Anonymous

Anonymous wrote:Anonymous wrote:Anonymous wrote:You need to keep pushing the lies/myth of poor being undeserving but of all the people undeserving are people who have enough money to buy a house or save money for college. Give me a break. The us isn’t divided into givers and takers, we are all takers! There are some serious snobs on here. You’re no better than those you look down on.

I believe in welfare, but you need to give us a break. We aren’t “all takers.” You need to stop with that. My family, like many here in DC, have paid millions into taxes. My kids go to private and we donate to food insecurity and education. So no, I’m not a taker. I’m a giver. You are welcome.

And you receive fire/police, utilities, laws, educated community, national defense, etc.

Right, I think the first couple of million dollars of taxes have covered that…

Anonymous

Reasons why we hate the poor:

Life time on state aid..

Health insurance

Food stamps

Housing

Education

Monthly cash

Add anything I miss on my list. Then you wonder why people have such hatred toward a group of people or we feel obligated to support for life. GTFO

Life time on state aid..

Health insurance

Food stamps

Housing

Education

Monthly cash

Add anything I miss on my list. Then you wonder why people have such hatred toward a group of people or we feel obligated to support for life. GTFO

Anonymous

The focus on federal income tax ignores State and Local taxes. Low-income families also pay substantial state and local taxes. Most state and local

taxes are regressive, meaning that low-income families pay a larger share of their incomes in these taxes than wealthier households do. The bottom fifth of taxpayers paid 12.3 percent of their incomes in state and local taxes in 2011, according to the Institute on Taxation and Economic Policy (ITEP). That was well above the 7.9 percent average rate that the top 1 percent of households paid.

Poor people are not takers. They pay too!

taxes are regressive, meaning that low-income families pay a larger share of their incomes in these taxes than wealthier households do. The bottom fifth of taxpayers paid 12.3 percent of their incomes in state and local taxes in 2011, according to the Institute on Taxation and Economic Policy (ITEP). That was well above the 7.9 percent average rate that the top 1 percent of households paid.

Poor people are not takers. They pay too!

Anonymous

Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:40% of Americans pay no federal tax at all, while receiving a ton of benefits.

— low-income households as a group do, in fact, pay federal taxes. Congressional Budget Office data show that the poorest fifth of households paid an average of 4.0 percent of their incomes in federal taxes in 2007, the latest year for which these data are available — not an insignificant amount given how modest these households’ incomes are; the poorest fifth of households had average income of $18,400 in 2007. The next-to-the bottom fifth — those with incomes between $20,500 and $34,300 in 2007 — paid an average of 10.6 percent of their incomes in federal taxes.

No. Not income taxes.

https://www.npr.org/sections/thetwo-way/2012/09/18/161333783/romneys-wrong-and-right-about-the-47-percent

From the article you posted:

"many of those who don't pay income tax do pay other taxes — federal payroll and excise taxes as well as state and local income, sales, and property taxes."

Those are not income tax, and other people pay those too. Do you think the poor shouldn’t pay sales tax or property tax either?

They pay a payroll tax, isn’t that income?!

No. That’s the tax that funds social security.

But it’s still based on income. It’s still a tax.

Anonymous

Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:40% of Americans pay no federal tax at all, while receiving a ton of benefits.

— low-income households as a group do, in fact, pay federal taxes. Congressional Budget Office data show that the poorest fifth of households paid an average of 4.0 percent of their incomes in federal taxes in 2007, the latest year for which these data are available — not an insignificant amount given how modest these households’ incomes are; the poorest fifth of households had average income of $18,400 in 2007. The next-to-the bottom fifth — those with incomes between $20,500 and $34,300 in 2007 — paid an average of 10.6 percent of their incomes in federal taxes.

No. Not income taxes.

https://www.npr.org/sections/thetwo-way/2012/09/18/161333783/romneys-wrong-and-right-about-the-47-percent

From the article you posted:

"many of those who don't pay income tax do pay other taxes — federal payroll and excise taxes as well as state and local income, sales, and property taxes."

Those are not income tax, and other people pay those too. Do you think the poor shouldn’t pay sales tax or property tax either?

Poor people generally don’t own homes.

PP above me mentioned property tax as a tax poor people pay. It’s not an income tax.

Anonymous

Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:40% of Americans pay no federal tax at all, while receiving a ton of benefits.

— low-income households as a group do, in fact, pay federal taxes. Congressional Budget Office data show that the poorest fifth of households paid an average of 4.0 percent of their incomes in federal taxes in 2007, the latest year for which these data are available — not an insignificant amount given how modest these households’ incomes are; the poorest fifth of households had average income of $18,400 in 2007. The next-to-the bottom fifth — those with incomes between $20,500 and $34,300 in 2007 — paid an average of 10.6 percent of their incomes in federal taxes.

No. Not income taxes.

https://www.npr.org/sections/thetwo-way/2012/09/18/161333783/romneys-wrong-and-right-about-the-47-percent

From the article you posted:

"many of those who don't pay income tax do pay other taxes — federal payroll and excise taxes as well as state and local income, sales, and property taxes."

Those are not income tax, and other people pay those too. Do you think the poor shouldn’t pay sales tax or property tax either?

They pay a payroll tax, isn’t that income?!

No. That’s the tax that funds social security.

Anonymous

Let’s not punch down.

Anonymous

Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:40% of Americans pay no federal tax at all, while receiving a ton of benefits.

— low-income households as a group do, in fact, pay federal taxes. Congressional Budget Office data show that the poorest fifth of households paid an average of 4.0 percent of their incomes in federal taxes in 2007, the latest year for which these data are available — not an insignificant amount given how modest these households’ incomes are; the poorest fifth of households had average income of $18,400 in 2007. The next-to-the bottom fifth — those with incomes between $20,500 and $34,300 in 2007 — paid an average of 10.6 percent of their incomes in federal taxes.

No. Not income taxes.

https://www.npr.org/sections/thetwo-way/2012/09/18/161333783/romneys-wrong-and-right-about-the-47-percent

From the article you posted:

"many of those who don't pay income tax do pay other taxes — federal payroll and excise taxes as well as state and local income, sales, and property taxes."

Those are not income tax, and other people pay those too. Do you think the poor shouldn’t pay sales tax or property tax either?

Poor people generally don’t own homes.

NP. Shockingly, people can have things happen in their lives that cause them to fall into poverty after previously being able to afford a home. (It could even happen to you.)

Anonymous

Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:40% of Americans pay no federal tax at all, while receiving a ton of benefits.

— low-income households as a group do, in fact, pay federal taxes. Congressional Budget Office data show that the poorest fifth of households paid an average of 4.0 percent of their incomes in federal taxes in 2007, the latest year for which these data are available — not an insignificant amount given how modest these households’ incomes are; the poorest fifth of households had average income of $18,400 in 2007. The next-to-the bottom fifth — those with incomes between $20,500 and $34,300 in 2007 — paid an average of 10.6 percent of their incomes in federal taxes.

No. Not income taxes.

https://www.npr.org/sections/thetwo-way/2012/09/18/161333783/romneys-wrong-and-right-about-the-47-percent

From the article you posted:

"many of those who don't pay income tax do pay other taxes — federal payroll and excise taxes as well as state and local income, sales, and property taxes."

Those are not income tax, and other people pay those too. Do you think the poor shouldn’t pay sales tax or property tax either?

Poor people generally don’t own homes.

True but the argument is that poor people do not pay taxes. Oh wait, did you move the goalpost ?!

Anonymous

Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:40% of Americans pay no federal tax at all, while receiving a ton of benefits.

— low-income households as a group do, in fact, pay federal taxes. Congressional Budget Office data show that the poorest fifth of households paid an average of 4.0 percent of their incomes in federal taxes in 2007, the latest year for which these data are available — not an insignificant amount given how modest these households’ incomes are; the poorest fifth of households had average income of $18,400 in 2007. The next-to-the bottom fifth — those with incomes between $20,500 and $34,300 in 2007 — paid an average of 10.6 percent of their incomes in federal taxes.

No. Not income taxes.

https://www.npr.org/sections/thetwo-way/2012/09/18/161333783/romneys-wrong-and-right-about-the-47-percent

From the article you posted:

"many of those who don't pay income tax do pay other taxes — federal payroll and excise taxes as well as state and local income, sales, and property taxes."

Those are not income tax, and other people pay those too. Do you think the poor shouldn’t pay sales tax or property tax either?

They pay a payroll tax, isn’t that income?!

Anonymous

Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:40% of Americans pay no federal tax at all, while receiving a ton of benefits.

— low-income households as a group do, in fact, pay federal taxes. Congressional Budget Office data show that the poorest fifth of households paid an average of 4.0 percent of their incomes in federal taxes in 2007, the latest year for which these data are available — not an insignificant amount given how modest these households’ incomes are; the poorest fifth of households had average income of $18,400 in 2007. The next-to-the bottom fifth — those with incomes between $20,500 and $34,300 in 2007 — paid an average of 10.6 percent of their incomes in federal taxes.

No. Not income taxes.

https://www.npr.org/sections/thetwo-way/2012/09/18/161333783/romneys-wrong-and-right-about-the-47-percent

From the article you posted:

"many of those who don't pay income tax do pay other taxes — federal payroll and excise taxes as well as state and local income, sales, and property taxes."

Those are not income tax, and other people pay those too. Do you think the poor shouldn’t pay sales tax or property tax either?

Poor people generally don’t own homes.

Anonymous

Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:40% of Americans pay no federal tax at all, while receiving a ton of benefits.

— low-income households as a group do, in fact, pay federal taxes. Congressional Budget Office data show that the poorest fifth of households paid an average of 4.0 percent of their incomes in federal taxes in 2007, the latest year for which these data are available — not an insignificant amount given how modest these households’ incomes are; the poorest fifth of households had average income of $18,400 in 2007. The next-to-the bottom fifth — those with incomes between $20,500 and $34,300 in 2007 — paid an average of 10.6 percent of their incomes in federal taxes.

No. Not income taxes.

https://www.npr.org/sections/thetwo-way/2012/09/18/161333783/romneys-wrong-and-right-about-the-47-percent

From the article you posted:

"many of those who don't pay income tax do pay other taxes — federal payroll and excise taxes as well as state and local income, sales, and property taxes."

Those are not income tax, and other people pay those too. Do you think the poor shouldn’t pay sales tax or property tax either?

Anonymous

I have contempt for corporate welfare but not poor people OP.

Anonymous

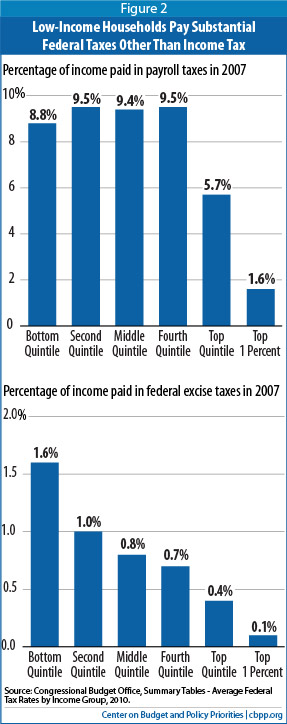

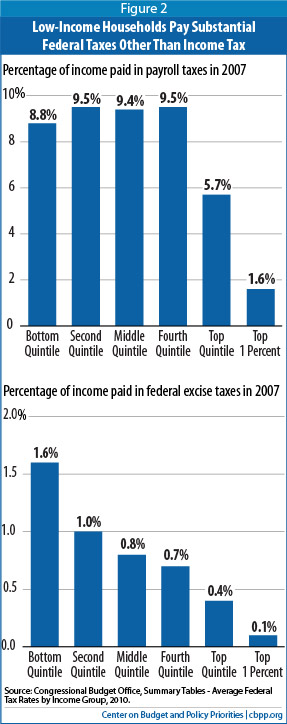

Another fabulous graph from PP’s article!

The poor pay taxes! They pay more payroll tax. SNAP and Aid for needy families, which have work requirements (and subject to payroll tax!!) should be seen as hard working people getting their pay back. Just like the mortgage deduction, or 529s or 401Ks!

Some of you are really living a big lie.

The poor pay taxes! They pay more payroll tax. SNAP and Aid for needy families, which have work requirements (and subject to payroll tax!!) should be seen as hard working people getting their pay back. Just like the mortgage deduction, or 529s or 401Ks!

Some of you are really living a big lie.

Anonymous

If people aren't paying taxes because they are poor, so earn so little they aren't taxed, is that something I should be upset about? How shitty of a person do you have to be to let a poor person's plight anger you? Sweep around your own front door.