Anonymous

Anonymous

Anonymous wrote:Great messaging from the left on this thread.

If you cannot readily absorb fuel costs, you are a failure.

Don’t take car trips.

Your suv is the problem.

The left hates working and middle class people/ at least the white ones.

Yep we're going to get clobbered in November. But at least we have a trans woman swim chanp.

Anonymous

Anonymous wrote:I’m beyond tired of hearing bubbas whining about gas prices. Seriously, who GAF? If a dollar more per gallon is going to wreck your entire budget, you’re lazy, made poor life choices, and deserve your fate. You didn’t make anything of yourself and instead of acknowledging that you’re a failure, you just want “oWn ThE LiBs!!!”

Milk is also a buck more per gallon.

Anonymous

Anonymous wrote:Great messaging from the left on this thread.

If you cannot readily absorb fuel costs, you are a failure.

Don’t take car trips.

Your suv is the problem.

The left hates working and middle class people/ at least the white ones.

This is objectively true, which is why they’re getting blown to smithereens in polling.

Anonymous

Great messaging from the left on this thread.

If you cannot readily absorb fuel costs, you are a failure.

Don’t take car trips.

Your suv is the problem.

The left hates working and middle class people/ at least the white ones.

If you cannot readily absorb fuel costs, you are a failure.

Don’t take car trips.

Your suv is the problem.

The left hates working and middle class people/ at least the white ones.

Anonymous

Anonymous wrote:Anonymous wrote:Imagine that. They don't have the high cost of exploration because the WH is telling them not to look for more oil. They also sell less product in more countries globally with a declining USD. Less refining capacity also to drive up prices.

What did you think was going to happen?

BP and Shell aren't even US companies. What point were you trying to make?

Your brain is stewing in complete bullshit propaganda with right wing claims that somehow the US oil sector has been shut down.

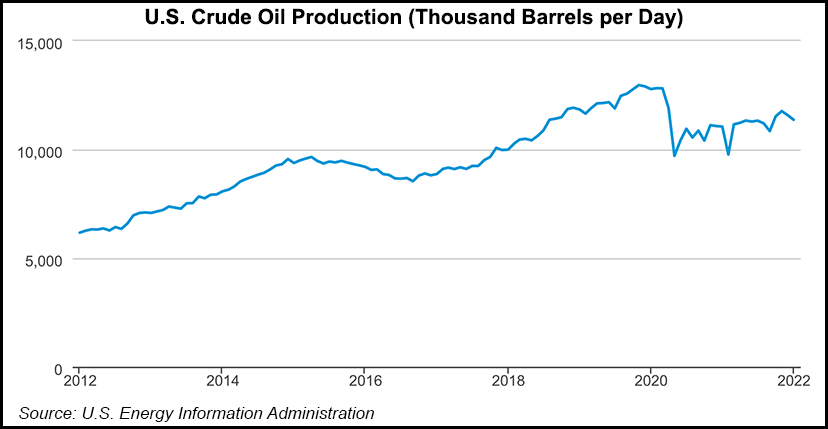

US oil production is at all time highs.

Production lags drilling activity. The American oil industry has been cannibalizing working inventory in order to keep production close to flat (since about August of 2020). That’s going to really hurt the country in the second half of the year. The industry is shut down for a variety of reasons—one of which is perceived or actual hostility from the current admin. Others include a labor shortage and supply chain issues.

Absent a worldwide recession that materially impacts demand, oil prices are going to continue to dramatically rise this year.

Good high level view on what is happening with drilled but uncompleted wells in the link below. As the US burns off this inventory and given that we’re already releasing from the SPR, I’m very concerned about where oil prices are heading this summer and in the fall. Oil prices are going to dominate the conversation around the midterms. Also, don’t sleep on natural gas prices.

https://www.forbes.com/sites/thebakersinstitute/2022/03/17/can-ducs-continue-to-goose-us-oil-production/

Anonymous

You would love to witness the chaos that rationing would create, wouldn’t you?

Anonymous

All the Biden Administration needs to do is implement immediate rationing for gasoline. That’ll force people to abandon their stupid SUV’s overnight. And less gasoline being sold in a rationing program will also stick it to oil companies and gas stations who’ve been gouging prices and profiteering while blaming Joe for high gas prices while they laugh all the way to the bank. Time to wipe the smiles off big oil’s face.

Problem solved.

Problem solved.

Anonymous

Maybe more people who don't need behemoth SUVs and trucks will stop buying them, especially in urban and suburban areas.

You don't need a giant SUV to pick little Larlo up from school.

No one is forcing you to go on long weekend driving trips.

I've just made a tank of gas in my gas sipping Honda last a month.

If you decrease demand the prices will go down people.

You don't need a giant SUV to pick little Larlo up from school.

No one is forcing you to go on long weekend driving trips.

I've just made a tank of gas in my gas sipping Honda last a month.

If you decrease demand the prices will go down people.

Anonymous

I’m beyond tired of hearing bubbas whining about gas prices. Seriously, who GAF? If a dollar more per gallon is going to wreck your entire budget, you’re lazy, made poor life choices, and deserve your fate. You didn’t make anything of yourself and instead of acknowledging that you’re a failure, you just want “oWn ThE LiBs!!!”

Anonymous

Anonymous wrote:Anonymous wrote:Imagine that. They don't have the high cost of exploration because the WH is telling them not to look for more oil. They also sell less product in more countries globally with a declining USD. Less refining capacity also to drive up prices.

What did you think was going to happen?

BP and Shell aren't even US companies. What point were you trying to make?

Your brain is stewing in complete bullshit propaganda with right wing claims that somehow the US oil sector has been shut down.

US oil production is at all time highs.

Interesting that you linked a chart that ended in 2020 - when Trump was president.

Of course we are not at all time highs now.

Anonymous

Anonymous wrote:Imagine that. They don't have the high cost of exploration because the WH is telling them not to look for more oil. They also sell less product in more countries globally with a declining USD. Less refining capacity also to drive up prices.

What did you think was going to happen?

BP and Shell aren't even US companies. What point were you trying to make?

Your brain is stewing in complete bullshit propaganda with right wing claims that somehow the US oil sector has been shut down.

US oil production is at all time highs.

Anonymous

Imagine that. They don't have the high cost of exploration because the WH is telling them not to look for more oil. They also sell less product in more countries globally with a declining USD. Less refining capacity also to drive up prices.

What did you think was going to happen?

BP and Shell aren't even US companies. What point were you trying to make?

What did you think was going to happen?

BP and Shell aren't even US companies. What point were you trying to make?

Anonymous

Anonymous wrote:Anonymous wrote:Anonymous wrote:Anonymous wrote:Cannot afford a Tesla- cannot afford Biden gas….

Working people are fed up.

Yes, people can't afford Biden gas, which is why they're hitting the road in record numbers.

Hint: gas is expensive because there's a lot of demand for it.

And because the gas companies are gouging like crazy making record profits.

Cite evidence that this is happening. Tell us about the price gouging.

Are you REALLY that uninformed about what's going on?

BP: https://www.reuters.com/business/energy/bp-records-highest-profit-eight-years-2021-2022-02-08/

Shell: https://www.reuters.com/business/energy/shell-again-boosts-dividend-buybacks-profits-soar-2022-02-03/

Chevron: https://www.wsj.com/articles/chevron-rakes-in-15-6-billion-in-annual-profits-as-oil-prices-climb-11643370301

Exxon: https://www.nytimes.com/2022/02/01/business/exxon-earnings-4q-2021.html

You should be embarrassed for being so clueless and yet so incredulous, PP.