Anonymous

Anonymous wrote:Anonymous wrote:As long as GNP continues to grow to 4% and beyond, and the stock market passes 25,000, his popularity will grow. In the end a good economy benefits everyone. Most people outside of the coasts have no idea what net neutrality is, and will not be effected by it. On the other hand, if they have good jobs and growing wages, they will have no desire to change the course.

The GDP has not grown at 4% or beyond. You are already banking on a forecast of one single quarter. Go count the 4% growth quarters over the last eight years.

Let's be truthful here (and only a Democrat can do that these days), Obama inherited a recession from Bush II and cleaned it up so the economy could grow.

Trump inherited a growing economy that Obama put into place, and then Trump claimed that HE was responsible for all that growth that Obama's policies allowed to happen.

Claims that Trumpy is responsible for the stock market and GDP growth isypical GOP deceit and lying. Taking credit for the good things they didn't do and lying about the crappy things they did do.

The lying conservatives posting trash here need to take Econ 101 to get a basic grasp of economics before posting. All they post is ignorant bullshit.

Anonymous

Anonymous wrote:Anonymous wrote:With the House having passed this bill, the breaking point is here. The ones that are going to be destroyed by this just don't feel it yet. I am so angry right now, I can barely see.

You're welcome to pay more in taxes anytime.

Send your check to the Treasury ASAP. Put your money where your mouth is.

So Steve Mnuchin can have another sheet mask made out of foreskins and Ivanka can blow another 60K on a clamshell? Lol, no. We'll wait till ethics and morals, a la the Obamas, return to the White House.

Anonymous

Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Post your taxes. Potomac at one time had houses selling for $50,000. My dad was military. I’m not sure why you need to get all snooty. A lot of people have their net built in the increases in their house value, especially lower income folks - that’s their major investment.

Oh, Patton Oswalt posted a quote just for you: "Nobody talks more of free enterprise and competition and of the best man winning than the man who inherited his father's store or farm." -- C. Wright Mills, 1951

That's basically the entire White House and the GOP donor class: DJT, Jr, Ivanka, Jared, Mnunchin, The Koch Brothers, etc.

I've said it many times: everything happening in politics right now is a war being perpetrated at the hands of inherited wealth. They've managed to convince a large segment of America that a bunch of people with large inheritances are somehow fighting "the Establishment." It's the cruelest trick ever played on Americans.

+1 Love that quote.

+1

That quote reminds me of something I was thinking the other day... Rs love the whole "pull yourself up by your boot straps" mentality. There is no clearer example of that than the Clintons. You can say whatever you want about their policies or their behavior (which I have criticized in the past), but those two people came from humble beginnings and used their intelligence and hard work to get where they are at. For those who claim HRC rode on her husband's coat tails, I don't know how true that is because if you read about her past, and how she graduated magnum cum laude, and how her college classmates thought she would be the first female president, I think it shows how tough and intelligent she is. I'm thinking she was an asset for Bill more than anything. He had the charisma, but I think she had the smarts.

Trump, OTH, is the anti-thesis of the R battle cry.

BTW, I used to be a R, and voted for both Bushes and highly criticized the Clintons during that whole Lewanski scandal. I remember when people used to call her Billary, but I never understood why they did that and was actually kind of offended by it. As a female, I think men just didn't like that a female could be so ballsy and intelligent. Up until then, FLOTUS were pretty quiet and unassuming.

Sorry, totally off topic, I know.

Anonymous

Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:It's has nothing to do with "deserving". It's time the able bodied pick themselves up.

Can't subsidize them forever, even though you would like that to happen.

Intergenerational welfare has to stop.

Then why are you bitching about shoes?

That was ME talking about poor people wasting money on $200 shoes....not the PP you're replying to. Why do liberals always assume they are talking to ONE conservative? Can't you tell the difference in writing style and content? Jeez.

You mean there is more than one f-ing idiot dotard?

You dotards all want to punish people for their sins - being poor, getting pregnant, etc.

You call me an idiot? How many times do I have to tell you that expecting a poor person to go without a $200 pair of sneakers is not a punishment. "You are going to have to wear a $100 pair of shoes as punishment for being poor!" These liberal attitudes that poor people are entitled to throw out (taxpayer) unnecessarily or otherwise they're being punished is the source of a lot of problems.

This is today's Russian talking point. Distract with some stupid example that is pointless and worthless.

The big story TODAY is that the rich 1% and wealthy corporations are STEALING middle American taxpayers' money to enrich themselves even further because of this tax steal they PAID for by buying (or threatening) Republicans in Congress. (I'm betting the Russians have all sorts of dirt on every Republican who accepted their dirty Russian money.) The 1% owns 34% of the wealth in this country. If that's not oligarchy, well, we're getting there.

Count another win for Vlad. He's the richest man in the world, and he wants to become the most powerful man in the universe by taking over the US government. He's got his Orange Puppet and his GOP puppet congress -- can't wait for his next move -- dismantling Medicare and Medicaid and Social Security??

Trumpkins are going to love that!! But they'll be dead from their loss of health care benefits, so who care about them? says VladTrump. So. Much. Winning.

Anonymous

Intergenerational welfare has to stop.

Intergenerational inheritance has to stop. What has Ivanka done to deserve to inherit billions?

Anonymous

Anonymous wrote:With the House having passed this bill, the breaking point is here. The ones that are going to be destroyed by this just don't feel it yet. I am so angry right now, I can barely see.

You're welcome to pay more in taxes anytime.

Send your check to the Treasury ASAP. Put your money where your mouth is.

Anonymous

Anonymous wrote:It's has nothing to do with "deserving". It's time the able bodied pick themselves up.

Can't subsidize them forever, even though you would like that to happen.

Intergenerational welfare has to stop.

God, you're stupid and ignorant.

Anonymous

Anonymous wrote:https://www.obamaphone.com/obama-phone-numbers

What kind of bullshit is this? Did the Russian trolls build this website??

Anonymous

Anonymous wrote:Anonymous wrote:Anonymous wrote:

Jfc, you assholes are so purposely deceitful. You damn well know the poor pay taxes: excise, property, payroll, and sales taxes.

Again, how do you wring blood out of a stone?

Don't give me that poor crap. Close to half the country is not contributing to the revenue base and that's economically unsustainable. Stop pleading poor at every discussion on just how far out of whack the numbers have become.

+ 1 We are now in a spot where half the people are "too poor" to contribute to the federal revenue base and liberals don't see a problem with that? Sorry, but if a poor person can afford to buy a $200 pair of sneakers, he can pay $100 to the government instead and "sacrifice" with a $100 pair.

I'm old enough to remember the old "welfare queens driving cadillacs" argument against paying for poor people's health care back in the 1970s. Your example smells like it was pulled from the same sewer.

Poor people--I don't know if you know this--don't have much money. They live in shitty neighborhoods, attend shitty schools, are badly educated, often speak poorly because of their terrible education, so can't get jobs that pay more than minimum wage (which is not a living wage), and thus they remain poor. The exceptional poor person who gets lucky with a combination of brains and a chance to attend a good school may find a way out of that cycle of poverty, but most poor people are not so lucky.

If these poor people could find jobs where they earned a living wage, could live in neighborhoods where crime wasn't rampant, could attend good schools and get a good education (which Betsy DeVos is trying to make even more difficult by limiting funding for public schools), they'd get better jobs, pay higher taxes and you wouldn't be bitching about the fact that they can't afford to pay income taxes on their piddling wages.

Your stupid example shows how ignorant you are about the lives of people who are poor. Spend a few years working in an inner city neighborhood, and you'll start to see these people as regular working human beings who are struggling against a system where the deck is stacked against them. Sure, the best and brightest may escape poverty, but the rest of the average joes are not going to make it without help from people who have more resources. They are not freeloaders (unlike those spoiled rich kids who inherit millions -- what do you call them?), they are mostly people with few opportunities and little education who are mired in a system they can't navigate their way out of. Why are you so callous towards people you've never met, many of whom look different from you? Why don't you try going out and meeting these people, spend some time talking with them, figure out how nice and kind and generous and welcoming many of them are, how hardworking and peaceful and really great people they are -- before you condemn them solely because they are poor, with little education, who need help from more affluent and educated people?

If you're a Russbot, OK, I get it. If you're just an asshole, I get that too. But it would be helpful to you as well as the world if you'd try to regain some of your humanity.

Anonymous

Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Post your taxes. Potomac at one time had houses selling for $50,000. My dad was military. I’m not sure why you need to get all snooty. A lot of people have their net built in the increases in their house value, especially lower income folks - that’s their major investment.

Oh, Patton Oswalt posted a quote just for you: "Nobody talks more of free enterprise and competition and of the best man winning than the man who inherited his father's store or farm." -- C. Wright Mills, 1951

That's basically the entire White House and the GOP donor class: DJT, Jr, Ivanka, Jared, Mnunchin, The Koch Brothers, etc.

I've said it many times: everything happening in politics right now is a war being perpetrated at the hands of inherited wealth. They've managed to convince a large segment of America that a bunch of people with large inheritances are somehow fighting "the Establishment." It's the cruelest trick ever played on Americans.

+1 Love that quote.

+1

Anonymous

Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:We are getting a tax cut. For 8 years Obama taxed the crap out of us. Unemployment is down, food stamp usage is down, can we have 6 more years of this please

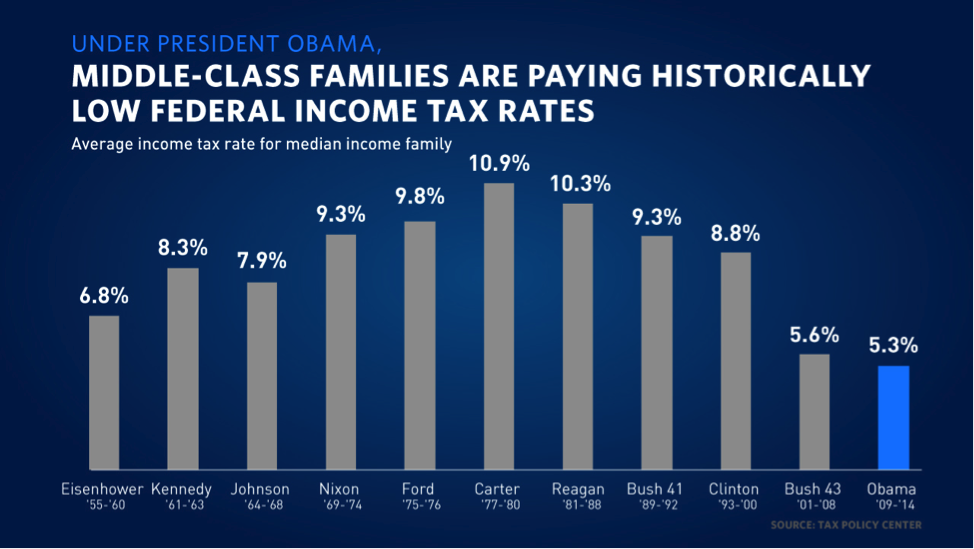

Please shut the f#ck up with your pathetic lies. Tax burden was higher under Reagan than Obama:

lol wasn't obama responsible for continuing the Bush tax cuts? So he rode up the deficit and taxed Americans more than any other president at the same time? lol you guys!

What is the gross income for the data represented in this chart? What is the AGI? How is middle class defined? I’ve posted my tax picture before:

Obama year 2016

Single no dependents -income 130,000

Fed income tax. 23,000

Property tax 12000

State inc. tax. 4,000

Soc. Sec + Med. 10,000

Gas and sales abt. $ 2,000

No mortgage Interest to deduct. Taxes = $51,000.

Plus I pay student loans not deductible with AGI over 65,000

Am I middle class? Or am I the wealthy that needs to pay more?

Post your taxes that you pay.

So you own a million dollar house free and clear?

It was the house I grew up in and my parents passed.

Born on third, thinks he hit a triple.

Post your taxes. Potomac at one time had houses selling for $50,000. My dad was military. I’m not sure why you need to get all snooty. A lot of people have their net built in the increases in their house value, especially lower income folks - that’s their major investment.

Yes, exactly. My grandmother bought her beach condo for $25,000 in the 1960s and it is now worth $800,000.

You are rich. Good for you. Average net worth for an American is around $150k and you are substantially above that. Must be nice.

I'm not rich. Who sad we still have the condo? It was sold in the 1990s. I was just showing the price appreciation of a modestly priced house bought years ago in support of the OP.

Anonymous

Anonymous wrote:I fully expect violence against the economic and/or political elite within the next two years. Don't be surprised we start hearing about the murders of corporate execs, finance types, and lobbyist swamp creatures. It's only a matter of time - it hasn't happened in the US since the 1960s but we are quickly headed that way.

Read about the Lead Years in Italy in the 1970s...very scary times ahead:

https://en.m.wikipedia.org/wiki/Years_of_Lead_(Italy)

Oh. God. Not another Russbot post!! Vlad, are you posting on DCUM yourself?? Wow. Inciting violence. Pretending to be lefty. Woo hoo. You gotta do better than this.

Anonymous

Anonymous wrote:We are getting a tax cut. For 8 years Obama taxed the crap out of us. Unemployment is down, food stamp usage is down, can we have 6 more years of this please

Sure you are, if you're RICH.

But if you're middle class, you are getting a TAX HIKE.

Watch for it folks! Taxes will increase, especially in high tax states. This is a giveaway to the rich, pure and simple, paid for on the backs of the poor and middle class.

The lying, scheming Republicans with their narcissistic orange bully at the helm have succeeded in ripping off the vast majority of the American public.

The Republicans will lose their jobs, and the next wave of Democrats will reverse this atrocity, restoring taxes to the rich and corporations, and making them permanent, so the next sleazy Republican-led administration can't reverse them.

This tax grab is sickening, completely horrifying, and will harm so many hardworking Americans, many of whom voted for the Orange Piece of Shit. The oligarchs are laughing all the way to their bulging offshore bank accounts in the Caymans.

Anonymous

Anonymous wrote:As long as GNP continues to grow to 4% and beyond, and the stock market passes 25,000, his popularity will grow. In the end a good economy benefits everyone. Most people outside of the coasts have no idea what net neutrality is, and will not be effected by it. On the other hand, if they have good jobs and growing wages, they will have no desire to change the course.

Total load of crap

Fewer than half of Americans even own stock, and most of those own stock indirectly in retirement plans. The rest of America doesn't even know what the stock market is.

They won't have good jobs or growing wages because as billionaire business owner Mike Bloomberg wrote in the NY Times, the rich corporations will not pass their tax savings onto their workers. The corporations are already sitting on trillions of dollars in cash, and a few more trillions won't make any difference -- they won't spend it on higher wages or more jobs.

The course has already changed. Look at Alabama and Virginia. The tide is turning. Congress will be awash in Democrats in 2018, and then Trump and his enablers will be vanquished and order restored to our government and our country.

Anonymous

Anonymous wrote:Anonymous wrote:Anonymous wrote:Post your taxes. Potomac at one time had houses selling for $50,000. My dad was military. I’m not sure why you need to get all snooty. A lot of people have their net built in the increases in their house value, especially lower income folks - that’s their major investment.

Oh, Patton Oswalt posted a quote just for you: "Nobody talks more of free enterprise and competition and of the best man winning than the man who inherited his father's store or farm." -- C. Wright Mills, 1951

That's basically the entire White House and the GOP donor class: DJT, Jr, Ivanka, Jared, Mnunchin, The Koch Brothers, etc.

I've said it many times: everything happening in politics right now is a war being perpetrated at the hands of inherited wealth. They've managed to convince a large segment of America that a bunch of people with large inheritances are somehow fighting "the Establishment." It's the cruelest trick ever played on Americans.

+1 Love that quote.