Trump voters getting tax shock and regretting their votes

Anonymous

+1. Just because a tiny fraction of Americans are better off doesn’t make it a good tax plan. Your grandkids will be paying back trump’s foolish tax cuts for the rich. |

Anonymous

And the tax hike on the middle class exacerbates income inequality + reduces competitiveness. |

Anonymous

I am an actual middle class person—HHI about $100K in the Rust Belt and we got our best refund yet. Will be voting Trump again. |

Anonymous

Why do you think the amount of the refund is important? The important amount is your total tax bill. Did you pay more or less in taxes than last year? The refund amount is just based on your withholdings - and they changed the withholdings this year so you can't compare to last year. |

Anonymous

Not OP. But you just showed you can't read graphs. Did you also notice that the GDP fell in 2013 and grew back in 2014 during Obama years. No economy grows linearly and there will be some zigs and zags. Thats just the nature of any real data. Unless there is a significant change to the general growth pattern, then it is just continuing the same trend as set by Obama. Unless Trump consistently shows over 4% growth or below 1% growth, the trend is same as Obama years. |

Anonymous

Do you know our debt to GDP is 100%? Do you know China's Debt to GDP is 40%? We don't increase our deficit/debt when the economy is doing well. Thats when we should have increased the tax to pay for poor education of Americans who believe in a snake oil selling con man, to build our infrastructure and give better access to healthcare. But instead the fraud party of trickle down economics gave permanent tax cuts to the rich and temporary tax cuts to the middle class. Enjoy it while it lasts but don't expect much of medicare or SS because we have to pay back interest on our debt to China in the near future. |

Anonymous

Uh - the PP doesn't even understand taxes vs. refund. I don't think PP gets debt-to-GDP ratio.... |

Anonymous

Jeff Zucker is that you? Exactly 9 people are watching cnn right now—9. |

Anonymous

The GOP brought this on themselves with their withholding scheme. People perceive their taxes are going up. But you manipulate people, eventually it backfires on you. https://www.newsweek.com/tax-day-2019-americans-think-taxes-will-increase-1388692 I wonder how these uber trump supporters feel about the corporate tax breaks being permanent but the individual tax cuts being phased out over ten years? And even these expiring cuts are expected to send the deficit soaring. |

Anonymous

Thank you, Sir or Madam. I hope you have money invested in the stock market to enjoy the very nice ride so far. |

Anonymous

|

I think the article that started this thread is BS.

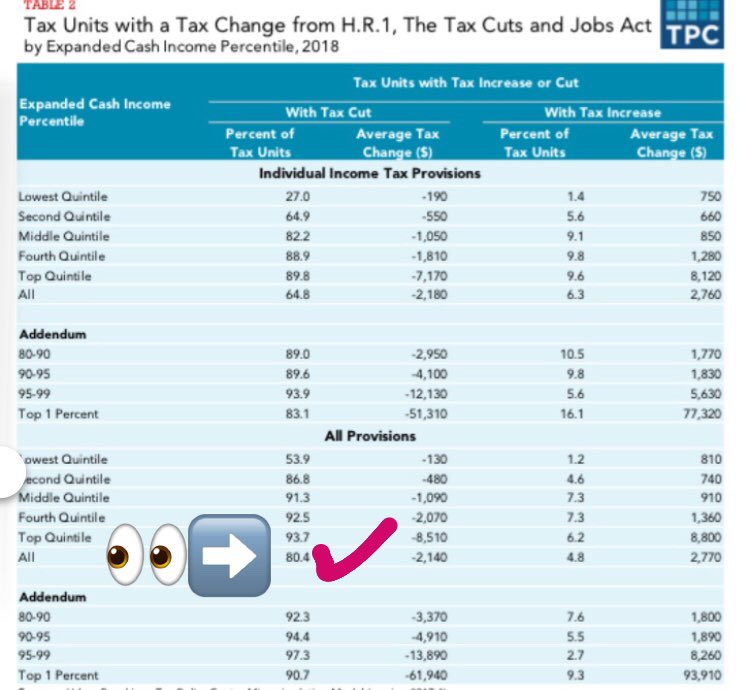

Tax Day Facts: Via the left-leaning Tax Policy Center, 80.4% of Americans (& 91.3% of middle income earners) got a *tax CUT* in 2018, thanks to the GOP tax reform law.

|

Anonymous

Holy sh1t. Look how many more 1%ers got a cut over the lowest brackets. Wow. |

Anonymous

|

Adding onto the pp's chart above. The Democrats have something to put in their win column. From today's New York Times: https://www.nytimes.com/2019/04/14/business/economy/income-tax-cut.html

If you’re an American taxpayer, you probably got a tax cut last year. And there’s a good chance you don’t believe it. Ever since President Trump signed the Republican-sponsored tax bill in December 2017, independent analyses have consistently found that a large majority of Americans would owe less because of the law. Preliminary data based on tax filings has shown the same. Yet as the first tax filing season under the new law wraps up on Monday, taxpayers are skeptical. A survey conducted in early April for The New York Times by the online research platform SurveyMonkey found that just 40 percent of Americans believed they had received a tax cut under the law. Just 20 percent were certain they had done so. To a large degree, the gap between perception and reality on the tax cuts appears to flow from a sustained — and misleading — effort by liberal opponents of the law to brand it as a broad middle-class tax increase. That effort began in the fall of 2017, when Republicans prepared to introduce legislation that models by the independent Tax Policy Center predicted could raise taxes on nearly a third of middle-class taxpayers. It continued through Mr. Trump’s signing of the law, even though the group’s models showed that the revised bill would raise taxes on relatively few in the middle class in the 2018 tax year. The messaging stuck. In December 2017, polling for The Times by SurveyMonkey showed that nearly two-thirds of Americans — and three-quarters of Democrats — did not believe they would get a tax cut from the new law. In this month’s poll, three-quarters of Democrats again said they did not think they got a tax cut from the law, and the overall share of Americans who said they had benefited rose only slightly from the 2017 expectations. In convincing people that they would not benefit, “the Democrats did a very good job,” said Howard Gleckman, a senior fellow at the Tax Policy Center. “They were able to put that into the public perception, and the reality has been unable to break that perception.” |

Anonymous

|

A party that has won the popular vote just once since 1988 lead by a con man who can't anything straight is not exactly a party in good health. The GOP base is just the "poorly educated" and the rich. Minorities, educated men and women, millennials aren't with the GOP. The conman is driving the party into a corner from which it can't easily get out.

How long can this charade continue? A majority of Americans want universal healthcare, a majority of Americans want to give legal status to dreamers, a majority of Americans don't approve the conman's job. The con man is embroiled in a dozen cases and he is not gonna cheat his way out of everything. It simply boils down to you can fool some people (his cult) all the time but he can't fool all the people all the time. And sooner or later just enough of his cult will wake up to his con(which many already did in 2018 as can be seen by the 9% win by dems and gop wipeout), then watch the bottom fall out and the crazy con man whimper out as the worst president ever mumbling about election fraud and that he won but the swamp got him. Sad! |

Anonymous

A majority of Americans want universal healthcare - Until they find out how much it costs. Then, not so much. a majority of Americans want to give legal status to dreamers - Seems the Democrats aren't interested in this. They have had their chance and turned it down. The con man is embroiled in a dozen cases - Let's wait and see if you are still claiming this after the IG report on the FISA warrants. Your post comes across as full of desperation. |