Anonymous

Anonymous wrote:I clicked on this post because it reminded me very much of the situation I was in when I was picking colleges. Granted, it was in 2004 so a very very different time, but there were still a number of fairly prestigious colleges that I was a good fit for stats-wise that didn't offer merit aid.

My dad took me on a bunch of tours and info sessions for these schools and others that would offer me significant merit aid and very adamantly advised me to take the scholarships and not go into debt. They had some money in a 529 but definitely not enough to cover four years full ticket at Georgetown or Cornell, even back then. I ended up taking a full tuition scholarship to a DC private university where I was more of a big fish in a small pond, and it was an amazing fit for me.

As an adult, I am so incredibly grateful that I was pushed in that direction. It would have been much easier for him, I think, to agree that I "deserved" to go to these brand-name schools, because on paper, I really did! But that kind of debt would have crippled me as a young adult, and I also think I would have been unhappy as an 18-year-old surrounded by kids from a much different SES than I came from. I experienced enough of that in law school, but at least I was a more fully-formed adult.. kind of.. at that point.

Your kid will bloom where they are planted, OP! I hope that they are able to understand the financial impact longterm that some of these decisions have on them/their family and make positive choices from there.

I'm a PP, and ITA with what you wrote, and I am advising my DC to NOT go into debt. I have a 26 yr old niece who had the option of going to a well known slac but being $80K in debt when they graduated or going to the in state honors college with some merit aide. It's not a public ivy, but a decent school. She is now so glad she made that choice, although, originally she was unhappy about it. She is seeing so many of her friends who had to take out loans. They are of course still paying it off while my niece is now saving to buy her first place.

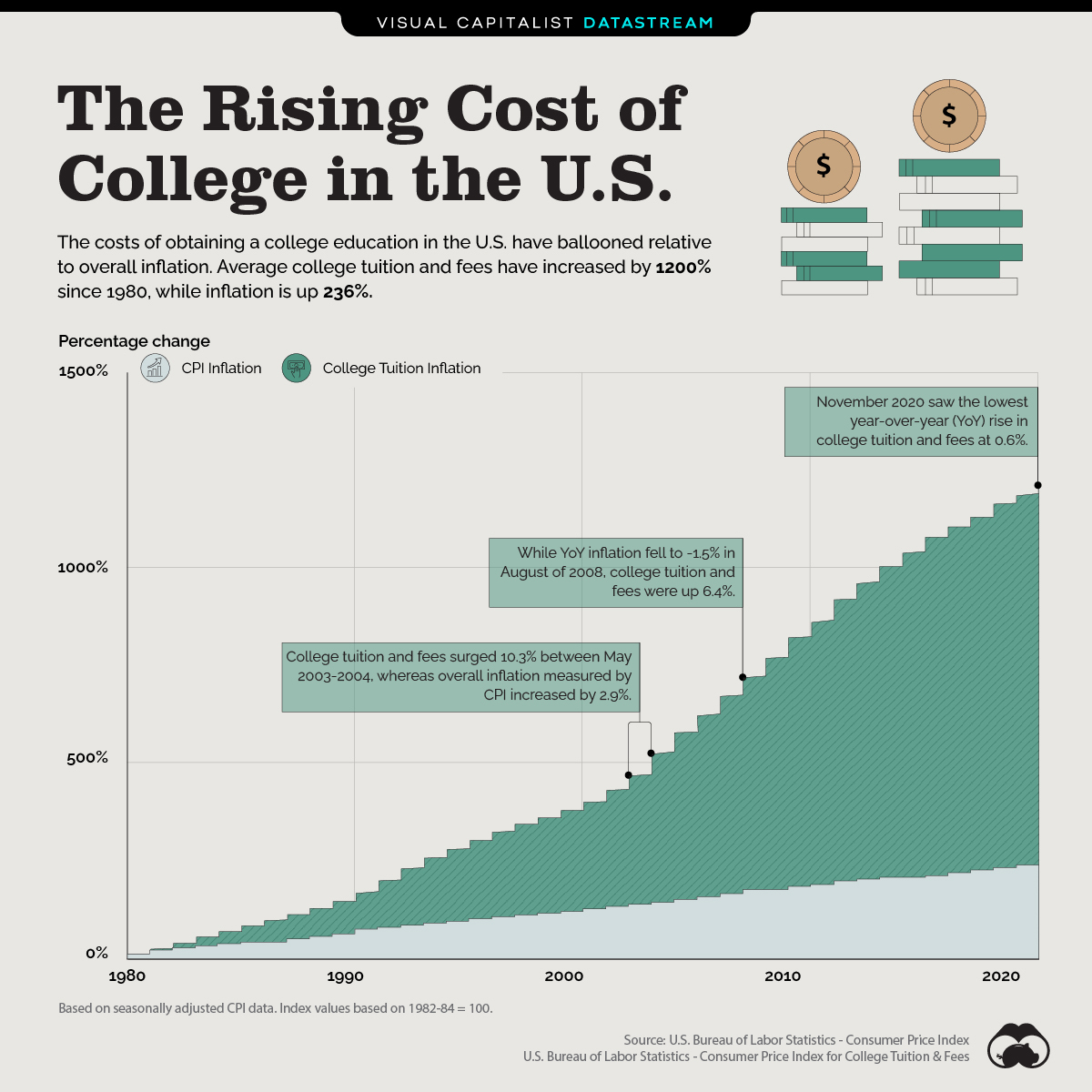

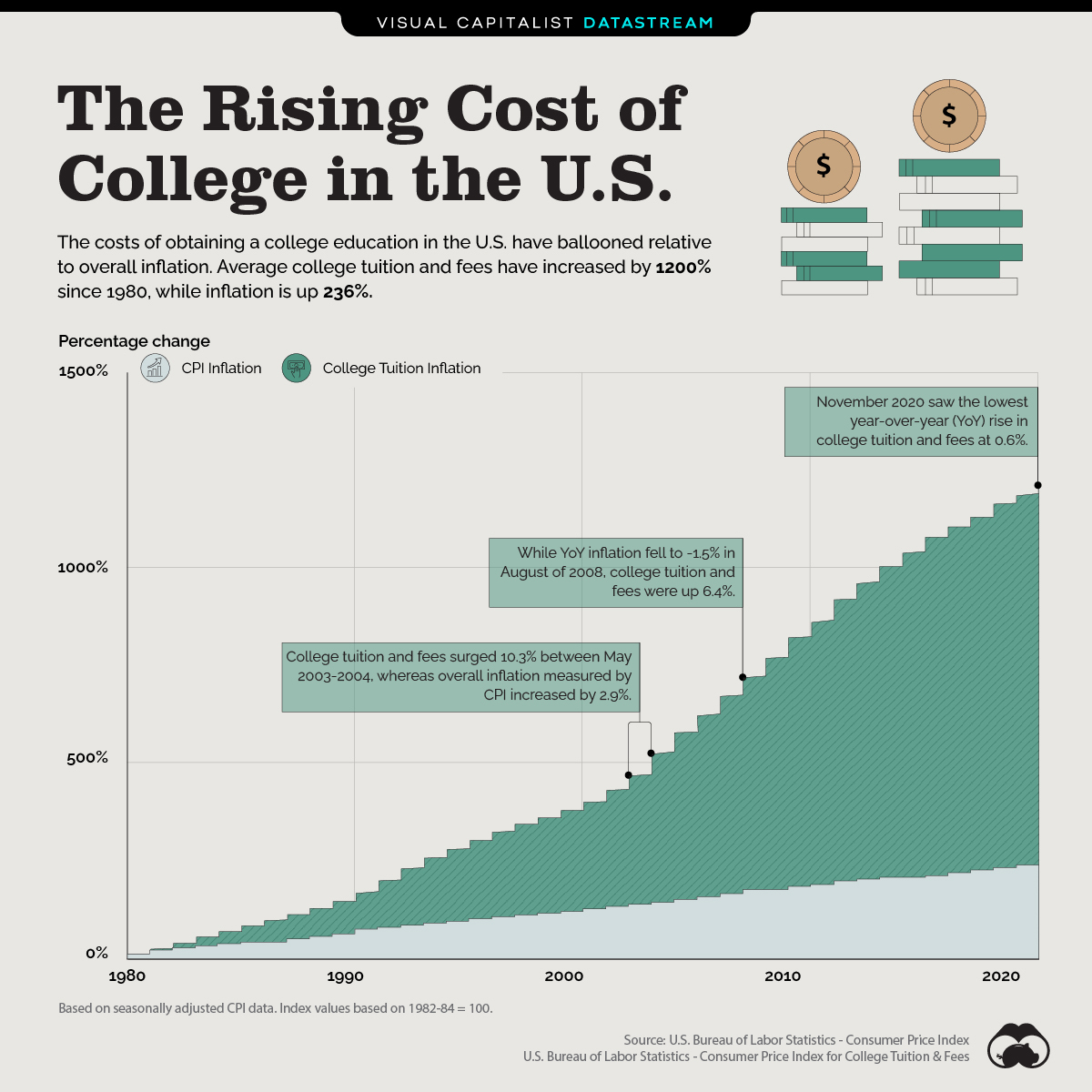

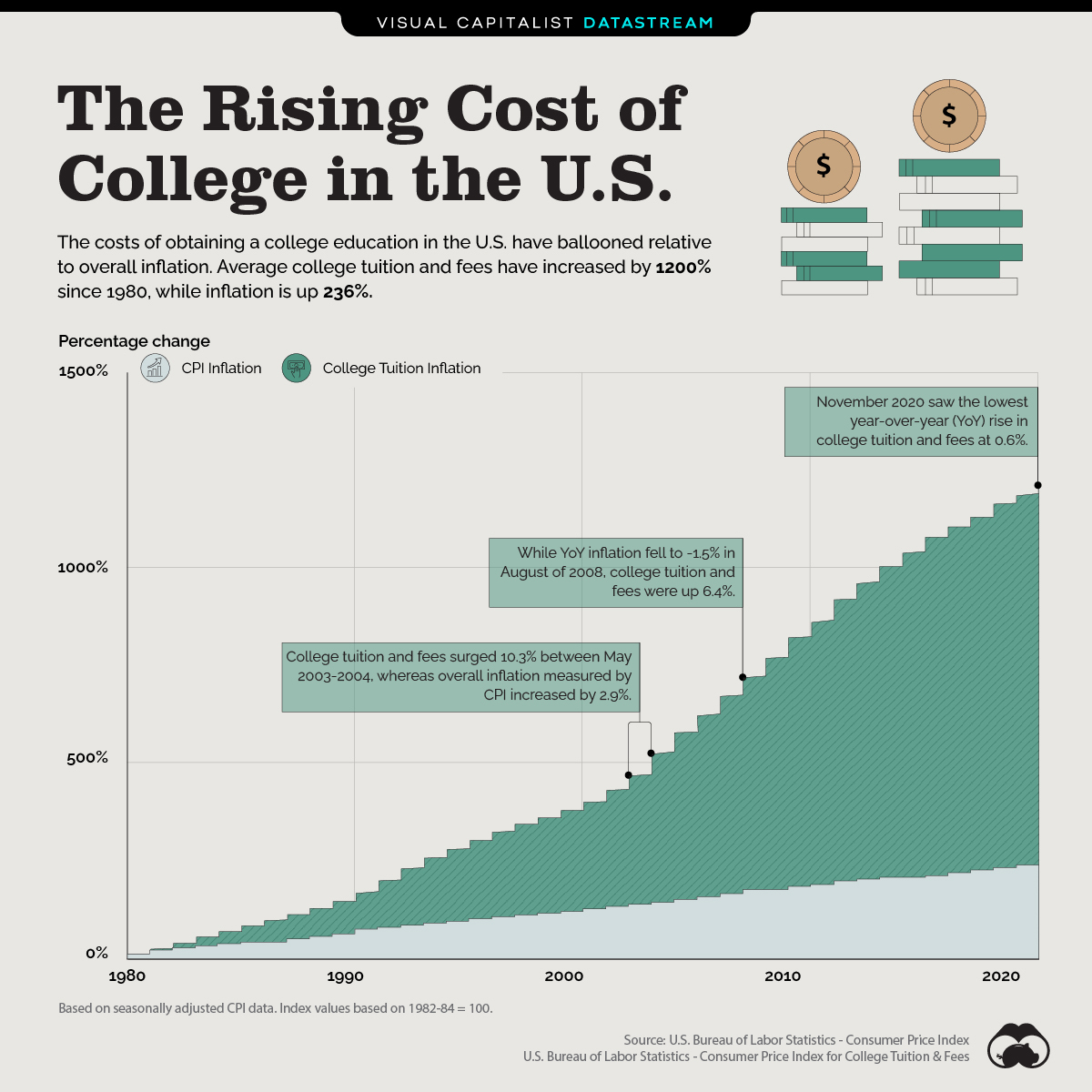

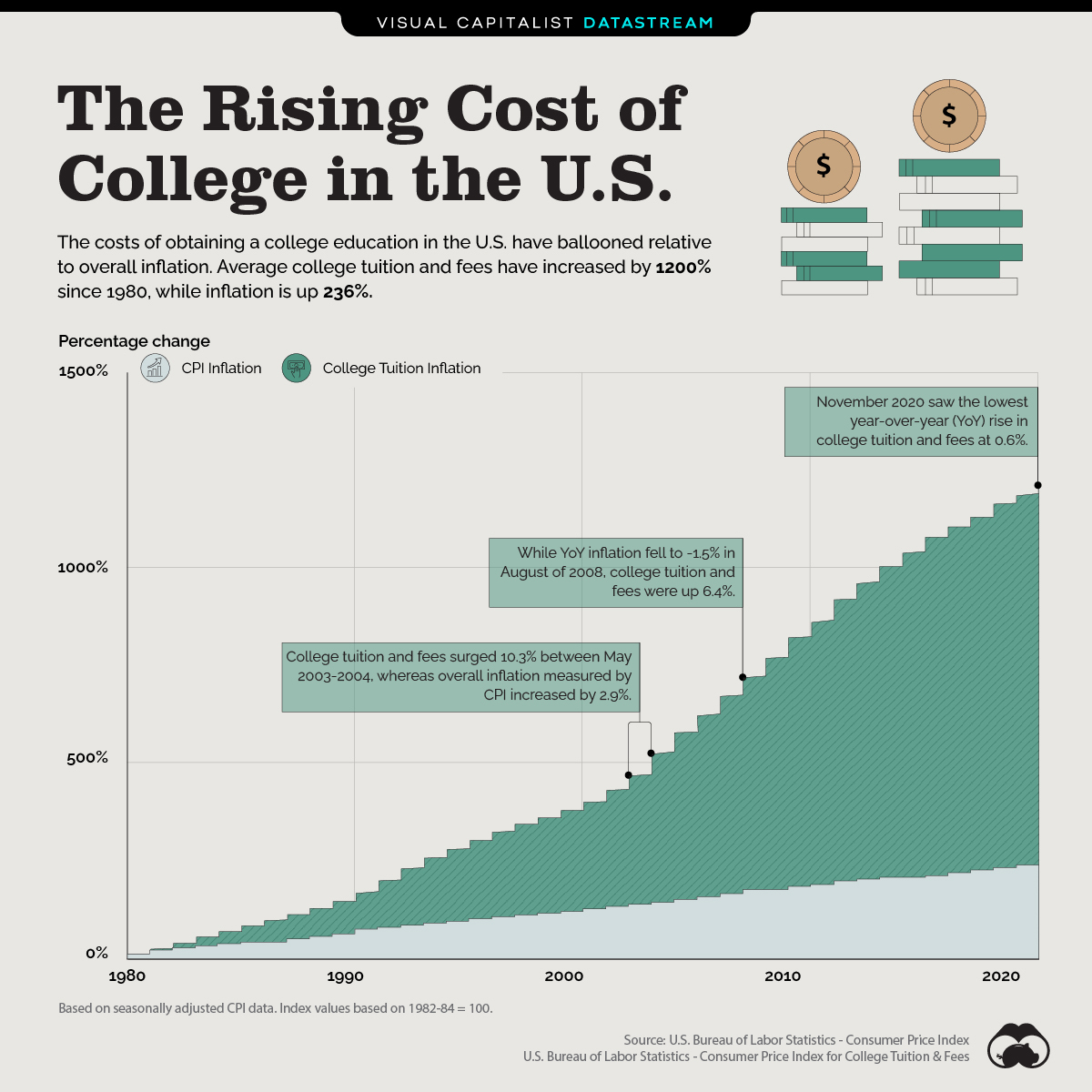

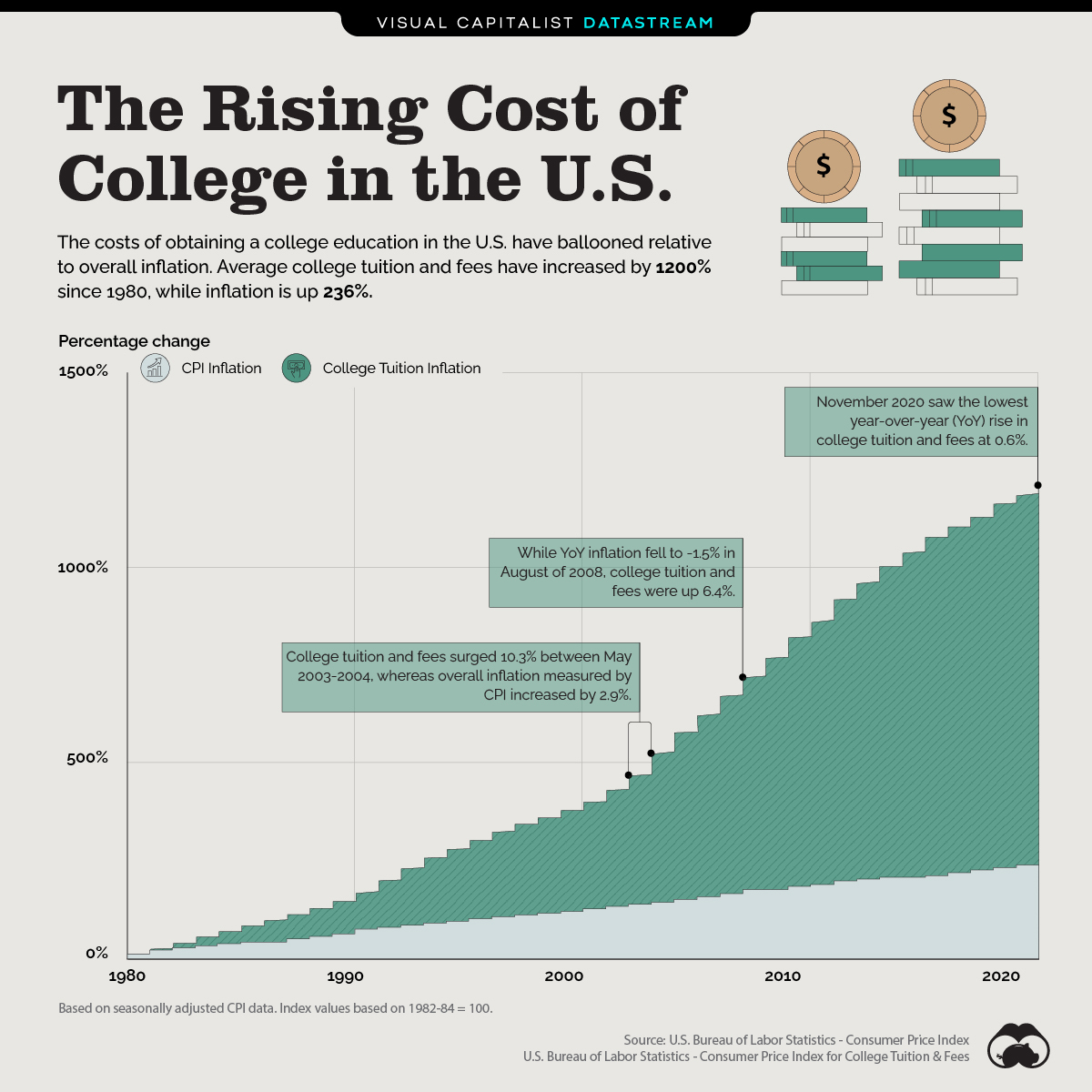

But it's still so incredibly ridiculous how out of control college costs have become.

Anonymous

Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Long story short: we will not get any financial aid. We make too much for help but don't make enough to go full pay at a private in a way that leaves any wiggle room.

We are just starting this process, and child is an athlete that is in the midst of recruiting (only D3 at this point b/c of NCAA limits- and FTR I don't care if DC plays a sport or not but she does). I'm looking at the finances of the various schools and was shocked to learn that some of the schools she's been talking to give NO MERIT aid. DC has excellent grades, community service, ECs, and athletics.

I get she's one of many like man others . . . and I know at DC there are no athletic scholarships. But, how are people affording places like Wellesley? Their website and what I'm finding says they give ZERO aid on the basis that, essentially, "everyone there is special."

Yes, she can look elsewhere. And she is. But it is so sad to have to shut down a possibility that would, honestly, be such a perfect fit for her in every way. With room and board, etc. the cost per year is nearly $80K!!!! Two years would eat up more than our 529 has in it. Super bummed to have to limit her.

They are either poor enough to get a lot of aid, rich enough to not need it, or had parents putting away a lot of money from conception.

Well it is no shock that top schools would cost ~$80K/year when my kid would enter college. So we did plan for that and sock away as much as we could from an early age, as we knew we wouldn't qualify for any FA. Had we not been able to do that, our kid would have had to search out more affordable schools.

Congratulations on making enough money to save 320k per kid?

No, it's congratulation on planning. Anyone smart enough to save $160K should be smart enough to know that college will be up to $80K/year in 2022. SO if attending those "Top schools" is important you plan accordingly.

Had we not been able to save enough, I would have set the mindset with my kids that while you can apply to T40 schools, we might not be able to afford them. So, you need to have a balanced list of college choices. To me, the most important part is finding great schools that are affordable to YOU. And there are many, many, many choices available for everyone. The OP has ~$40K/year saved for DD. There are literally hundreds of amazing options that will allow DD to graduate debt free. If only the OP would change their mindset and focus on what's available instead of complaining.

Similarly, I don't buy a house/car/vacation that I can't afford. I live within my means, or deal with the consequences. I don't expect others to compensate me for my lack of planning. OP could likely now cash flow another $10K+/year if they wanted to, based on their statements. So if the Top college is that important, they can do that and take parent loans and pay them off now that they have a higher income. (not saying I'd recommend that, as I actually think that's a bad idea----no school is worth going into debt for). But there are options. Smartest option (IMO) is to find a great school list that is affordable....and many many exist, just not T20 schools.

This is such an uber-American, "personal responsibility" thought pattern. So when college costs $200K/year in the future, anyone who didn't "plan" should just be shut out? How about when it gets to a million dollars a year? Are we all good with it only being for the children of Elon Musk and the like and if we can't do it, well then the fault is somehow our own?

It has not always been like this. Private schools have always been more expensive than public, but not to the degree they are now.

Instead of pointing fingers at people for "lack of planning" by saving $300K+ / child, why aren't we demanding to know why the costs are so outrageously impossible for even wealthy people to handle?

You are NOT SHUT OUT. You are simply shut out of the “luxury” product version of college. You feel entitled to a Louis Vuitton degree for your kid on your Coach budget. I’m sorry that you’ve bought into the idea that admissions are the ultimate arbiter of your kids’ merit but there are plenty of affordable options including community college.

That is your reaction to these graphics?

I'm not the PP, but basically yes. College costs are crazy and, being a former FAFSA kid, I'm kinda shocked that OP, who also claims to have been on FA in college, didn't realize that the costs were outpacing inflation and wasn't setting expectations accordingly with their DCs. The number of parents who get to their kids' junior or senior years and have absolutely no idea on how financing college works is stunning.

OP, you have enough money set aside that your DC can land a merit scholarship, attend a great school, and graduate debt free. That would be so great for your kid and an opportunity neither you nor your husband were able to have. Rather than focusing on what probably cannot happen, lean in to the fabulous opportunities your DC can have that many kids are not able to experience.

GL to your DC!

You just breezed past this part.

You think it's A-OK that college costs are crazy and continue to be crazy for the indefinite future? You're good with that?

Anonymous

Anonymous wrote:I clicked on this post because it reminded me very much of the situation I was in when I was picking colleges. Granted, it was in 2004 so a very very different time, but there were still a number of fairly prestigious colleges that I was a good fit for stats-wise that didn't offer merit aid.

My dad took me on a bunch of tours and info sessions for these schools and others that would offer me significant merit aid and very adamantly advised me to take the scholarships and not go into debt. They had some money in a 529 but definitely not enough to cover four years full ticket at Georgetown or Cornell, even back then. I ended up taking a full tuition scholarship to a DC private university where I was more of a big fish in a small pond, and it was an amazing fit for me.

As an adult, I am so incredibly grateful that I was pushed in that direction. It would have been much easier for him, I think, to agree that I "deserved" to go to these brand-name schools, because on paper, I really did! But that kind of debt would have crippled me as a young adult, and I also think I would have been unhappy as an 18-year-old surrounded by kids from a much different SES than I came from. I experienced enough of that in law school, but at least I was a more fully-formed adult.. kind of.. at that point.

Your kid will bloom where they are planted, OP! I hope that they are able to understand the financial impact longterm that some of these decisions have on them/their family and make positive choices from there.

With current loan limits, probably very little impact. You can not got to Wellesley on student loans, you can't even afford room and board on loans

Anonymous

Anonymous wrote:Anonymous wrote:I second the idea to look at other Seven Sisters colleges like Smith, Mount Holyoke, and Bryn Mawr that offer merit. I know kids at MoHo and BMC who are athletes, likely with merit aid. My kid at Oberlin has several athlete friends who got discounts through academic scholarships, as many non-athletes also receive. Her friend is on the cross-country team at Wooster and is truly a brilliant student (prospective physics major) and as the oldest of 3, was only able to attend a LAC due to generous merit aid. Check out some of those! Gettysburg, Dickinson, Allegheny, Kalamazoo, are also good suggestions. Otherwise, she might have to make a decision, like many of DD's friends have, to forgo the D3 varsity sports experience and play at the club level at a public flagship.

Thanks. Many of these are on her list.

Anytime, good luck with the process! She sounds like a good kid, so it'll work out in the end. If there's anything she's specifically looking for in terms of academics, fit, location or campus culture, let us know and we'll see if we can chip in with some more ideas.

Anonymous

I clicked on this post because it reminded me very much of the situation I was in when I was picking colleges. Granted, it was in 2004 so a very very different time, but there were still a number of fairly prestigious colleges that I was a good fit for stats-wise that didn't offer merit aid.

My dad took me on a bunch of tours and info sessions for these schools and others that would offer me significant merit aid and very adamantly advised me to take the scholarships and not go into debt. They had some money in a 529 but definitely not enough to cover four years full ticket at Georgetown or Cornell, even back then. I ended up taking a full tuition scholarship to a DC private university where I was more of a big fish in a small pond, and it was an amazing fit for me.

As an adult, I am so incredibly grateful that I was pushed in that direction. It would have been much easier for him, I think, to agree that I "deserved" to go to these brand-name schools, because on paper, I really did! But that kind of debt would have crippled me as a young adult, and I also think I would have been unhappy as an 18-year-old surrounded by kids from a much different SES than I came from. I experienced enough of that in law school, but at least I was a more fully-formed adult.. kind of.. at that point.

Your kid will bloom where they are planted, OP! I hope that they are able to understand the financial impact longterm that some of these decisions have on them/their family and make positive choices from there.

My dad took me on a bunch of tours and info sessions for these schools and others that would offer me significant merit aid and very adamantly advised me to take the scholarships and not go into debt. They had some money in a 529 but definitely not enough to cover four years full ticket at Georgetown or Cornell, even back then. I ended up taking a full tuition scholarship to a DC private university where I was more of a big fish in a small pond, and it was an amazing fit for me.

As an adult, I am so incredibly grateful that I was pushed in that direction. It would have been much easier for him, I think, to agree that I "deserved" to go to these brand-name schools, because on paper, I really did! But that kind of debt would have crippled me as a young adult, and I also think I would have been unhappy as an 18-year-old surrounded by kids from a much different SES than I came from. I experienced enough of that in law school, but at least I was a more fully-formed adult.. kind of.. at that point.

Your kid will bloom where they are planted, OP! I hope that they are able to understand the financial impact longterm that some of these decisions have on them/their family and make positive choices from there.

Anonymous

Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Long story short: we will not get any financial aid. We make too much for help but don't make enough to go full pay at a private in a way that leaves any wiggle room.

We are just starting this process, and child is an athlete that is in the midst of recruiting (only D3 at this point b/c of NCAA limits- and FTR I don't care if DC plays a sport or not but she does). I'm looking at the finances of the various schools and was shocked to learn that some of the schools she's been talking to give NO MERIT aid. DC has excellent grades, community service, ECs, and athletics.

I get she's one of many like man others . . . and I know at DC there are no athletic scholarships. But, how are people affording places like Wellesley? Their website and what I'm finding says they give ZERO aid on the basis that, essentially, "everyone there is special."

Yes, she can look elsewhere. And she is. But it is so sad to have to shut down a possibility that would, honestly, be such a perfect fit for her in every way. With room and board, etc. the cost per year is nearly $80K!!!! Two years would eat up more than our 529 has in it. Super bummed to have to limit her.

They are either poor enough to get a lot of aid, rich enough to not need it, or had parents putting away a lot of money from conception.

Well it is no shock that top schools would cost ~$80K/year when my kid would enter college. So we did plan for that and sock away as much as we could from an early age, as we knew we wouldn't qualify for any FA. Had we not been able to do that, our kid would have had to search out more affordable schools.

Congratulations on making enough money to save 320k per kid?

No, it's congratulation on planning. Anyone smart enough to save $160K should be smart enough to know that college will be up to $80K/year in 2022. SO if attending those "Top schools" is important you plan accordingly.

Had we not been able to save enough, I would have set the mindset with my kids that while you can apply to T40 schools, we might not be able to afford them. So, you need to have a balanced list of college choices. To me, the most important part is finding great schools that are affordable to YOU. And there are many, many, many choices available for everyone. The OP has ~$40K/year saved for DD. There are literally hundreds of amazing options that will allow DD to graduate debt free. If only the OP would change their mindset and focus on what's available instead of complaining.

Similarly, I don't buy a house/car/vacation that I can't afford. I live within my means, or deal with the consequences. I don't expect others to compensate me for my lack of planning. OP could likely now cash flow another $10K+/year if they wanted to, based on their statements. So if the Top college is that important, they can do that and take parent loans and pay them off now that they have a higher income. (not saying I'd recommend that, as I actually think that's a bad idea----no school is worth going into debt for). But there are options. Smartest option (IMO) is to find a great school list that is affordable....and many many exist, just not T20 schools.

OP here. I guess I should have been smart enough not to acquire nearly $150K in medical bills due to cancer, as well?

Why don't you just stop with the speculation about what I should have done. We did all we could. And we saved a lot, notwithstanding that.

I never said my child did not have other options and wasn't considering other options. As I said, I grew up dirt poor and went to a non-elite school. I simply lamented HAVING to cross off schools -which are a perfect fit for her- solely based on finances. Especially when we saved aggressively for it. It sounds like people in the middle (too much money, but not enough) just can't go to these schools.

Good Lord OP. That's life! Obviously you haven't saved aggressively enough.

You sound nice.

Anonymous

Anonymous wrote:I second the idea to look at other Seven Sisters colleges like Smith, Mount Holyoke, and Bryn Mawr that offer merit. I know kids at MoHo and BMC who are athletes, likely with merit aid. My kid at Oberlin has several athlete friends who got discounts through academic scholarships, as many non-athletes also receive. Her friend is on the cross-country team at Wooster and is truly a brilliant student (prospective physics major) and as the oldest of 3, was only able to attend a LAC due to generous merit aid. Check out some of those! Gettysburg, Dickinson, Allegheny, Kalamazoo, are also good suggestions. Otherwise, she might have to make a decision, like many of DD's friends have, to forgo the D3 varsity sports experience and play at the club level at a public flagship.

Thanks. Many of these are on her list.

Anonymous

Anonymous wrote:Long story short: we will not get any financial aid. We make too much for help but don't make enough to go full pay at a private in a way that leaves any wiggle room.

We are just starting this process, and child is an athlete that is in the midst of recruiting (only D3 at this point b/c of NCAA limits- and FTR I don't care if DC plays a sport or not but she does). I'm looking at the finances of the various schools and was shocked to learn that some of the schools she's been talking to give NO MERIT aid. DC has excellent grades, community service, ECs, and athletics.

I get she's one of many like man others . . . and I know at DC there are no athletic scholarships. But, how are people affording places like Wellesley? Their website and what I'm finding says they give ZERO aid on the basis that, essentially, "everyone there is special."

Yes, she can look elsewhere. And she is. But it is so sad to have to shut down a possibility that would, honestly, be such a perfect fit for her in every way. With room and board, etc. the cost per year is nearly $80K!!!! Two years would eat up more than our 529 has in it. Super bummed to have to limit her.

It is good that you are realizing how the pricing works now rather than a year from now. Yes, if you aren't hugely wealthy, most people have to deal with financial limits when it comes to college selection. Like everything else in life -- are you super bummed to have limited her to riding in a particular type of car or living in a particular house/neighborhood or going on certain types of vacations because of cost? College is no different.

My kids only applied to reaches that were in-state publics (UVA, W&M) for this reason. One is now at VT and the other (while waiting on an answer from W&M) has acceptances from multiple LACs with large merit awards and is very happy with her choices, even if she doesn't get in to W&M. Possibly, in part, because we never even toured schools we knew we could never afford. Shopping for reaches you can't afford is such a waste of time and mental/emotional energy. Again, no different than shopping for a house or car I can't afford.

Wellesley is NOT a "perfect fit for her in every way" because it is not also a financial fit. So, she needs to think what were the specific aspects of Wellesley that she liked (and ranking doesn't count) and do the research to figure out what schools offer that and are generous with merit aid. There definitely are other schools out there and she won't be alone in being a strong student at a college a tier or two down. Plenty of people with great students have to make the same choices based on finances.

Here's one place to start -- this data visualization tool from the Chronicle of Higher Education can show you which colleges listed Wellesley as a "peer". Some of these are less selective and offer merit aid.

https://www.chronicle.com/article/who-does-your-college-think-its-peers-are

Anonymous

Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Long story short: we will not get any financial aid. We make too much for help but don't make enough to go full pay at a private in a way that leaves any wiggle room.

We are just starting this process, and child is an athlete that is in the midst of recruiting (only D3 at this point b/c of NCAA limits- and FTR I don't care if DC plays a sport or not but she does). I'm looking at the finances of the various schools and was shocked to learn that some of the schools she's been talking to give NO MERIT aid. DC has excellent grades, community service, ECs, and athletics.

I get she's one of many like man others . . . and I know at DC there are no athletic scholarships. But, how are people affording places like Wellesley? Their website and what I'm finding says they give ZERO aid on the basis that, essentially, "everyone there is special."

Yes, she can look elsewhere. And she is. But it is so sad to have to shut down a possibility that would, honestly, be such a perfect fit for her in every way. With room and board, etc. the cost per year is nearly $80K!!!! Two years would eat up more than our 529 has in it. Super bummed to have to limit her.

They are either poor enough to get a lot of aid, rich enough to not need it, or had parents putting away a lot of money from conception.

Well it is no shock that top schools would cost ~$80K/year when my kid would enter college. So we did plan for that and sock away as much as we could from an early age, as we knew we wouldn't qualify for any FA. Had we not been able to do that, our kid would have had to search out more affordable schools.

Congratulations on making enough money to save 320k per kid?

No, it's congratulation on planning. Anyone smart enough to save $160K should be smart enough to know that college will be up to $80K/year in 2022. SO if attending those "Top schools" is important you plan accordingly.

Had we not been able to save enough, I would have set the mindset with my kids that while you can apply to T40 schools, we might not be able to afford them. So, you need to have a balanced list of college choices. To me, the most important part is finding great schools that are affordable to YOU. And there are many, many, many choices available for everyone. The OP has ~$40K/year saved for DD. There are literally hundreds of amazing options that will allow DD to graduate debt free. If only the OP would change their mindset and focus on what's available instead of complaining.

Similarly, I don't buy a house/car/vacation that I can't afford. I live within my means, or deal with the consequences. I don't expect others to compensate me for my lack of planning. OP could likely now cash flow another $10K+/year if they wanted to, based on their statements. So if the Top college is that important, they can do that and take parent loans and pay them off now that they have a higher income. (not saying I'd recommend that, as I actually think that's a bad idea----no school is worth going into debt for). But there are options. Smartest option (IMO) is to find a great school list that is affordable....and many many exist, just not T20 schools.

This is such an uber-American, "personal responsibility" thought pattern. So when college costs $200K/year in the future, anyone who didn't "plan" should just be shut out? How about when it gets to a million dollars a year? Are we all good with it only being for the children of Elon Musk and the like and if we can't do it, well then the fault is somehow our own?

It has not always been like this. Private schools have always been more expensive than public, but not to the degree they are now.

Instead of pointing fingers at people for "lack of planning" by saving $300K+ / child, why aren't we demanding to know why the costs are so outrageously impossible for even wealthy people to handle?

You are NOT SHUT OUT. You are simply shut out of the “luxury” product version of college. You feel entitled to a Louis Vuitton degree for your kid on your Coach budget. I’m sorry that you’ve bought into the idea that admissions are the ultimate arbiter of your kids’ merit but there are plenty of affordable options including community college.

That is your reaction to these graphics?

My reaction to the graphics is that they’re stupid because they compare low income kids to sticker tuition. We all know that’s not the beef on DCUM. The complaint is that high income people are supposed to fork over their wealth. We all know low income people are getting majorly subsidized by the DCUM set so their incomes are irrelevant.

These graphs are also just another way of showing growing income inequality and how schools have fully seized the opportunity to take from the wealthy. Due to the inequality, they know there’s more money to take, and they are taking it.

That's not what they depict. It's not about low-income kids and sticker tuition. It's about tuition relative to HHI (in all classes). High income people have always forked over their wealth; it just wasn't as much in the past (yes, including for private schools).

The point of this thread is that college tuition raises have so greatly outstripped inflation and salary growth that it's priced out many people who otherwise could have afforded full tuition in the past. Colleges are not BMWs or Maseratis or Hondas. They are institutions of higher education. It's become a real burden for most working families, whether upper middle or lower middle class, to pay for higher education. Not being able to afford a luxury car is not a burden, but for many people, not being able to afford a college that our grandparents (who made less money, adjusted for inflation) could have paid for easily is a burden.

In my generation (I'm 61yo), the cost of attendance could be covered from savings, current income, the student's summer earnings, work study, and some modest loans. E.g. the expensive private SLAC I attended cost about $8,000 when I started in 1979, and I contributed about 25% of that from my summer work. Proportionally, a student today would have to contribute $20,000 to make the same dent in the same school's costs.

Adjusted for inflation, $8,000.00 in 1979 is equal to $32,838 today in 2023. But that school now costs over $80,000/year.

See also

https://www.theatlantic.com/education/archive/2014/04/the-myth-of-working-your-way-through-college/359735/

Once upon a time, a summer spent scooping ice cream could pay for a year of college. Today, the average student's annual tuition is equivalent to 991 hours behind the counter.

NP.. ITA with you. College costs like healthcare costs have vastly surpassed inflation and wage growth. There is something wrong with our society. I'm 52.

We don't qualify for FA, and some of the colleges DC is looking at for their major don't provide any merit aide. I grew up lower income; I'm frugal. I drove my last car for 15 years and only had to give it up because it was smoking a lot. I bought a $30K car. Some of those colleges cost almost 3x my car, per year. It's ridiculous.

I saved, but not $80k/yr for college, and also I have a younger child.

Maybe I should've not been so frugal and not saved. Maybe I should've bought a more expensive car every 3 years, buy name brand clothes (I shop at Target and Kohls), and all kinds of jewelry (only have my engagement ring and sapphire studs that DH bought me when I had our second child).

Then maybe we would qualify for some FA, and then taxpayers can pay off my Dc's college loans some time in the future.

Anonymous

Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Long story short: we will not get any financial aid. We make too much for help but don't make enough to go full pay at a private in a way that leaves any wiggle room.

We are just starting this process, and child is an athlete that is in the midst of recruiting (only D3 at this point b/c of NCAA limits- and FTR I don't care if DC plays a sport or not but she does). I'm looking at the finances of the various schools and was shocked to learn that some of the schools she's been talking to give NO MERIT aid. DC has excellent grades, community service, ECs, and athletics.

I get she's one of many like man others . . . and I know at DC there are no athletic scholarships. But, how are people affording places like Wellesley? Their website and what I'm finding says they give ZERO aid on the basis that, essentially, "everyone there is special."

Yes, she can look elsewhere. And she is. But it is so sad to have to shut down a possibility that would, honestly, be such a perfect fit for her in every way. With room and board, etc. the cost per year is nearly $80K!!!! Two years would eat up more than our 529 has in it. Super bummed to have to limit her.

They are either poor enough to get a lot of aid, rich enough to not need it, or had parents putting away a lot of money from conception.

Well it is no shock that top schools would cost ~$80K/year when my kid would enter college. So we did plan for that and sock away as much as we could from an early age, as we knew we wouldn't qualify for any FA. Had we not been able to do that, our kid would have had to search out more affordable schools.

Congratulations on making enough money to save 320k per kid?

No, it's congratulation on planning. Anyone smart enough to save $160K should be smart enough to know that college will be up to $80K/year in 2022. SO if attending those "Top schools" is important you plan accordingly.

Had we not been able to save enough, I would have set the mindset with my kids that while you can apply to T40 schools, we might not be able to afford them. So, you need to have a balanced list of college choices. To me, the most important part is finding great schools that are affordable to YOU. And there are many, many, many choices available for everyone. The OP has ~$40K/year saved for DD. There are literally hundreds of amazing options that will allow DD to graduate debt free. If only the OP would change their mindset and focus on what's available instead of complaining.

Similarly, I don't buy a house/car/vacation that I can't afford. I live within my means, or deal with the consequences. I don't expect others to compensate me for my lack of planning. OP could likely now cash flow another $10K+/year if they wanted to, based on their statements. So if the Top college is that important, they can do that and take parent loans and pay them off now that they have a higher income. (not saying I'd recommend that, as I actually think that's a bad idea----no school is worth going into debt for). But there are options. Smartest option (IMO) is to find a great school list that is affordable....and many many exist, just not T20 schools.

OP here. I guess I should have been smart enough not to acquire nearly $150K in medical bills due to cancer, as well?

Why don't you just stop with the speculation about what I should have done. We did all we could. And we saved a lot, notwithstanding that.

I never said my child did not have other options and wasn't considering other options. As I said, I grew up dirt poor and went to a non-elite school. I simply lamented HAVING to cross off schools -which are a perfect fit for her- solely based on finances. Especially when we saved aggressively for it. It sounds like people in the middle (too much money, but not enough) just can't go to these schools.

Good Lord OP. That's life! Obviously you haven't saved aggressively enough.

Anonymous

Anonymous wrote:Anonymous wrote:Anonymous wrote:Wellesley actually offers generous financial aid even to wealthier households. Have you run the NPC for that school? They use the CSS and take more into account than FAFSA.

Not for us. We now make too much. But, that was not always the case and that is not considered. We have no generational money. No parent support. We had loans of our own. We now make a very comfortable salary but that is a recent development and one that does not allow us to pay $70-80K / year without basically directing all of our income to school (at least for 2 of the years) and travel expenses getting to /from.

Are you saying that your income is about $120K pre-tax? Or is that your discretionary income and you want a luxury good without paying a luxury price?

We do not have anywhere close to $120K in discretionary income.

Anonymous

Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Long story short: we will not get any financial aid. We make too much for help but don't make enough to go full pay at a private in a way that leaves any wiggle room.

We are just starting this process, and child is an athlete that is in the midst of recruiting (only D3 at this point b/c of NCAA limits- and FTR I don't care if DC plays a sport or not but she does). I'm looking at the finances of the various schools and was shocked to learn that some of the schools she's been talking to give NO MERIT aid. DC has excellent grades, community service, ECs, and athletics.

I get she's one of many like man others . . . and I know at DC there are no athletic scholarships. But, how are people affording places like Wellesley? Their website and what I'm finding says they give ZERO aid on the basis that, essentially, "everyone there is special."

Yes, she can look elsewhere. And she is. But it is so sad to have to shut down a possibility that would, honestly, be such a perfect fit for her in every way. With room and board, etc. the cost per year is nearly $80K!!!! Two years would eat up more than our 529 has in it. Super bummed to have to limit her.

They are either poor enough to get a lot of aid, rich enough to not need it, or had parents putting away a lot of money from conception.

Well it is no shock that top schools would cost ~$80K/year when my kid would enter college. So we did plan for that and sock away as much as we could from an early age, as we knew we wouldn't qualify for any FA. Had we not been able to do that, our kid would have had to search out more affordable schools.

Congratulations on making enough money to save 320k per kid?

No, it's congratulation on planning. Anyone smart enough to save $160K should be smart enough to know that college will be up to $80K/year in 2022. SO if attending those "Top schools" is important you plan accordingly.

Had we not been able to save enough, I would have set the mindset with my kids that while you can apply to T40 schools, we might not be able to afford them. So, you need to have a balanced list of college choices. To me, the most important part is finding great schools that are affordable to YOU. And there are many, many, many choices available for everyone. The OP has ~$40K/year saved for DD. There are literally hundreds of amazing options that will allow DD to graduate debt free. If only the OP would change their mindset and focus on what's available instead of complaining.

Similarly, I don't buy a house/car/vacation that I can't afford. I live within my means, or deal with the consequences. I don't expect others to compensate me for my lack of planning. OP could likely now cash flow another $10K+/year if they wanted to, based on their statements. So if the Top college is that important, they can do that and take parent loans and pay them off now that they have a higher income. (not saying I'd recommend that, as I actually think that's a bad idea----no school is worth going into debt for). But there are options. Smartest option (IMO) is to find a great school list that is affordable....and many many exist, just not T20 schools.

This is such an uber-American, "personal responsibility" thought pattern. So when college costs $200K/year in the future, anyone who didn't "plan" should just be shut out? How about when it gets to a million dollars a year? Are we all good with it only being for the children of Elon Musk and the like and if we can't do it, well then the fault is somehow our own?

It has not always been like this. Private schools have always been more expensive than public, but not to the degree they are now.

Instead of pointing fingers at people for "lack of planning" by saving $300K+ / child, why aren't we demanding to know why the costs are so outrageously impossible for even wealthy people to handle?

You are NOT SHUT OUT. You are simply shut out of the “luxury” product version of college. You feel entitled to a Louis Vuitton degree for your kid on your Coach budget. I’m sorry that you’ve bought into the idea that admissions are the ultimate arbiter of your kids’ merit but there are plenty of affordable options including community college.

That is your reaction to these graphics?

I'm not the PP, but basically yes. College costs are crazy and, being a former FAFSA kid, I'm kinda shocked that OP, who also claims to have been on FA in college, didn't realize that the costs were outpacing inflation and wasn't setting expectations accordingly with their DCs. The number of parents who get to their kids' junior or senior years and have absolutely no idea on how financing college works is stunning.

OP, you have enough money set aside that your DC can land a merit scholarship, attend a great school, and graduate debt free. That would be so great for your kid and an opportunity neither you nor your husband were able to have. Rather than focusing on what probably cannot happen, lean in to the fabulous opportunities your DC can have that many kids are not able to experience.

GL to your DC!

Just my observation, people who were themselves on FA feel the most entitled to aid and are the most blindsided to find out they’re supposed to be able to afford sticker.

This x100

this is my observation as well

Anonymous

Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Long story short: we will not get any financial aid. We make too much for help but don't make enough to go full pay at a private in a way that leaves any wiggle room.

We are just starting this process, and child is an athlete that is in the midst of recruiting (only D3 at this point b/c of NCAA limits- and FTR I don't care if DC plays a sport or not but she does). I'm looking at the finances of the various schools and was shocked to learn that some of the schools she's been talking to give NO MERIT aid. DC has excellent grades, community service, ECs, and athletics.

I get she's one of many like man others . . . and I know at DC there are no athletic scholarships. But, how are people affording places like Wellesley? Their website and what I'm finding says they give ZERO aid on the basis that, essentially, "everyone there is special."

Yes, she can look elsewhere. And she is. But it is so sad to have to shut down a possibility that would, honestly, be such a perfect fit for her in every way. With room and board, etc. the cost per year is nearly $80K!!!! Two years would eat up more than our 529 has in it. Super bummed to have to limit her.

They are either poor enough to get a lot of aid, rich enough to not need it, or had parents putting away a lot of money from conception.

Well it is no shock that top schools would cost ~$80K/year when my kid would enter college. So we did plan for that and sock away as much as we could from an early age, as we knew we wouldn't qualify for any FA. Had we not been able to do that, our kid would have had to search out more affordable schools.

Congratulations on making enough money to save 320k per kid?

No, it's congratulation on planning. Anyone smart enough to save $160K should be smart enough to know that college will be up to $80K/year in 2022. SO if attending those "Top schools" is important you plan accordingly.

Had we not been able to save enough, I would have set the mindset with my kids that while you can apply to T40 schools, we might not be able to afford them. So, you need to have a balanced list of college choices. To me, the most important part is finding great schools that are affordable to YOU. And there are many, many, many choices available for everyone. The OP has ~$40K/year saved for DD. There are literally hundreds of amazing options that will allow DD to graduate debt free. If only the OP would change their mindset and focus on what's available instead of complaining.

Similarly, I don't buy a house/car/vacation that I can't afford. I live within my means, or deal with the consequences. I don't expect others to compensate me for my lack of planning. OP could likely now cash flow another $10K+/year if they wanted to, based on their statements. So if the Top college is that important, they can do that and take parent loans and pay them off now that they have a higher income. (not saying I'd recommend that, as I actually think that's a bad idea----no school is worth going into debt for). But there are options. Smartest option (IMO) is to find a great school list that is affordable....and many many exist, just not T20 schools.

This is such an uber-American, "personal responsibility" thought pattern. So when college costs $200K/year in the future, anyone who didn't "plan" should just be shut out? How about when it gets to a million dollars a year? Are we all good with it only being for the children of Elon Musk and the like and if we can't do it, well then the fault is somehow our own?

It has not always been like this. Private schools have always been more expensive than public, but not to the degree they are now.

Instead of pointing fingers at people for "lack of planning" by saving $300K+ / child, why aren't we demanding to know why the costs are so outrageously impossible for even wealthy people to handle?

You are NOT SHUT OUT. You are simply shut out of the “luxury” product version of college. You feel entitled to a Louis Vuitton degree for your kid on your Coach budget. I’m sorry that you’ve bought into the idea that admissions are the ultimate arbiter of your kids’ merit but there are plenty of affordable options including community college.

That is your reaction to these graphics?

My reaction to the graphics is that they’re stupid because they compare low income kids to sticker tuition. We all know that’s not the beef on DCUM. The complaint is that high income people are supposed to fork over their wealth. We all know low income people are getting majorly subsidized by the DCUM set so their incomes are irrelevant.

These graphs are also just another way of showing growing income inequality and how schools have fully seized the opportunity to take from the wealthy. Due to the inequality, they know there’s more money to take, and they are taking it.

That's not what they depict. It's not about low-income kids and sticker tuition. It's about tuition relative to HHI (in all classes). High income people have always forked over their wealth; it just wasn't as much in the past (yes, including for private schools).

The point of this thread is that college tuition raises have so greatly outstripped inflation and salary growth that it's priced out many people who otherwise could have afforded full tuition in the past. Colleges are not BMWs or Maseratis or Hondas. They are institutions of higher education. It's become a real burden for most working families, whether upper middle or lower middle class, to pay for higher education. Not being able to afford a luxury car is not a burden, but for many people, not being able to afford a college that our grandparents (who made less money, adjusted for inflation) could have paid for easily is a burden.

In my generation (I'm 61yo), the cost of attendance could be covered from savings, current income, the student's summer earnings, work study, and some modest loans. E.g. the expensive private SLAC I attended cost about $8,000 when I started in 1979, and I contributed about 25% of that from my summer work. Proportionally, a student today would have to contribute $20,000 to make the same dent in the same school's costs.

Adjusted for inflation, $8,000.00 in 1979 is equal to $32,838 today in 2023. But that school now costs over $80,000/year.

See also

https://www.theatlantic.com/education/archive/2014/04/the-myth-of-working-your-way-through-college/359735/

Once upon a time, a summer spent scooping ice cream could pay for a year of college. Today, the average student's annual tuition is equivalent to 991 hours behind the counter.

It's not a burden when said kid can afford a less expensive option based on merit aid and parents' savings. I shared a bedroom with 4 siblings and 8 people shared one bath growing up - you are just not gonna persuade me to feel bad for someone who can attend a school wildly better and more expensive than broad swaths of their peers. And probably grew up in a completely fine home along the way.

Anonymous

Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Long story short: we will not get any financial aid. We make too much for help but don't make enough to go full pay at a private in a way that leaves any wiggle room.

We are just starting this process, and child is an athlete that is in the midst of recruiting (only D3 at this point b/c of NCAA limits- and FTR I don't care if DC plays a sport or not but she does). I'm looking at the finances of the various schools and was shocked to learn that some of the schools she's been talking to give NO MERIT aid. DC has excellent grades, community service, ECs, and athletics.

I get she's one of many like man others . . . and I know at DC there are no athletic scholarships. But, how are people affording places like Wellesley? Their website and what I'm finding says they give ZERO aid on the basis that, essentially, "everyone there is special."

Yes, she can look elsewhere. And she is. But it is so sad to have to shut down a possibility that would, honestly, be such a perfect fit for her in every way. With room and board, etc. the cost per year is nearly $80K!!!! Two years would eat up more than our 529 has in it. Super bummed to have to limit her.

They are either poor enough to get a lot of aid, rich enough to not need it, or had parents putting away a lot of money from conception.

Well it is no shock that top schools would cost ~$80K/year when my kid would enter college. So we did plan for that and sock away as much as we could from an early age, as we knew we wouldn't qualify for any FA. Had we not been able to do that, our kid would have had to search out more affordable schools.

Congratulations on making enough money to save 320k per kid?

No, it's congratulation on planning. Anyone smart enough to save $160K should be smart enough to know that college will be up to $80K/year in 2022. SO if attending those "Top schools" is important you plan accordingly.

Had we not been able to save enough, I would have set the mindset with my kids that while you can apply to T40 schools, we might not be able to afford them. So, you need to have a balanced list of college choices. To me, the most important part is finding great schools that are affordable to YOU. And there are many, many, many choices available for everyone. The OP has ~$40K/year saved for DD. There are literally hundreds of amazing options that will allow DD to graduate debt free. If only the OP would change their mindset and focus on what's available instead of complaining.

Similarly, I don't buy a house/car/vacation that I can't afford. I live within my means, or deal with the consequences. I don't expect others to compensate me for my lack of planning. OP could likely now cash flow another $10K+/year if they wanted to, based on their statements. So if the Top college is that important, they can do that and take parent loans and pay them off now that they have a higher income. (not saying I'd recommend that, as I actually think that's a bad idea----no school is worth going into debt for). But there are options. Smartest option (IMO) is to find a great school list that is affordable....and many many exist, just not T20 schools.

This is such an uber-American, "personal responsibility" thought pattern. So when college costs $200K/year in the future, anyone who didn't "plan" should just be shut out? How about when it gets to a million dollars a year? Are we all good with it only being for the children of Elon Musk and the like and if we can't do it, well then the fault is somehow our own?

It has not always been like this. Private schools have always been more expensive than public, but not to the degree they are now.

Instead of pointing fingers at people for "lack of planning" by saving $300K+ / child, why aren't we demanding to know why the costs are so outrageously impossible for even wealthy people to handle?

You are NOT SHUT OUT. You are simply shut out of the “luxury” product version of college. You feel entitled to a Louis Vuitton degree for your kid on your Coach budget. I’m sorry that you’ve bought into the idea that admissions are the ultimate arbiter of your kids’ merit but there are plenty of affordable options including community college.

That is your reaction to these graphics?

I'm not the PP, but basically yes. College costs are crazy and, being a former FAFSA kid, I'm kinda shocked that OP, who also claims to have been on FA in college, didn't realize that the costs were outpacing inflation and wasn't setting expectations accordingly with their DCs. The number of parents who get to their kids' junior or senior years and have absolutely no idea on how financing college works is stunning.

OP, you have enough money set aside that your DC can land a merit scholarship, attend a great school, and graduate debt free. That would be so great for your kid and an opportunity neither you nor your husband were able to have. Rather than focusing on what probably cannot happen, lean in to the fabulous opportunities your DC can have that many kids are not able to experience.

GL to your DC!

Just my observation, people who were themselves on FA feel the most entitled to aid and are the most blindsided to find out they’re supposed to be able to afford sticker.

Curious how you got that from my posts. I have been aware for awhile that we would get no FA. We are not even asking for "need based" aid. I was expecting -based on what our counselor says and other kids experiences at very good schools- that most would give some sort of other aid for high performing kids. Most "regular" families cannot afford these sticker prices. Clearly, that is not the case and my information was wrong about that.

Anonymous

Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Long story short: we will not get any financial aid. We make too much for help but don't make enough to go full pay at a private in a way that leaves any wiggle room.

We are just starting this process, and child is an athlete that is in the midst of recruiting (only D3 at this point b/c of NCAA limits- and FTR I don't care if DC plays a sport or not but she does). I'm looking at the finances of the various schools and was shocked to learn that some of the schools she's been talking to give NO MERIT aid. DC has excellent grades, community service, ECs, and athletics.

I get she's one of many like man others . . . and I know at DC there are no athletic scholarships. But, how are people affording places like Wellesley? Their website and what I'm finding says they give ZERO aid on the basis that, essentially, "everyone there is special."

Yes, she can look elsewhere. And she is. But it is so sad to have to shut down a possibility that would, honestly, be such a perfect fit for her in every way. With room and board, etc. the cost per year is nearly $80K!!!! Two years would eat up more than our 529 has in it. Super bummed to have to limit her.

They are either poor enough to get a lot of aid, rich enough to not need it, or had parents putting away a lot of money from conception.

Well it is no shock that top schools would cost ~$80K/year when my kid would enter college. So we did plan for that and sock away as much as we could from an early age, as we knew we wouldn't qualify for any FA. Had we not been able to do that, our kid would have had to search out more affordable schools.

Congratulations on making enough money to save 320k per kid?

No, it's congratulation on planning. Anyone smart enough to save $160K should be smart enough to know that college will be up to $80K/year in 2022. SO if attending those "Top schools" is important you plan accordingly.

Had we not been able to save enough, I would have set the mindset with my kids that while you can apply to T40 schools, we might not be able to afford them. So, you need to have a balanced list of college choices. To me, the most important part is finding great schools that are affordable to YOU. And there are many, many, many choices available for everyone. The OP has ~$40K/year saved for DD. There are literally hundreds of amazing options that will allow DD to graduate debt free. If only the OP would change their mindset and focus on what's available instead of complaining.

Similarly, I don't buy a house/car/vacation that I can't afford. I live within my means, or deal with the consequences. I don't expect others to compensate me for my lack of planning. OP could likely now cash flow another $10K+/year if they wanted to, based on their statements. So if the Top college is that important, they can do that and take parent loans and pay them off now that they have a higher income. (not saying I'd recommend that, as I actually think that's a bad idea----no school is worth going into debt for). But there are options. Smartest option (IMO) is to find a great school list that is affordable....and many many exist, just not T20 schools.

OP here. I guess I should have been smart enough not to acquire nearly $150K in medical bills due to cancer, as well?

Why don't you just stop with the speculation about what I should have done. We did all we could. And we saved a lot, notwithstanding that.

I never said my child did not have other options and wasn't considering other options. As I said, I grew up dirt poor and went to a non-elite school. I simply lamented HAVING to cross off schools -which are a perfect fit for her- solely based on finances. Especially when we saved aggressively for it. It sounds like people in the middle (too much money, but not enough) just can't go to these schools.