When do you think the stock market will crash?

Anonymous

This magical thinking is hilarious. You really think the booming economy is due to Obama's policies?

|

Anonymous

Yep. Facts aren't magic. "Behind the curtains" he's doing ... something ... to fix ... something is magical thinking. https://fortune.com/2019/11/01/trump-obama-markets-comparison-s-and-p-500-dow-nasdaq-economy/ |

Anonymous

| There needs to be a 10-15% correction to bring it back to a normal long term rate. For those of us who have invested for many years we expect this to happen and we have learned to live with it. I'm not putting anything more into the market and all dividends and new savings are going into a cash account. |

Anonymous

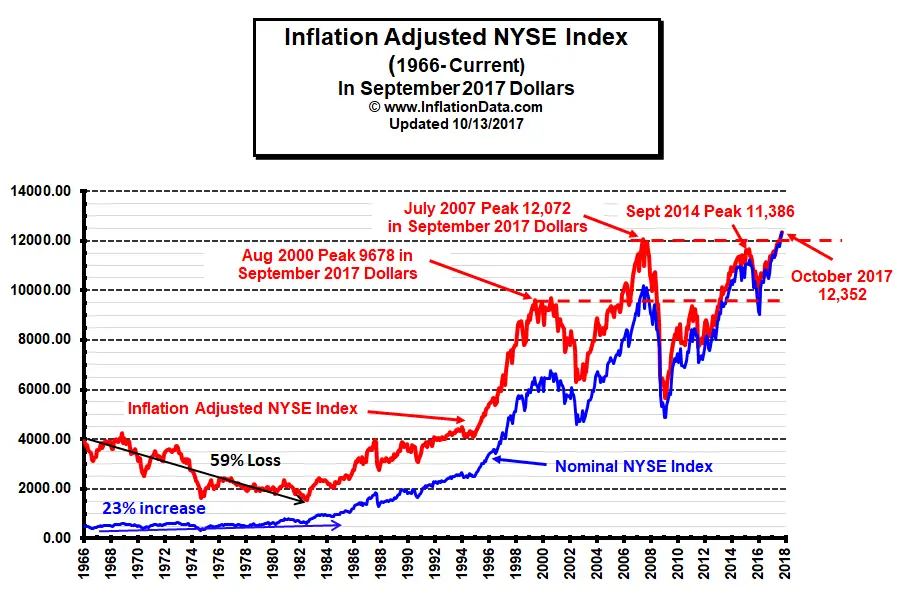

Long term rate? If you look at trends, going back to the 90s before LTCM and the Fed actively bailing out bubbles crashes, stocks would drop by more than half.

But I don’t expect Fed to ever stop pumping, so honestly, RISK ON. |

Anonymous

I agree sadly. |

Anonymous

Since the 1930's or so the market CAGR has been about 8%. 2018 the market was flat or slightly down and it's up something like 25%+ this year so for two years its up about 12-13% per year. A 10-15% correction next year would bring the three year rate down to about 8% per year or consistent with the long term rate. You can have big drops that are well past being a correction but then you have rebounds. |

Anonymous

3 year rate is meaningless when Fed has been manipulating since 90s and all-in bailout mode since TARP |

Anonymous

| When corporate profits begin to slow |

Anonymous

The average since 1930 is around 8% - the 3 year rate is simply consistent with the long term rate. |

Anonymous

|

pffff...just read an article today where one economist thinks that the economy will roar allllllllllll throughout the 2020s. Major new innovations are on the horizon that will radically transform society like the railway - gene therapies, artificial intelligence, space travel, 5G, etc. etc. The market may still be low after years of underperforming.

The point is that no one knows. People who try to market time always lose over the long run because they sell prematurely while the market still goes up, sell too late after the market is already going down, and buy back in too late after the market has already started to recover. Humans are dumb. Even though we have decades of evidence suggesting that the best possible way to invest is to buy, hold, and ignore for decades, people still try to market time like lemmings. |

Anonymous

don't worry, that's not going to happen. |

Anonymous

|

There's a saying that the stock market climbs a wall of worry. We've not been on that wall for very long yet. Anyone remember the run up to the dot com boom/bust? I expect something like that again.

My prediction is that the crash will come when rates rise, but every time that seems like it's going to happen the fed will ease. Finally, the fed easing will stop working. I have no idea how many rounds that will be. I think we've had one round so far. |

Anonymous

Yep. Rinse and repeat. I would really like to time this one, as I am getting closer to retirement. |

Anonymous

|

Fed will never let market crash long term. Look at 2007-2008. So as long as buying long term enjoy the ride.

Worst case scenario would be high inflation, but stock market still best bet in that case. |

Anonymous

|

If Elizabeth Warren or Bernie wins in 2020, but their win is highly unlikely.

So, the market will crash when the next Democrat is in the White House which won't be until 2024 the earliest. |