Breaking Point?

Anonymous

| Given Trump’s huge unpopularity and the unpopularity of the net neutrality (80% was against the rollback) and the tax plan, when will people get fed up with GOP path? Will it only happen at the next election? Or are we going to see more open resistance? |

Anonymous

| People are already fed up with some of these proposals (as you pointed out), but it only has real impact if the elected officials actually listen to their constituents and vote accordingly. |

Anonymous

| They are betting on the fact that reality won't hit on the tax plan until April 15, 2019. |

Anonymous

|

As long as GNP continues to grow to 4% and beyond, and the stock market passes 25,000, his popularity will grow. In the end a good economy benefits everyone. Most people outside of the coasts have no idea what net neutrality is, and will not be effected by it. On the other hand, if they have good jobs and growing wages, they will have no desire to change the course.

|

Anonymous

Trump's popularity is shrinking. |

Anonymous

As you know, the latter (especially for subgroups of individuals) does not necessarily follow from the former. |

Anonymous

|

I fully expect violence against the economic and/or political elite within the next two years. Don't be surprised we start hearing about the murders of corporate execs, finance types, and lobbyist swamp creatures. It's only a matter of time - it hasn't happened in the US since the 1960s but we are quickly headed that way.

Read about the Lead Years in Italy in the 1970s...very scary times ahead: https://en.m.wikipedia.org/wiki/Years_of_Lead_(Italy) |

Anonymous

|

Trump will imploded when his deplorables start having their livelihoods cut. Welfare, disability, Social Security, Medicare.

All these are on the chopping block, and people will only react when they are smacked in the wallet. Health care premiums will skyrocket now, and that will be the first taste of the medicine the Trumpers will get. |

Anonymous

|

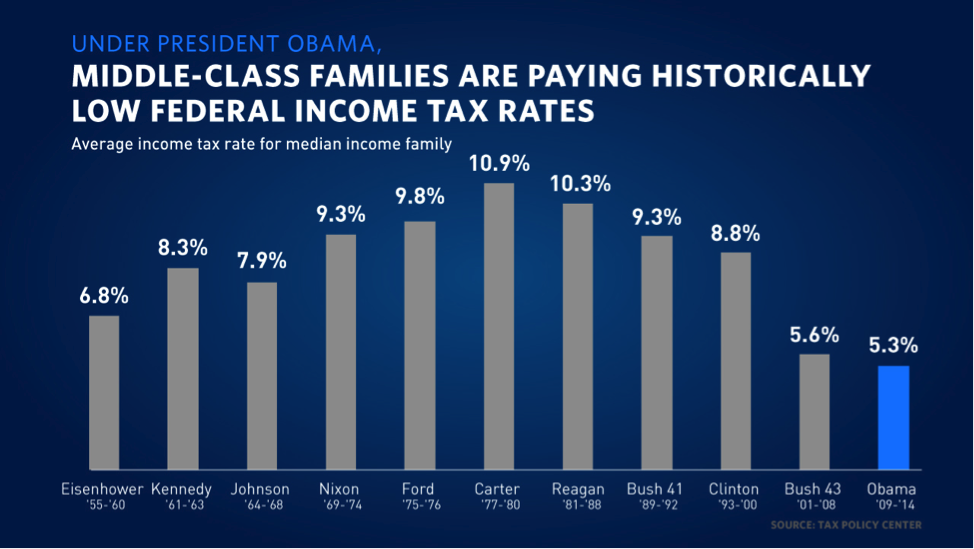

From the same Tax Policy Center: http://www.taxpolicycenter.org/model-estimates/tax-units-zero-or-negative-income-tax/tax-units-zero-or-negative-income-tax Nearly half the country pays zero income tax or gets a rebate. The wagon is getting awfully full.

|

Anonymous

lol wasn't obama responsible for continuing the Bush tax cuts? So he rode up the deficit and taxed Americans more than any other president at the same time? lol you guys! |

Anonymous

You can be that poor too, if you don't want to pay. Give a try for a year and let us know how it goes. You can't get blood from a stone, fool. |

Anonymous

|

Obama raised the national debt from 10 Trillion to 20 Trillion. The cognitive dissonance is amazing.

|

Anonymous

Thanks for providing this information. And while liberals are crying that the major taxpayers are getting to keep too much of their money, they are neglecting to mention that even MORE Americans will move to paying no income taxes at all. Even more....the bill now will give money to non- payers, via the increased child tax credit. Everyone should have some skin in the game, even if it is a token amount. How can we have a country where half the people are getting free government services and the other half is responsible for paying it? |

Anonymous

Jfc, you assholes are so purposely deceitful. You damn well know the poor pay taxes: excise, property, payroll, and sales taxes. Again, how do you wring blood out of a stone? |

Anonymous

Don't give me that poor crap. Close to half the country is not contributing to the revenue base and that's economically unsustainable. Stop pleading poor at every discussion on just how far out of whack the numbers have become. |