schools w/ no merit aid

Anonymous

Including Jewish, black, and Latino kids? |

Anonymous

https://www.schev.edu/financial-aid/in-state-tuition-and-fees Make the cutoff 30K and in 2020/21 everything except W&M was under $30k. It's the mentality that you have to "drop pretty far down the list" that gets people into trouble. Every state school is less than $30K except W&M. A kid can earn $8-10K/year by working summers/breaks/part time during School year for 10-12 hours/week. That leaves ~$20K---take $5.5K in federal loans. Now you are at $15K. That's $60K for the 4 years. That's less than 50% of what the OP has in their 529. I'd argue most people making $150-200K have probably saved close to $60K in their kids 529, and if not could find a way to pay $5-10K per year cash flowing it. If that education is beneath you, then it's your choice to go into major debt. But the fact is it can be done affordably, just not the elite schools. And once again, it comes down to choices in life. But the smart people will find a way to do college with minimal debt. And there are obviously many choices, just not the ones you seem to want. |

Anonymous

That's not cost of attendance. They are off by about 10k a year for at least UVA |

Anonymous

But, OP, pretty much everyone has to cross off certain schools that are a great fit, due to finances. Why did you think you’d be different? Why are you so angry? I’m sorry about your cancer but that should’ve been even more reason for you guys to realize that elite and expensive schools may not be possible. Or did you really live in a dream world where you thought the Wellesleys of the world needed to hand out merit aid to UMC kids? |

Anonymous

This is a fairly tone deaf response. Simply because you are "from a big family who attended a public high school" doesn't mean that it was accessible for everyone. |

Anonymous

Yep. I have a kid at Smith. Also $80k and not a lot of merit aid. The financial aid they do give is grants not loans, but that won’t help a donut hole family. We pay full price but DD loves it and we had 3/4th saved and will pay cash for the rest. It has been an amazing experience so well worth it from my perspective. |

Anonymous

Man, you people really are truly awful people. But, that is typical for here. Ugly, ugly people. |

Anonymous

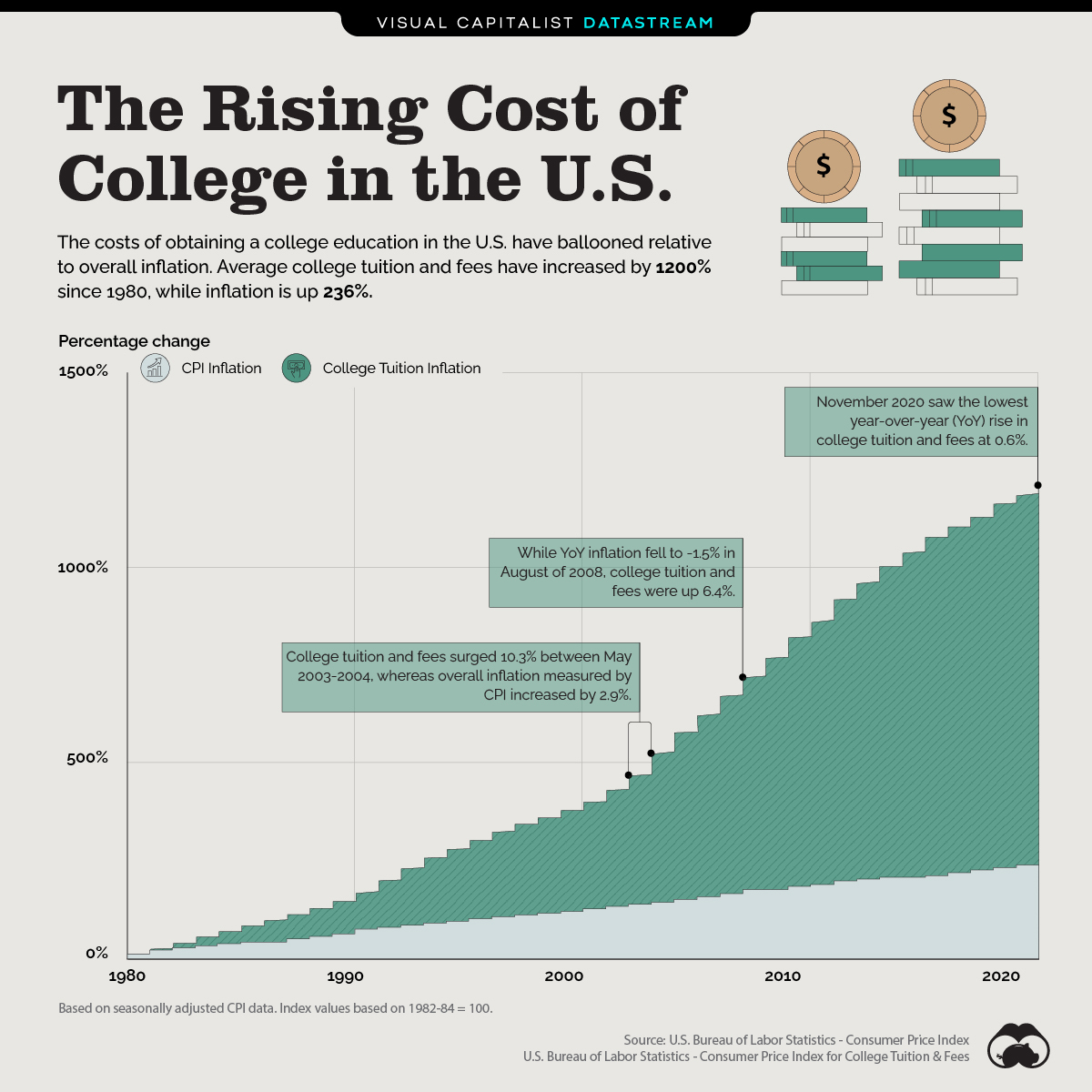

The point is. One should not have to. People who save aggressively and do everything their supposed to do. I drive a 12 yo car. Live in the same "starter" home. Etc. Etc. I'm no spendthrift. At what we have saved, we should be able to afford just about anything but costs have skyrocketed. The rich have choices. The poor get aid. The middle gets nothing but what's left over. |

Anonymous

Careful who you come for. Spent the last two years of college organizing protests against tuition hikes. Have supported efforts in my hometown to removing financial barriers to kids seeking college degrees/certification programs. Have lobbied state/federal electeds over two decades on stopping cuts to higher ed institutions, a key driver of increased college costs, as opposed to cutting taxes for the wealthy. I am definitely not okay with it, yet this is the world we and OP live in and we have to guide our kids accordingly. OP has been thrown some curveballs as an adult and didn't benefit from intergenerational wealth transfers as many on here did and will. That's really tough. But this is the reality in which we live - DC may not get to Wellesley, but is pretty darn lucky, as I stated, that they can probably land a merit scholarship + 529 = graduate debt free. Maybe then they can go to an Ivy or similar institution for grad as I did. |

Anonymous

My guess is that most middle class families would not trade their situations with the poor in order to get aid. That just wouldn't happen. |

Anonymous

And the poor get a lot less aid than you think. Yes, if they are high achievers who can get into T25-type schools they will likely get it covered 100%. But outside that tier they are not. And, the schools that might give good merit aid to your middle class student who can pay $30-$40k may turn down a poor student with a high EFC because while they can bring the cost down to $30-$40k, they can't bring it down to what that student can afford. I volunteer with low income students to help them with college apps. Most of the students in our program end up going to NVCC aiming to transfer to UVA or VT or they go to GMU because they can live at home. |

Anonymous

Dp, but I don’t see what you are complaining about. |

Anonymous

Actually, the true middle class get aid. You just don’t recognize that you are wealthy, just not wealthy enough to be full pay. |

Anonymous

Ding ding ding! Totally this. So hard to get admitted to a "meets need" school. I have one DC at a "meets need" and, having grown up working class, I can tell that many of his friends probably have a high EFC and are a mix of white and POC students. Most of them do not come home for any breaks other than winter and spring. The other DC is also at a meets need school, slightly more selective, and nearly all of DC's friends are from solid MC/UMC families. There are definitely FGLI students at the latter's school but do not seem as plentiful. |

Anonymous

How is that awful? It's reality. Life throws you many different situations, and you have to adjust and live within your means, whatever that means for your family. Most families have situations like that that are not readily apparent. But in reality, someone with HHI of near $150-200K+ and a 529 with $150-160K is not something to feel sorry for---they are doing better than 90%+ of the USA. So in perspective, is their kid not being able to afford to attend an elite college really that much of a terrible thing? Majority of American's cannot afford it. But the truth is hundreds of great school are/will be affordable to that family---it's all about perspective. And yes, it shouldn't be news to them that $160K isn't enough for an elite school and the fact that most elite schools do NOT give merit awards to very many should not be a surprise. This information is readily available in the CDS and with quick searches. It's not as if their kid cannot attend a great school. There are hundreds they can attend (and get into )for zero to minimal debt. |