Republican Tax Bill - the final Bill

Anonymous

|

For those with meeting how Trump and the Rs tend to pay for the tax cuts (besides elimination by funding for CHIP and getting rid of the student loan interest deduction), apparently funding for domestic security is in the he block and feds can expect a pay freeze:

https://www.washingtonpost.com/news/powerpost/wp/2017/12/14/democrats-say-trump-to-seek-federal-pay-freeze-and-cuts-to-domestic-security/?hpid=hp_local-news_davidson-745am%3Ahomepage%2Fstory&utm_term=.6cd63b78701a I guess the argument is that are no is going to keep all the terrorists out so we don’t need to worry about it? |

Anonymous

Geez, sorry, major iPhone typing fail.  Corrected post below. Corrected post below.

|

Anonymous

Democrats under Obama, Pelosi, and Reid cut taxes in 2009 as part of the 2009 stimulus package. The difference was that the tax cuts were targeted at the middle class. These tax cuts are targeted primarily at the wealthy and are not needed (we are not in a recession right now). In 2009, the Republicans voted against almost solidly the bill. |

Anonymous

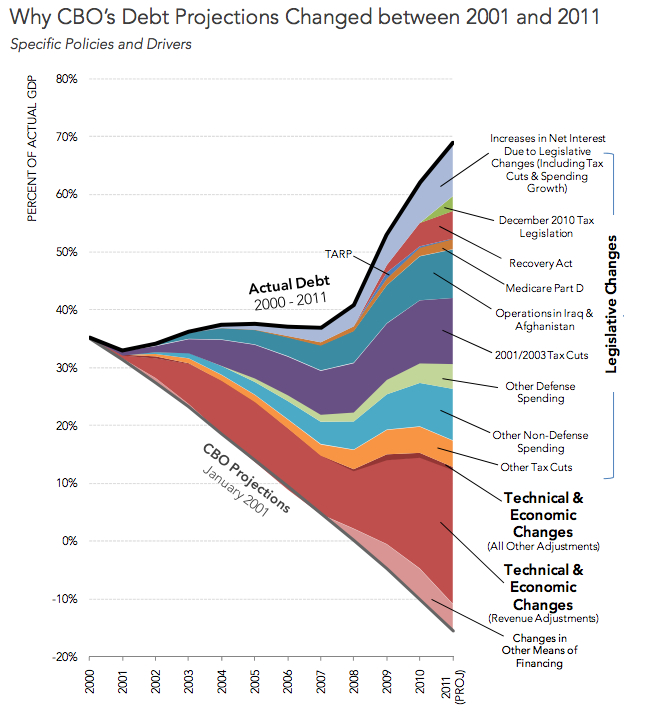

You do realize that the vast majority of the deficit spending that occurred during Obama's 8 years was pre-baked when he came into office, right? The Bush tax cuts, the wars in Iraq and A'stan, and the Bank Bailouts were all approved by GWB and the Republican Congress and continued to increase in size during the Obama Presidency. There was zero Obama could do about the tax cut size and bank bailouts because those were statutory.

Do you now see Republicans' "strategy"? They initiate deficits when in power, which then get bigger - by design - when someone else is in power (usually a Democrat). Look at that graph and see what the biggest growers are to the deficit - you'll see that they are mostly GWB initiatives. |

Anonymous

Why should the federal tax structure subsidize states that have ludicrously exorbitant state tax rates whether state income tax or property taxes? If your argument is that these taxes are needed to pay for services that the state provides then you should be willing to pay for it without the federal government chipping in by providing a deduction against federal taxes. |

Anonymous

DP... I would be happy to have a flat 10% federal tax rate across the board, then let states tax the rest. Federal government should not give ANY states ANY money. Let the states take care of its own, just like Rs want - states' rights and all that. We'll see how low tax red states fare. If KS is any indication, they won't do very well. http://www.foxbusiness.com/markets/2017/06/18/kansas-tax-hike-hailed-as-fix-doesnt-quite-balance-budget.html http://www.businessinsider.com/kansas-budget-disaster-tax-reform-repeal-gop-similar-to-trumps-2017-6

|

Anonymous

Brush up on Federalism and tax codes and then come back and re-ask the question. |

Anonymous

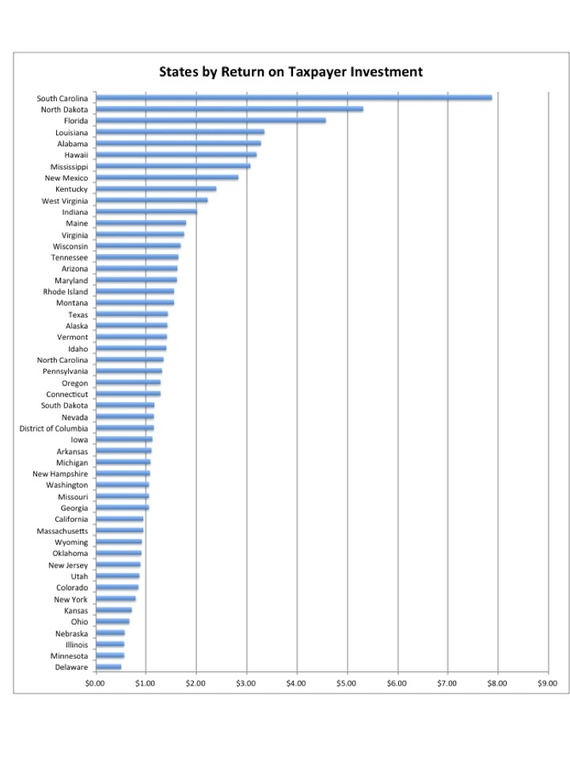

I’d counter that with the fact that low tax states tend to receive more than they pay in federal taxes. Maybe they shouldn’t get as much then? Why should blue states subsidize red states? Seems like they should take care of themselves, right? |

Anonymous

So many haters on here. Sad! |

Anonymous

| Liberals love to spend as long as someone else picks up the tab! |

Anonymous

In fact the most highly taxed states tend to get less back in federal funding. So those blue states keep on subsidizing the red states. But whatever helps you sleep at night. https://www.theatlantic.com/business/archive/2014/05/which-states-are-givers-and-which-are-takers/361668/

The reddest states also have the highest levels of poverty and therefore the greatest number of people on federal assistance programs - but those of us in blue states are happy to provide where that heartless red state won't. |

Anonymous

Can you read, honey? 12:45 explained it, but she's not going to shove your face directly into the water. |

Anonymous

| Don't confuse them with facts. |

Anonymous

But I thought Republicans promised American workers they would see an average wage increase of $4000 as a result of the tax cuts. I am so confused! Are federal workers not American anymore? |

Anonymous

Conservative fantasy. We pay your red state bills. |