Anonymous

You did not pull them correctly, as a matter of fact.

Every stated written and verbal policy from the Obama administration has been to keep the rates as they exist now in place on the first $250,000. That's every budget proposal, every SOTU address, every speech, every piece of testimony.

You may not believe him, but you can't prove he intends to do anything other than what he said.

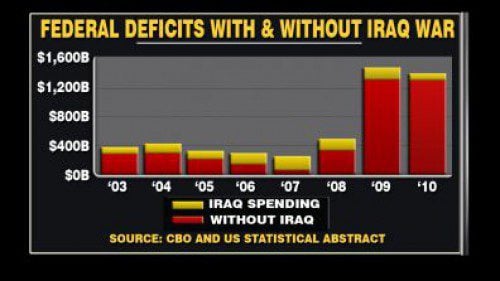

As for your graph about the debt, I wasn't referring to the war. I was referring to Bush's economic policies, particularly the "ownership society" rhetoric and the fiscally imprudent tax policy.

BTW, you do realize that Bush nationalized the banks, right? That wasn't an Obama policy.

Every stated written and verbal policy from the Obama administration has been to keep the rates as they exist now in place on the first $250,000. That's every budget proposal, every SOTU address, every speech, every piece of testimony.

You may not believe him, but you can't prove he intends to do anything other than what he said.

As for your graph about the debt, I wasn't referring to the war. I was referring to Bush's economic policies, particularly the "ownership society" rhetoric and the fiscally imprudent tax policy.

BTW, you do realize that Bush nationalized the banks, right? That wasn't an Obama policy.

Anonymous

Anonymous wrote:

(4) Worst natural disaster in U.S. history (Obama told foreign aid to clean up to go home, continued his vacay, and months later took credit for inventing the cap - LMAO!) [/b]how sad are you that you consider the BP oil spill to be a natural disaster?[b]

Don't play coy with me - you must mistake me for someone with an IQ as low as yours - you know what I mean. But to spell it out a little more clearly for you:

THE BIGGEST ECOLOGICAL DISASTER IN US HISTORY, a.k.a., THE BIGGEST OIL SPILL IN US HISTORY.

Are you still not entirely clear what I am referring to?

THE BP OIL SPILL.

Still not sure?

It happened in 2010 in the Gulf of Mexico. It was BP's fault. If you need more clarification, google it. This is not in my mind's eye or "fictitious." It really did happen.

Oy vey! Some real "stupid" on this site!

Anonymous

And you are right PP - my figures are "fictitious" - I'm schizophrenic - I made them all up and did not pull them right from www.irs.gov (maybe that site is fictitious too!)

Anonymous

Anonymous wrote:

(6) Obama's proposed tax hike on ALL taxable income over $0. This is factually incorrect. Obama has said repeatedly and consistently he'd keep the lower rates in place on the first $250,000 of a married couple's income. Thus, your brackets below are fictitious.

Pre-Bush Tax Cuts / Obama's Proposal:

$0 to $25,750 = 15%

$25,750 to $62,450 = 28% + $3,862

$62,450 to $130,250 = 31% + $14,138

$130,250 to $283,150 = 36% + $35,156 $3,862.50 + 25,750

$283,150+ = 39.6% +$90,200

Bush Tax Cuts (Current Rates)

$0 to $8,500 = 10%

$8,500 to $34,500 = 15% + $850

$34,500 to $83,600 = 25% + $4,750

$83,600 to $174,400 = 28% + $17,025

$174,400 to $379,150 = 33% + $42,449

$379,150+ = 35% + $110,016

"Obama said.. . " a lot of things

Anonymous

Anonymous wrote:

(1) Worst recession in U.S. history (stimuli/green packages = crap, trillions more debt) As been pointed out previously, the recession ended in 2009. The problem with the stimulus package in terms of jumpstarting job creation wasn't that it had "green" packages, it was that 45% of it was tax cuts, so it made too little of an injection into the economy. That said, most economists agree that the stimulus arrested the economic freefall and began the process of turning the U.S.S. America in the right direction. The economy is demonstrably stronger now than it was 3 years ago. The debt trajectory is completely irrelevant to discussing the short-term financial crisis that began on Bush's watch due largely to Bush's policies.

(2) Two wars that have not ended (promise to end = crap) Fair to say Iraq has been wound down in terms of U.S. involvement. I recall Obama promising to escalate Afghanistan, not end it.

(3) Wall Street unscathed after the housing/stock market meltdown Unscathed is an imprecise word. Moreover, I don't recall Obama promising to "scathe" or "punish" Wall Street. In any event, TARP has been repaid, bonuses are down, prop desk trading is done, and the credit crunch has eased. The Ted Spread is back to normal. I realize you don't know what the Ted Spread is, but that's OK if you want to Google it.

(4) Worst natural disaster in U.S. history (Obama told foreign aid to clean up to go home, continued his vacay, and months later took credit for inventing the cap - LMAO!) [/b]how sad are you that you consider the BP oil spill to be a natural disaster?

(5) Guitmo is still open for business (promise to close = crap) [b]I'll grant you that.

(6) Obama's proposed tax hike on ALL taxable income over $0 This is factually incorrect. Obama has said repeatedly and consistently he'd keep the lower rates in place on the first $250,000 of a married couple's income. Thus, your brackets below are fictitious.

Pre-Bush Tax Cuts / Obama's Proposal:

$0 to $25,750 = 15%

$25,750 to $62,450 = 28% + $3,862

$62,450 to $130,250 = 31% + $14,138

$130,250 to $283,150 = 36% + $35,156 $3,862.50 + 25,750

$283,150+ = 39.6% +$90,200

Bush Tax Cuts (Current Rates)

$0 to $8,500 = 10%

$8,500 to $34,500 = 15% + $850

$34,500 to $83,600 = 25% + $4,750

$83,600 to $174,400 = 28% + $17,025

$174,400 to $379,150 = 33% + $42,449

$379,150+ = 35% + $110,016

(7) Obamacare penalizes people for not being able to afford health insurance on their tax return (and they still don't get any insurance!!!) I have no problem with this.

Examples:

2014; family of 2; taxable income=$26,000;

penalty=$260 ($260=$26,000x1% > $190=$95x2.)

2014; family of 3; taxable income=$26,000;

penalty=$285 ($260=$26,000x1% < $285=$95x3.)

2016; family of 3; taxable income=$26,000;

penalty=$2,085 ($650=$26,000x2.5% < $2,085=$695x3.)

2016; family of 3; taxable income=$85,000;

penalty=$2,125 ($2,125=$85,000x2.5% > $2,085=$695x3.)

2016; family of 8; taxable income=$85,000;

penalty=$2,125 ($2,1t25=$85,000x2.5% > $2,085=$695x3.)

-----------------------------

I realize Facts died last week (see http://articles.chicagotribune.com/2012-04-19/news/ct-talk-huppke-obit-facts-20120419_1_facts-philosopher-opinion for the obituary), but you're really living in a fantasyland.

jsteele

Anonymous wrote:Im not sure how the misquote changes the substance of the message?

This has been explained multiple times in this thread.

Obama was talking about the fact that he and Michelle both received assistance to obtain their educations. Romney could have been asked whether he thinks it is important to maintain and/or expand educational assistance so that people who are born without means can get the type of opportunities that the Obamas received. Instead, Romney was served a softball opportunity to attack Obama with accusations that Obama was trying to divide America.

Is it as severe as the Zimmerman editing? No. But, why has not one Fox supporter been able to say something like, "Fox made an unfortunate mistake and should issue a correction"? Plenty of liberals did something similar in the Zimmerman case. Instead, we have accusations made against MSNBC, my news-watching habits, and the threads that I start, plus countless posters unable to understand why it makes a difference.

Anonymous

(1) Worst recession in U.S. history (stimuli/green packages = crap, trillions more debt) As been pointed out previously, the recession ended in 2009. The problem with the stimulus package in terms of jumpstarting job creation wasn't that it had "green" packages, it was that 45% of it was tax cuts, so it made too little of an injection into the economy. That said, most economists agree that the stimulus arrested the economic freefall and began the process of turning the U.S.S. America in the right direction. The economy is demonstrably stronger now than it was 3 years ago. The debt trajectory is completely irrelevant to discussing the short-term financial crisis that began on Bush's watch due largely to Bush's policies.

(2) Two wars that have not ended (promise to end = crap) Fair to say Iraq has been wound down in terms of U.S. involvement. I recall Obama promising to escalate Afghanistan, not end it.

(3) Wall Street unscathed after the housing/stock market meltdown Unscathed is an imprecise word. Moreover, I don't recall Obama promising to "scathe" or "punish" Wall Street. In any event, TARP has been repaid, bonuses are down, prop desk trading is done, and the credit crunch has eased. The Ted Spread is back to normal. I realize you don't know what the Ted Spread is, but that's OK if you want to Google it.

(4) Worst natural disaster in U.S. history (Obama told foreign aid to clean up to go home, continued his vacay, and months later took credit for inventing the cap - LMAO!) [/b]how sad are you that you consider the BP oil spill to be a natural disaster?

(5) Guitmo is still open for business (promise to close = crap) [b]I'll grant you that.

(6) Obama's proposed tax hike on ALL taxable income over $0 This is factually incorrect. Obama has said repeatedly and consistently he'd keep the lower rates in place on the first $250,000 of a married couple's income. Thus, your brackets below are fictitious.

Pre-Bush Tax Cuts / Obama's Proposal:

$0 to $25,750 = 15%

$25,750 to $62,450 = 28% + $3,862

$62,450 to $130,250 = 31% + $14,138

$130,250 to $283,150 = 36% + $35,156 $3,862.50 + 25,750

$283,150+ = 39.6% +$90,200

Bush Tax Cuts (Current Rates)

$0 to $8,500 = 10%

$8,500 to $34,500 = 15% + $850

$34,500 to $83,600 = 25% + $4,750

$83,600 to $174,400 = 28% + $17,025

$174,400 to $379,150 = 33% + $42,449

$379,150+ = 35% + $110,016

(7) Obamacare penalizes people for not being able to afford health insurance on their tax return (and they still don't get any insurance!!!) I have no problem with this.

Examples:

2014; family of 2; taxable income=$26,000;

penalty=$260 ($260=$26,000x1% > $190=$95x2.)

2014; family of 3; taxable income=$26,000;

penalty=$285 ($260=$26,000x1% < $285=$95x3.)

2016; family of 3; taxable income=$26,000;

penalty=$2,085 ($650=$26,000x2.5% < $2,085=$695x3.)

2016; family of 3; taxable income=$85,000;

penalty=$2,125 ($2,125=$85,000x2.5% > $2,085=$695x3.)

2016; family of 8; taxable income=$85,000;

penalty=$2,125 ($2,1t25=$85,000x2.5% > $2,085=$695x3.)

-----------------------------

I realize Facts died last week (see http://articles.chicagotribune.com/2012-04-19/news/ct-talk-huppke-obit-facts-20120419_1_facts-philosopher-opinion for the obituary), but you're really living in a fantasyland.

Anonymous

Im not sure how the misquote changes the substance of the message? In the MSNBC quote, it was very obvious the motivation was focused on George Zimmerman. Similarly, it was a spliced recording which created a very new image of George Zimmerman.

In the Foxnews case, this is a misquote via someone's word of mouth-- not a spliced recording. Similarly, if you take out the addition to the quote, it is still very clear who his target is. There is a very rich and successful man who Barak Obama (who has waged a war on the rich) must defeat in 7 months.

I would argue that if you are correlating this misquote with the villification of George Zimmerman, that you are picking the hairs of zebras and giraffes and comparing them wondering if they look the same. Yes, it was wrong and a mistake of quotation, but not in the same ballpark.

(waiting for the BO guy to chime in out smells)

In the Foxnews case, this is a misquote via someone's word of mouth-- not a spliced recording. Similarly, if you take out the addition to the quote, it is still very clear who his target is. There is a very rich and successful man who Barak Obama (who has waged a war on the rich) must defeat in 7 months.

I would argue that if you are correlating this misquote with the villification of George Zimmerman, that you are picking the hairs of zebras and giraffes and comparing them wondering if they look the same. Yes, it was wrong and a mistake of quotation, but not in the same ballpark.

(waiting for the BO guy to chime in out smells)

jsteele

Anonymous wrote:Anonymous wrote:Jeff,

There are some current, important issues for you I listed above. I care not to start a thread, because I can see that the contribution from most of the people on this site would be nominal if not counter-productive (e.g., probably more talk about Mitt's $$$, more talk about "Fox lies" or whatever, maybe some calling me or whoever a "racist/bigot/troll," etc. It's rather unfortunate that a site with so many lawyers is most often unable to produce anything near a true "debate" on any particular issue of importance).

If you don't care to start good topics then for crying out loud, stop complaining about seeing nothing but bad topics!

Yes, exactly. If your only contribution to DCUM is going to be complaining about threads that other people start, it's not really much of a contribution. It's like people who don't vote complaining about who got elected.

Anonymous

Anonymous wrote:Jeff,

There are some current, important issues for you I listed above. I care not to start a thread, because I can see that the contribution from most of the people on this site would be nominal if not counter-productive (e.g., probably more talk about Mitt's $$$, more talk about "Fox lies" or whatever, maybe some calling me or whoever a "racist/bigot/troll," etc. It's rather unfortunate that a site with so many lawyers is most often unable to produce anything near a true "debate" on any particular issue of importance).

If you don't care to start good topics then for crying out loud, stop complaining about seeing nothing but bad topics!

Anonymous

Anonymous wrote:Anonymous wrote: And to the Latin scholar who wrote "Res Ipsa Loquitur" on one of these threads, it's "ipse".

I am not a "scholar" - I am a lawyer. We use Black's Law Dictionary, and the 6th edition says "Res ipsA loquitur."

I weep for the profession.

Anonymous

Anonymous wrote: And to the Latin scholar who wrote "Res Ipsa Loquitur" on one of these threads, it's "ipse".

I am not a "scholar" - I am a lawyer. We use Black's Law Dictionary, and the 6th edition says "Res ipsA loquitur."

Anonymous

"Triviality?"

Taxing the poor = "trivial?"

Worst economic disaster since the depression = "trivial?"

The BP Oil Spill - "trivial?"

Spending trillions on 2 wars = "trivial?"

Guitmo = "trivial?"

I will stop - as I said before, no point in even opening the floor for debate, because nobody CAN debate. Just name call, e.g., troll, Republican, trivial, whatever. This is all so ignorant.

Taxing the poor = "trivial?"

Worst economic disaster since the depression = "trivial?"

The BP Oil Spill - "trivial?"

Spending trillions on 2 wars = "trivial?"

Guitmo = "trivial?"

I will stop - as I said before, no point in even opening the floor for debate, because nobody CAN debate. Just name call, e.g., troll, Republican, trivial, whatever. This is all so ignorant.

Anonymous

Anonymous wrote:Anonymous wrote:Anonymous wrote:Somehow I think Mitt will survive the insinuation that he didn't loans to get through school.

This was about education programs, not about Mitt. If you want something that was about Mitt, look at Rosen's comment complaining that Mitt gets his information about women in the economy from his wife, who is totally insulated from economic hardship; THAT was an attack on Mitt (and not on Ann). How do we let ourselves get manipulated by Fox/GOP distortions?

"Fox/GOP Distortions?"

Here is a distortion for you:

While the following is occurring in America, your attention has been deflected by the MAINSTREAM media over to things like how much $$$ Mitt and Ann have:

(1) Worst recession in U.S. history (stimuli/green packages = crap, trillions more debt)

(2) Two wars that have not ended (promise to end = crap)

(3) Wall Street unscathed after the housing/stock market meltdown

(4) Worst natural disaster in U.S. history (Obama told foreign aid to clean up to go home, continued his vacay, and months later took credit for inventing the cap - LMAO!)

(5) Guitmo is still open for business (promise to close = crap)

(6) Obama's proposed tax hike on ALL taxable income over $0

Pre-Bush Tax Cuts / Obama's Proposal:

$0 to $25,750 = 15%

$25,750 to $62,450 = 28% + $3,862

$62,450 to $130,250 = 31% + $14,138

$130,250 to $283,150 = 36% + $35,156 $3,862.50 + 25,750

$283,150+ = 39.6% +$90,200

Bush Tax Cuts (Current Rates)

$0 to $8,500 = 10%

$8,500 to $34,500 = 15% + $850

$34,500 to $83,600 = 25% + $4,750

$83,600 to $174,400 = 28% + $17,025

$174,400 to $379,150 = 33% + $42,449

$379,150+ = 35% + $110,016

(7) Obamacare penalizes people for not being able to afford health insurance on their tax return (and they still don't get any insurance!!!)

Examples:

2014; family of 2; taxable income=$26,000;

penalty=$260 ($260=$26,000x1% > $190=$95x2.)

2014; family of 3; taxable income=$26,000;

penalty=$285 ($260=$26,000x1% < $285=$95x3.)

2016; family of 3; taxable income=$26,000;

penalty=$2,085 ($650=$26,000x2.5% < $2,085=$695x3.)

2016; family of 3; taxable income=$85,000;

penalty=$2,125 ($2,125=$85,000x2.5% > $2,085=$695x3.)

2016; family of 8; taxable income=$85,000;

penalty=$2,125 ($2,1t25=$85,000x2.5% > $2,085=$695x3.)

So you all keep worrying about things like how much money Mitt and Ann have, exactly how one should best say Obama didn't grow up with a silver spoon in his mouth, and bash some Catholics, while intelligent people care about more important issues in America, OK?

And you, who claim to be focused on all those important things, are writing about this triviality and then criticizing me for doing exactly what you were doing. I'm guessing that you must be a Republican, doing exactly what I keep complaining about Republicans doing!

Note that I don't call you a stupid shmuck, just because you do the stupid shmucky thing that pisses me off so much. I try not to be ad hominem (or ad feminam, as the case may be).

And to the Latin scholar who wrote "Res Ipsa Loquitur" on one of these threads, it's "ipse".

Anonymous

Jeff,

There are some current, important issues for you I listed above. I care not to start a thread, because I can see that the contribution from most of the people on this site would be nominal if not counter-productive (e.g., probably more talk about Mitt's $$$, more talk about "Fox lies" or whatever, maybe some calling me or whoever a "racist/bigot/troll," etc. It's rather unfortunate that a site with so many lawyers is most often unable to produce anything near a true "debate" on any particular issue of importance).

There are some current, important issues for you I listed above. I care not to start a thread, because I can see that the contribution from most of the people on this site would be nominal if not counter-productive (e.g., probably more talk about Mitt's $$$, more talk about "Fox lies" or whatever, maybe some calling me or whoever a "racist/bigot/troll," etc. It's rather unfortunate that a site with so many lawyers is most often unable to produce anything near a true "debate" on any particular issue of importance).