Breaking Point?

Anonymous

They will get out of social security and Medicare far more than they paid in, so payroll taxes ~ eh, not so much a tax as an investment that pays later in down the road. |

Anonymous

It was the house I grew up in and my parents passed. |

Anonymous

Born on third, thinks he hit a triple. |

Anonymous

So you object to being called "liberal," as if that's an insult....and then call people who didn't vote your way "conservative scum" (the post upthread), f*in idiots! and greedy scum? You remind me of the poster who called conservatives racists and morons, and then objected to being called a "lib." And why are you assuming that I am rich? Or that I want the tax bill approved because it benefits me? FYI, I am among the 15% it does not help but I know it's good for. 85% (directly, via tax reduction). As for everyone else, we benefit by having a booming economy, bringing jobs back, and having policies that encourage companies to stay in this country. Finally, are the poor so virtuous in your mind that you cannot criticize any obviously irresponsible behavior on their part? Can you acknowledge that poor people getting food stamps, cash, subsidized housing, and all sorts of taxpayer-funded benefits should not be wasting OUR money on $200 shoes? Liberals are fine taunting and mocking working-class people as morons in flyover country but become livid of anyone suggests poor people do anything stupid. There are plenty of morons among the poor, believe me. |

Anonymous

Post your taxes. Potomac at one time had houses selling for $50,000. My dad was military. I’m not sure why you need to get all snooty. A lot of people have their net built in the increases in their house value, especially lower income folks - that’s their major investment. |

Anonymous

Agree. The liberals have to stop saying how the low-income pay payroll taxes, as if that's their contribution to the revenue base. It's a forced retirement plan so they will have an income in their old age, and they get back a lot more relatively than higher earners. |

Anonymous

Yes, exactly. My grandmother bought her beach condo for $25,000 in the 1960s and it is now worth $800,000. |

Anonymous

| With the House having passed this bill, the breaking point is here. The ones that are going to be destroyed by this just don't feel it yet. I am so angry right now, I can barely see. |

Anonymous

Heads up, kiddo - you're sponging off your parents hard work. That's what "born on third, thinks he hit a triple" means. You're posing like some financial genius, and it's your parents' money! Also, your level of aggression sounds like someone who wants to meet for coffee in Georgetown.

|

Anonymous

I know, it's a shit box. But chin up. There's a bigger fight, and if twitter rumor is true (and it is, given the fact that NO ONE save billionaires, bots and MAGAts wants this atrocity yet still the GOP rammed it through, illegal kickbacks and all, like they don't really have to work for their constituents) they'll largely be gone in under a year and we can begin to undo this. The GOP is no longer a political party. Let's crush it. |

Anonymous

This will be voted on (in effect) a year from now. Half the people will be thrilled with the swelling blalance in their retirement accounts, and the other half don't pay taxes anyway - and still won't. Add in that 80% of taxpayers will have seen their taxes drop! and we will have a country of happy campers. |

Anonymous

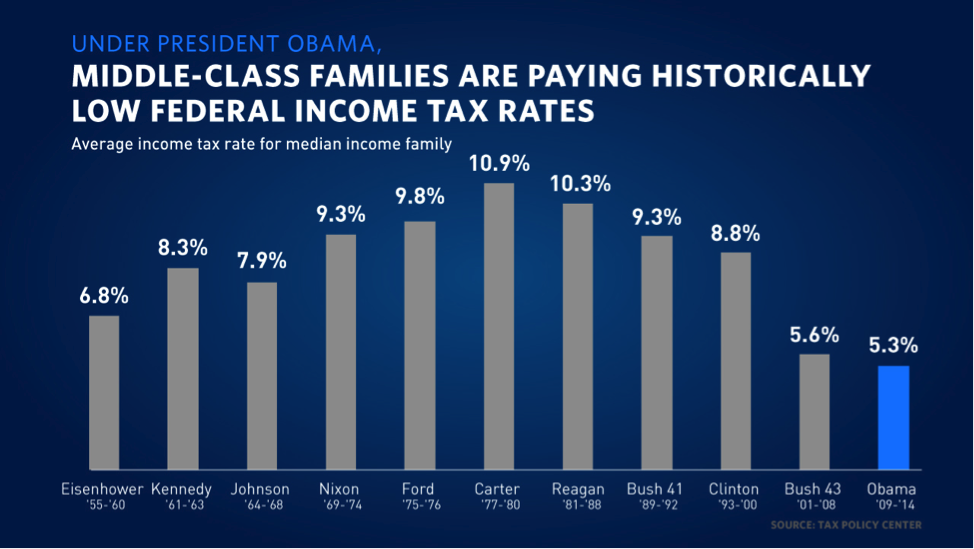

Here, this may help you.

|

Anonymous

NP: How is he sponging? Lucky for sure, but I don't see how that impacts his arguments. You really shouldn't let envy get in the way of logical thinking. |

Anonymous

| The glee with which the Republicans are savoring their self-enrichment riles me up, offsetting the fatigue I feel from the craziness of this past year. |

Anonymous

The lifeline program expansion to cover cellphone service happened under President Bush. Full stop. The “ Obamaphone” name may be catchy, that does not make it true. Yes it does a lot of good and yes the FCC under the Obama Administration expended a lot of effort to reduce waste fraud and abuse. |