Is 300k the bare minimum income to buy a single family now?

Anonymous

No way you can afford starter home inside beltway with kids at current rates without a lot of help or huge savings for anything decent SFH in a good neighborhood. Not incl a driveway either

When rates were lower, for sure. Not now. Nothing in a 5 block radius to my Alexandria neighborhood is there a SFH not $1M+. I truly don't know what you do unless you make $500k+ HHI with kids. I guess you rent or live somewhere further out or in a shitty hood. I did the numbers and actually with kids prob more like needing $600k. Kids are crazy money whether daycare or older kids who need activity/camos. You do a vacation annually and unless it's a beach drive, it's going to cost you. If your kid needs anything by way of tutoring or any other kind of medical or mental support, man... |

Anonymous

If you make $600k and bought a tiny house with 2 kids then you chose a great location with a short commute and have time to see your kids.

Also, $150k is slightly below median family income (MFI) for a four-person household in the Washington Metropolitan Statistical Area. The homeownership rate is 40% in D.C. and 63.5% in the D.C area. You can marry someone with comparable income. Otherwise you make less than most families but aspire to own a home. You are a candidate for a starter home in outlying suburbs. The D.C. area is nice, with good schools, great restaurants, and free parks, museums and monuments. D.C. salaries are 40% higher than the rest of the country to compensate for the cost of living. So $150k might make you a big success in Arkansas, but you are an average Joe or Jane here. So be grateful to be here. Tevye (from Fiddler on the Roof): "It's no shame to be poor... but it's no great honor either." Mark Twain: "The world owes you nothing. It was here first." |

Anonymous

| We bought in a poor school district and will supplement. And try to move up the property ladder before high school. |

Anonymous

Fed and private sector in regulatory field. $150k a piece. Not enough for a good school district in the DMV. |

Anonymous

We had friends buy in Chevy Chase and N Arlington this year with $300K HHI and 5-10% down around the $1.2M mark. That’ll get you in an original 3-4 bed, 2-3 bath home close in (say 2200 ish sq ft). Not saying it’s risk free but it can be done if you stretch. If you’re a fed I’d be more inclined to stretch. |

Anonymous

We didn’t want to feel stretched. We didn’t want a bad commute. We wanted to be okay to pay for extras, as needed. We owned a house and condo in DC but didn’t want to sink all the proceeds of those sales into a house in a good school district. We’re in much better financial shape here and everything is just easier. |

Anonymous

Agreed. And I say this as someone who is a bit older and did buy earlier, but I've watched my sister and BIL struggle to buy their first house. Combo teacher and Fed incomes. They stretched to buy something that didn't need a ton of work and wouldn't give them both killer commutes, a ~$700k house, but they still have one kid in daycare and literally have money for nothing else. Our other sibling currently lives overseas and we were planning to go visit together and she can't even commit to buying a $1000 plane ticket to come with me. |

Anonymous

Have you turned on the news lately? |

Anonymous

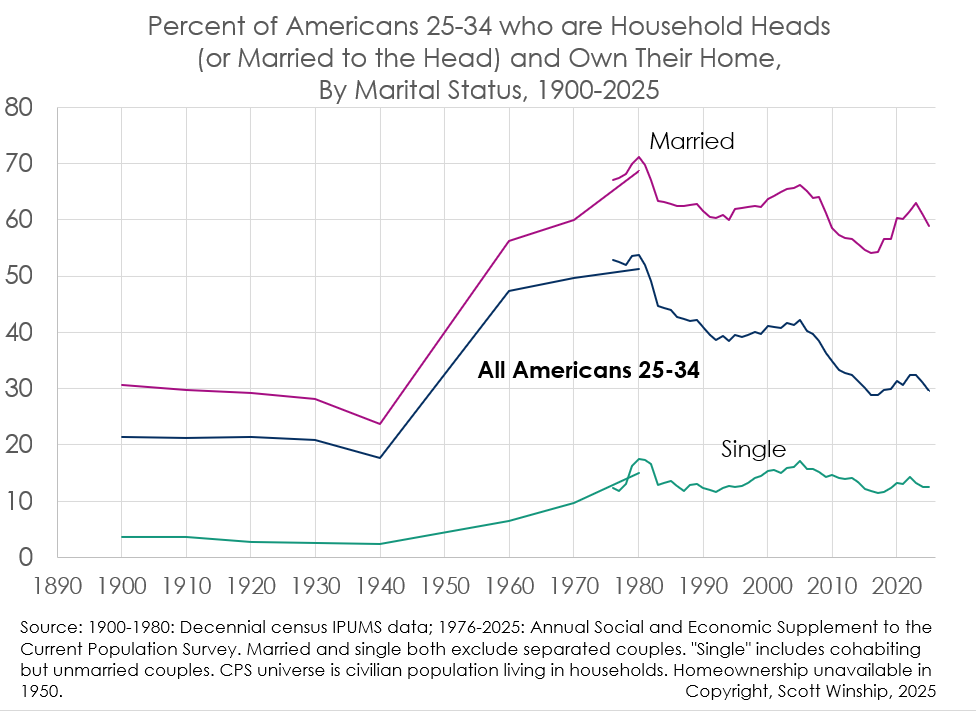

Over the past 4-5 decades, homeownership for young married couples has declined only slightly from 70% to 60%. Make more money, marry someone rich, or move to a cheaper area. https://x.com/swinshi/status/1978501964259307966/photo/1

|

Anonymous

|

When tear downs are $950k=$1M listings, that really says something about the housing market.

I just think this entire society has a reckoning coming, just a matter of time. OR - inflation will find other opportunities of affording stuff incl housing. The only other outcome is a whole lot of violence everywhere when nobody can afford decent shelter. |

Anonymous

I get what you’re saying because I agree that it’s insane but you can move. We did. There are a lot of very nice places in this country that aren’t as expensive. |

Anonymous

|

I bought in 2018 which doesn't seem that long ago but I recognize times have changed.

At the time our HHI was about $200K. We had one child in daycare. We had saved $100K for a down payment. We bought a 3 bedroom 2000 square foot townhouse near Vienna. I thought it was a starter home, but we are still there. We can easily afford it. Our income is $300K now and no more kids in daycare. We locked in a super low rate. I dont think buying a home has as much to do with your INCOME as it does your SAVINGS. If you live a life that allowed you to put aside 10 to 20% of a down-payment, I believe you can afford that property. |

Anonymous

Get married and your HHI could double. I think it's pretty normal for a couple in the DC area of house buying age to make $100K to $150K each. |

Anonymous

Yep! Exceot you can't save anymore. That is the crux of the prob. Not when a bowl of soup and noodles aha pho is $18 a bowl!!!!! lol I mean you go to see a movie and it's like $80 for 2. It's not about doing that it's about where we are. Of course you don't have to eat out or go to the theater but the point is that if such little and daily things are this pricy, you bet you round little bottom, all other important things are just as pricy! |

Anonymous

yet people are still buying first homes. You must adjust to the cost of living and live within your means, and to me that includes saving for an Emergency Fund and to have as much as possible for a home downpayment. It means pre kids and pre house, living in an okay apartment and making sacrifices. Live on one salary and bank the other for 1-2 years. It also means you have to stop taking more than the federal student loans for college (~$27k total for 4 years). Find somewhere you can afford to attend, don't go into massive debt. Because yeah it's always been difficult to save for a home downpayment if you have $100K+ in student loans or choose to use both salaries to "live". Yes, things cost more, but many people do have areas they could cut, or different choices they could have made in their 20s and be much better off. |