Anonymous

Anonymous wrote:Loving my tax cut! Thank you Potus

+1

Anonymous

If you got a tax cut, post your HHI.

Anonymous

Anonymous wrote:Loving my tax cut! Thank you Potus

Hie much of a cut on what HHI?

Anonymous

Loving my tax cut! Thank you Potus

Anonymous

Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Just got our #s from our accountant. We will pay $50k less under the new system compared to the old. $50k! Which is great. But we are not the people who need to pay less. This is not good on a macro level.

45% people pay zero or even negative income tax. It's really tough to help them pay less...

Not sure of your point. My point, since it blew over your head, is that we are high income and got a pretty big benefit from the changes. Which is great on an individual level. But terrible on a macro level where people like us need to pay more (or at least the same) to support government programs. A huge and growing deficit is not good. It is pure stupidity that we are paying $50k less.

At a macro level, the best government program ever is to have a great economy and full employment -- which we have as a consequence of this tax reform, smartly primarily aimed at corporations, not individuals.

Now, if you want to spend that $50k, nothing prevents you from hiring a publicist and launching a coalition of folks who want to donate more to good causes.

So interesting that you don't include mention of pay raises/adequate salaries in your description. What good is a "great economy" if people are still living paycheck to paycheck, are one paycheck away from complete financial ruin, can't afford health insurance or health care, can't afford housing, etc etc etc? For whom is that economy great? Not those living in poverty or barely sustainable lower middle class. Meanwhile the rich get richer. Do you honestly think the massive income inequality in our country is a healthy, sustainable thing?

Hey, I thought that after 8 full years in the WH, and after spending TRILLIONS more than any other President...Obama had solved some of those problems?

Like.....none?

Like...what has Trump done to solve them?

Well, it's early to tell, but having more Americans employed than at any point in our history is a great start.

To finally see some general wage increases, even if too small, is another great data point.

To have the economy growing at 3% (vs 1% in 2016) is not bad either.

A booming stock market (which had been pretty flat in 2015 and 2016) also helps more than a hundred fifty million savers/ investors.

So, let's see!

The economy is continuing the same pattern as it was in obama years. This is just structural. As the boomers retire there is a shortage of workers and thus unemployment is low.

The growth is not significantly higher than Obama years. Learn before posting the conman lies as facts. If 1 year makes a trend for you, you are just a liar. Where is the 4% rate that the conman conned his cult with?

https://www.statista.com/statistics/188165/annual-gdp-growth-of-the-united-states-since-1990/

Oh please, you are a joke and you know it.

That link you shared shows the significant deceleration from 2015 to 2016, and the significant expansion 2016-2018.

But, hey, if you enjoy driving with your eyes closed, by all means do

Anonymous

Anonymous wrote:We live in moco. We used to get back $8k which we used for summer camp and vacation. This year we owed money.

If you got an $8k tax refund, you did something terribly wrong when calculating your withholdings.

I've never understood the people who get these huge refunds. The ideal situation is to owe just under $1k--low enough to avoid the penalty, but as high as possible to avoid giving any more of a free loan to the government than would be necessary.

People use it as a mechanism for forced savings. But the point of the PP has gone completely over your head, which is that they are paying 8K more this year than they had in the past.

Anonymous

We live in moco. We used to get back $8k which we used for summer camp and vacation. This year we owed money.

If you got an $8k tax refund, you did something terribly wrong when calculating your withholdings.

I've never understood the people who get these huge refunds. The ideal situation is to owe just under $1k--low enough to avoid the penalty, but as high as possible to avoid giving any more of a free loan to the government than would be necessary.

Anonymous

Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Just got our #s from our accountant. We will pay $50k less under the new system compared to the old. $50k! Which is great. But we are not the people who need to pay less. This is not good on a macro level.

45% people pay zero or even negative income tax. It's really tough to help them pay less...

Not sure of your point. My point, since it blew over your head, is that we are high income and got a pretty big benefit from the changes. Which is great on an individual level. But terrible on a macro level where people like us need to pay more (or at least the same) to support government programs. A huge and growing deficit is not good. It is pure stupidity that we are paying $50k less.

At a macro level, the best government program ever is to have a great economy and full employment -- which we have as a consequence of this tax reform, smartly primarily aimed at corporations, not individuals.

Now, if you want to spend that $50k, nothing prevents you from hiring a publicist and launching a coalition of folks who want to donate more to good causes.

So interesting that you don't include mention of pay raises/adequate salaries in your description. What good is a "great economy" if people are still living paycheck to paycheck, are one paycheck away from complete financial ruin, can't afford health insurance or health care, can't afford housing, etc etc etc? For whom is that economy great? Not those living in poverty or barely sustainable lower middle class. Meanwhile the rich get richer. Do you honestly think the massive income inequality in our country is a healthy, sustainable thing?

Hey, I thought that after 8 full years in the WH, and after spending TRILLIONS more than any other President...Obama had solved some of those problems?

Like.....none?

Like...what has Trump done to solve them?

Well, it's early to tell, but having more Americans employed than at any point in our history is a great start.

To finally see some general wage increases, even if too small, is another great data point.

To have the economy growing at 3% (vs 1% in 2016) is not bad either.

A booming stock market (which had been pretty flat in 2015 and 2016) also helps more than a hundred fifty million savers/ investors.

So, let's see!

The economy is continuing the same pattern as it was in obama years. This is just structural. As the boomers retire there is a shortage of workers and thus unemployment is low.

The growth is not significantly higher than Obama years. Learn before posting the conman lies as facts. If 1 year makes a trend for you, you are just a liar. Where is the 4% rate that the conman conned his cult with?

https://www.statista.com/statistics/188165/annual-gdp-growth-of-the-united-states-since-1990/

Anonymous

Anonymous wrote:We're paying $10k less after making $40k more.

401k and 529 funds are 35% up since 2016.

What's not to like.

What’s your HHI?

Anonymous

Anonymous wrote:Anonymous wrote:I think those living in Maryland (ny, ca and other states with high state taxes) are really feeling the pinch. We paid less and got back more.

We live in moco. We used to get back $8k which we used for summer camp and vacation. This year we owed money.

We aren't rich. Not even sure if we are considered UMC or just plain MC.

No clue why people don't realize the republicans only look out for the wealthy.

Same here on both fronts. We’re a middle class family, three kids, no frills life, and we paid more this year than we ever have. Good thing billionaires are getting tax breaks.

Anonymous

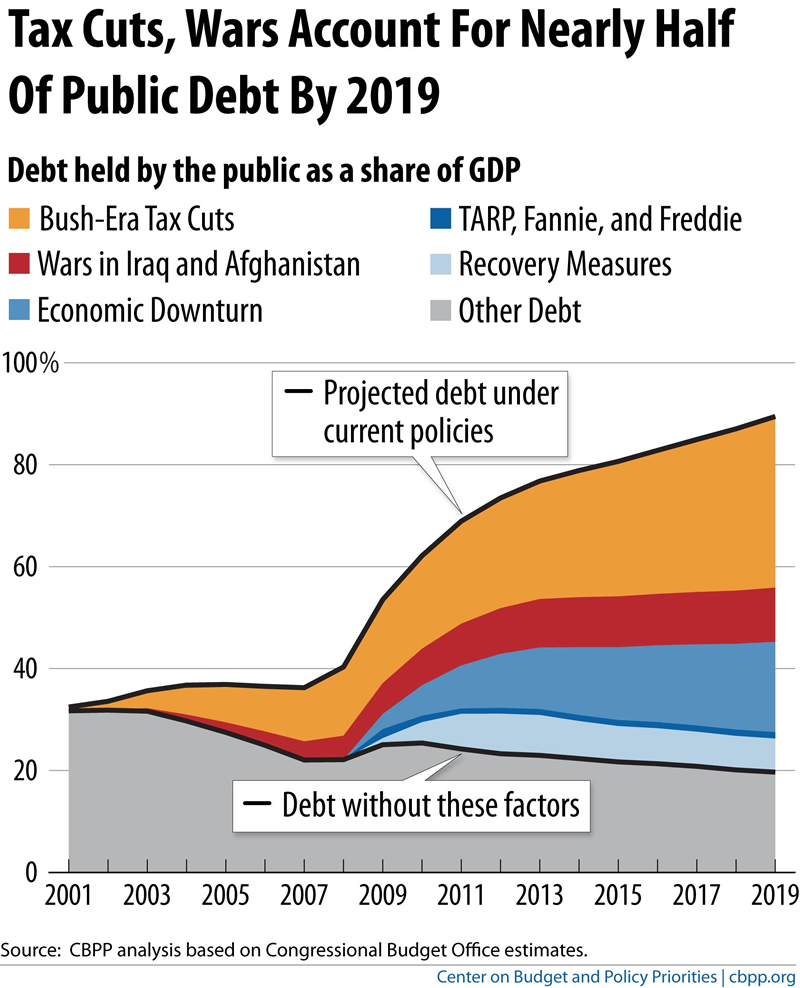

Anonymous wrote:Anonymous wrote:Plus a lot of the Obama deficit was because of the Bush tax cuts

BS.

It was Obama and Dems who chose to renew those cuts, plus most spending was unrelated.

You don't raise taxes in a recession. Duh. You cut taxes, cut interest rates, and engage in deficit spending. You then pay down the debt once the economy improves....which Trump is NOT doing. He's blowing up the deficit further.

This is why Europe was f#cked so badly in 2010-2014: the Europeans raised taxes and engaged in austerity politics. Meanwhile, the U.S. recovered fairly quickly.

Anonymous

Anonymous wrote:Plus a lot of the Obama deficit was because of the Bush tax cuts

BS.

It was Obama and Dems who chose to renew those cuts, plus most spending was unrelated.

Anonymous

Anonymous wrote:Plus a lot of the Obama deficit was because of the Bush tax cuts

Yup. That’s on Bush.

Anonymous

Plus a lot of the Obama deficit was because of the Bush tax cuts

Anonymous

Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Just got our #s from our accountant. We will pay $50k less under the new system compared to the old. $50k! Which is great. But we are not the people who need to pay less. This is not good on a macro level.

45% people pay zero or even negative income tax. It's really tough to help them pay less...

Not sure of your point. My point, since it blew over your head, is that we are high income and got a pretty big benefit from the changes. Which is great on an individual level. But terrible on a macro level where people like us need to pay more (or at least the same) to support government programs. A huge and growing deficit is not good. It is pure stupidity that we are paying $50k less.

At a macro level, the best government program ever is to have a great economy and full employment -- which we have as a consequence of this tax reform, smartly primarily aimed at corporations, not individuals.

Now, if you want to spend that $50k, nothing prevents you from hiring a publicist and launching a coalition of folks who want to donate more to good causes.

We already had that with Obama, but without the massive additional debt and deficit.

I'm an educator. Under Obama's administration, our school system reduced our salary across the board by over 2%, no raise in 6 years, and health insurance premium went up $100/month.

Thank you for reminding DC liberals about life outside the bubble.

Also,

1) Obama increased public debt by 8 trillion, more than all previous Presidents combined

2) The economy by 2015 and 2016 was on a serious decline, threatening another recession

So the comment by previous PP is beyond ludicrous.

The only time that you guys give a s*** about that is when there is a democrat in office