merit aid and her family has only saved $160k and would have to give up travel to afford to send her. The cost of college is outrageous, but that is not the main take away from the original post. This was followed by OP lashing out at posters that tried to addd a usual perspective. |

Anonymous

OP. Where did I say it "wasn't fair?" |

Anonymous

Yeah well my grandpa drove a truck and my grandma dropped out of high school at 15 to wait tables. My mom also dropped out of high school to work at KFC to fry chicken. I worked year round to pay for a state flagship you clearly look down on. I really have no sympathy for the fact that you feel entitled to your grandparents’ private school but didn’t successfully leverage all that generational privilege to afford. Actually, I’ll be honest. I’m effing thrilled you can’t have it. I hope all your spots go to first gen kids. Now you know. It was never a meritocracy. It was always something your crusty ass relatives were hoarding while pretending they earned it. |

Anonymous

Wow. Maybe this is OP? The follow on hateful responses OP made to posters that tried to be helpful speak for themselves. |

Anonymous

OP didn't whine and didn't mention travel - she expressed appropriate outrage. In response, some people on this thread e.g. comparing higher education to luxury cars have been mean (understatement) to OP. Every time this topic comes up on this board, the vast majority of responders pick on the OP and accuse them of being entitled, a whiner, a spendthrift, the list goes on. Only rarely does the discussion focus on the outrageous ever-rising costs of higher education and how unfair to the U.S. population in general that is (and it is). It's a huge problem. Outrage is an appropriate response to it. |

Anonymous

Not OP. A different PP. |

Anonymous

Nope, I'm OP. But the PP said a lot of things I agree with and better than i did. And, no, not all of those posters were being helpful. Some were sanctimonious and judgmental and making conclusions/observations based on a snippet of information about my background and situation. And no, I'm not going to just take that sort of thing. Sorry you don't like that. |

Anonymous

Actually, the opposite is true: It's hoarded now. It was not hoarded by anyone a few generations ago. |

Anonymous

It depends on what time you want to look at. Post WWII higher education opened and there was time where you could work your way though an elite school. Those days have ended. Prior to the post war GI bill boom, higher education was the domain of the elite |

Anonymous

wow. forget education. PP just needs help |

Anonymous

Yes, a few generations ago was Post WWII. That is the memory reference point for people contributing to this thread. |

Anonymous

It WAS hoarded (it’s always been very limited seats). It was just being accessed by people who met standards your family could meet, like the right high schools, the right extracurriculars, the right background. Now you’re mad because different people are accessing it. Deal with it. |