Anonymous

Anonymous wrote:OP, I don't know what your housing needs are or where you're going, but there has been a run of construction of single family rental communities. It will be a large community of houses, with a pool/gym/etc., managed by a large owner. There should be dedicated maintenance staff, and you shouldn't have the problems you previously experienced with repairs. You should find prices lower in the winter (less demand).

Can you give examples of these? I’ve never heard of this

Anonymous

Anonymous wrote:Rentals are gross, though. Termites, cracked foundations, mold, dog smell in the stained carpet.

Unless you stained the carpet and brought dog smell, you looked a smelly place with stained carpet and said "Yes I'll take it"? Who forced you to rent a home with - and/or do nothing to address - termites, mold, dog smell, stained carpet, ...?

You sound like someone trying to dissuade renting because your post makes no sense.

The best part about renting is that whenever anything needs repaired or replaced, the landlord is the one who shoulders the burden of paying for it.

When you own a home, you must ALWAYS have extra money in the event that something breaks.

Or perhaps if there are pests, etc.

My sister found a rat in her garage wall, then the next month had her water heater break.

All during or around the holidays. 🙁

Anonymous

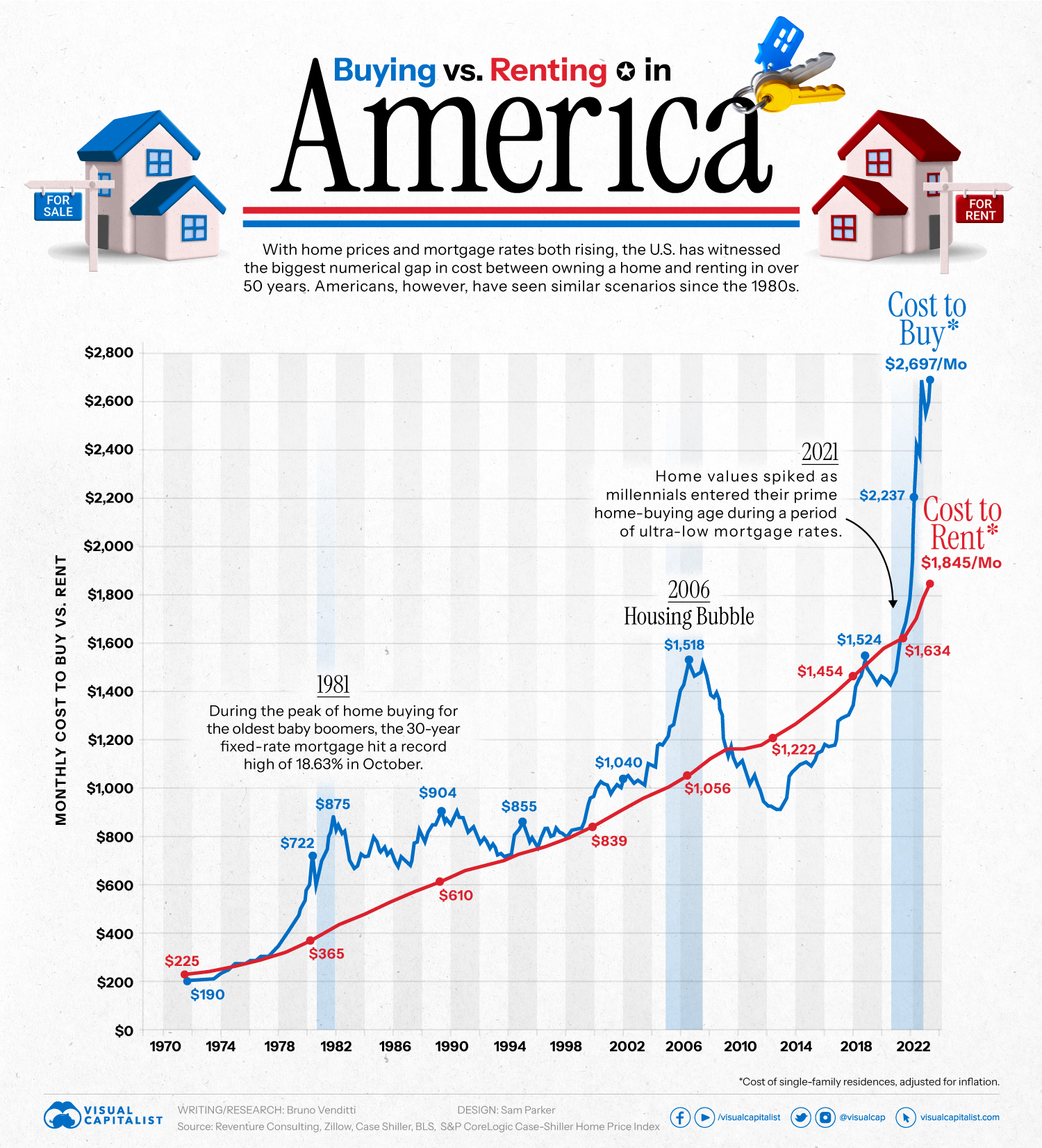

Anonymous wrote:Anonymous wrote:Anonymous wrote:Buying in this market hardly makes sense with the interest rates and prices (combined) where they are

Everyone keeps saying this as though it's a foregone conclusion that interest rates and prices are going to significantly improve. Lots of people on this forum were also saying that 2019 was a "bad time to move to MoCo", and were recommending to wait for "3+ years". What makes you so sure that conditions are going to favor buyers in the near future? Because if they're not, I disagree that it doesn't make sense to buy in current conditions, even if they're not ideal.

+1. If you can afford to buy now it Still makes sense. Look at this way - minute small adjustments in property taxes and assuming a fixed rate loan, your housing payment will never be MORE than it is right now if you buy. It’s very possible at some pi t it may go den if rates go down in th coming years. You shouldn’t base the entire decision to purchase on rates. That’s just silly. Fwiw, you know what happens when rates drop significantly? Buyers flood the market and prices go up. If you want or need to buy now and can afford th payment you should consider. Sooo many people from 2019-2020 who were going to “ wait it out” actually lost out on so much in appreciation.

Makes zero sense to me. Houses we like are around 2.3m and they rent for about 8k. If I buy it with 20% down payment my payment at 7.5% rate would be roughly 13000 and whopping 11500 of it would be interest. That is significantly more money “thrown out of the window” than renting. Unless you have massive amounts of cash for the down payment, owning is just not the best financial decision right now and definitely not for someone who is likely to move in a few years again.

Anonymous

Anonymous wrote:Anonymous wrote:Buying in this market hardly makes sense with the interest rates and prices (combined) where they are

Everyone keeps saying this as though it's a foregone conclusion that interest rates and prices are going to significantly improve. Lots of people on this forum were also saying that 2019 was a "bad time to move to MoCo", and were recommending to wait for "3+ years". What makes you so sure that conditions are going to favor buyers in the near future? Because if they're not, I disagree that it doesn't make sense to buy in current conditions, even if they're not ideal.

+1. If you can afford to buy now it Still makes sense. Look at this way - minute small adjustments in property taxes and assuming a fixed rate loan, your housing payment will never be MORE than it is right now if you buy. It’s very possible at some pi t it may go den if rates go down in th coming years. You shouldn’t base the entire decision to purchase on rates. That’s just silly. Fwiw, you know what happens when rates drop significantly? Buyers flood the market and prices go up. If you want or need to buy now and can afford th payment you should consider. Sooo many people from 2019-2020 who were going to “ wait it out” actually lost out on so much in appreciation.

Anonymous

We're renting for the same reason.

Anonymous

I think CW says you need to plan to stay in a house at least 3-5 years to consider buying. Buying 8 houses in 15 years, means you are just paying realtors.Anonymous wrote:Anonymous wrote:how many have you sold?Anonymous wrote:We are moving next summer - location isn't set in stone yet. We would prefer to buy, but we're finding that the current high interest rates are pricing us out of homes equivalent to what we're in now - but that rent in the same location is about half what a mortgage would cost us. This is the case across the country and in various size cities. We've purchased 8 houses in the past 15 years, and it's always been the opposite. Is this just because people who've held their mortgages a while can afford to charge less rent to cover, or is there something else going on?

All of them. Little equity though, obviously.

Anonymous

Anonymous wrote:Buying in this market hardly makes sense with the interest rates and prices (combined) where they are

Everyone keeps saying this as though it's a foregone conclusion that interest rates and prices are going to significantly improve. Lots of people on this forum were also saying that 2019 was a "bad time to move to MoCo", and were recommending to wait for "3+ years". What makes you so sure that conditions are going to favor buyers in the near future? Because if they're not, I disagree that it doesn't make sense to buy in current conditions, even if they're not ideal.

Anonymous

Buying in this market hardly makes sense with the interest rates and prices (combined) where they are... but I get the complaint about rental houses being of inferior quality. When we looked to buy, all of the houses that were formerly rentals looked like they were treated like trash by tenant and landlord alike, at whatever the price point.

Anonymous

Anonymous wrote:

Shoot. Thanks.

I just hate the idea of living in someone's gross cast-off again.

LOL my home that I own was someone's gross cast-off and 3 years later we're still working on repairs. That's why it was affordable.

Your money will stretch further to rent an actually nice place than to buy a beat up one like mine. Not all rentals are crappy, not all homes on the market are in great shape.

Anonymous

OP, I don't know what your housing needs are or where you're going, but there has been a run of construction of single family rental communities. It will be a large community of houses, with a pool/gym/etc., managed by a large owner. There should be dedicated maintenance staff, and you shouldn't have the problems you previously experienced with repairs. You should find prices lower in the winter (less demand).

Anonymous

Anonymous wrote:

Shoot. Thanks.

I just hate the idea of living in someone's gross cast-off again.

Assuming you're OP - I was sympathizing with you until you said this ^^^^ What a foolish and immature way to think. "Gross Cast-Off"? You know 8+ people now live in YOUR gross cast-offs?

Anonymous

Sounds like you pick cheap rentals. It helps to not rent directly from an owner. Go through a property manager so you are getting better service and quality.

Anonymous

Anonymous wrote:Anonymous wrote:Rentals are gross, though. Termites, cracked foundations, mold, dog smell in the stained carpet.

Unless you stained the carpet and brought dog smell, you looked a smelly place with stained carpet and said "Yes I'll take it"? Who forced you to rent a home with - and/or do nothing to address - termites, mold, dog smell, stained carpet, ...?

You sound like someone trying to dissuade renting because your post makes no sense.

We got on a winter cycle and housing is difficult to find some locations. We took what we could get.

Was this in a jurisdiction where landlords have zero responsibility to remediate termites, mold, dog smell, stained carpet, ...? Where was this rental located?

Anonymous

Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:how many have you sold?Anonymous wrote:We are moving next summer - location isn't set in stone yet. We would prefer to buy, but we're finding that the current high interest rates are pricing us out of homes equivalent to what we're in now - but that rent in the same location is about half what a mortgage would cost us. This is the case across the country and in various size cities. We've purchased 8 houses in the past 15 years, and it's always been the opposite. Is this just because people who've held their mortgages a while can afford to charge less rent to cover, or is there something else going on?

All of them. Little equity though, obviously.

I was going to say that you should have enough money to pay cash now.

Rent. Should have rented after second home. There are other ways to make money than buying homes.

Rentals are gross, though. Termites, cracked foundations, mold, dog smell in the stained carpet. I WFH, so I like to be surrounded by clean, nice things.

Owned properties are gross too.

You can pay more for a nicer place.

You can replace things and upgrade a house you own, though. We weren't even allowed to replace carpet on our own dime when we rented.

Anonymous

Anonymous wrote:Rentals are gross, though. Termites, cracked foundations, mold, dog smell in the stained carpet.

Unless you stained the carpet and brought dog smell, you looked a smelly place with stained carpet and said "Yes I'll take it"? Who forced you to rent a home with - and/or do nothing to address - termites, mold, dog smell, stained carpet, ...?

You sound like someone trying to dissuade renting because your post makes no sense.

We got on a winter cycle and housing is difficult to find some locations. We took what we could get.