Anonymous

Anonymous wrote:Anonymous wrote:Time in market beats timing the market.

Everybody thinks they know when to buy the dips, nobody actually does.

Go play this game 100 times and let me know your scores, I bet you'll win far less than 50% of the time.

https://www.personalfinanceclub.com/time-the-market-game/

I plowed $600,000 into the market from Jan-April of 2021. As it went down, I kept buying. It required nerves of steel, but I did it.

But, I agree with your point -- time in the market does beat timing the market.

Lol @ nerve of steel. I clap you.

Anonymous

Anonymous wrote:Time in market beats timing the market.

Everybody thinks they know when to buy the dips, nobody actually does.

Go play this game 100 times and let me know your scores, I bet you'll win far less than 50% of the time.

https://www.personalfinanceclub.com/time-the-market-game/

I plowed $600,000 into the market from Jan-April of 2021. As it went down, I kept buying. It required nerves of steel, but I did it.

But, I agree with your point -- time in the market does beat timing the market.

Anonymous

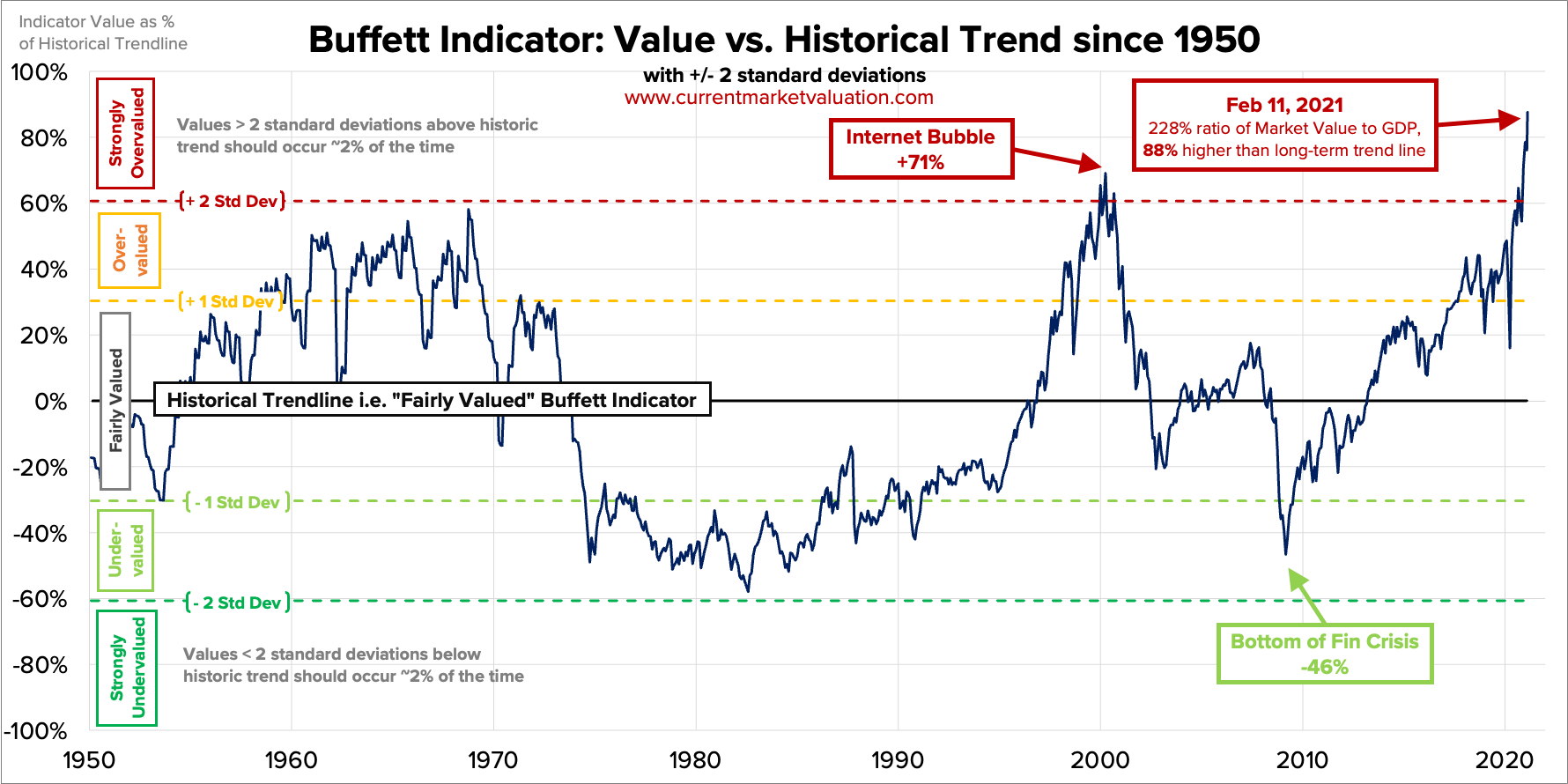

If you follow the logic of the chart above you wound't have bought any equities since 2012.

Anonymous

Continuing to buy through 401k and DH's PSP. Keeping some cash for alternative investments should anything interesting come up.

Anonymous

I'm going to continue to dollar cost average via paycheck contributions to my 401k and the kids' two plans, but I'm leaving this year's bonus in cash (other than $10k I already allocated to iBonds for 2022). Usually I invest my year-end bonus and quickly as I can, but this year I'm going to wait for a month and then maybe dollar cost average it into a brokerage account over the course of 2022.

Anonymous

Time in market beats timing the market.

Everybody thinks they know when to buy the dips, nobody actually does.

Go play this game 100 times and let me know your scores, I bet you'll win far less than 50% of the time.

https://www.personalfinanceclub.com/time-the-market-game/

Everybody thinks they know when to buy the dips, nobody actually does.

Go play this game 100 times and let me know your scores, I bet you'll win far less than 50% of the time.

https://www.personalfinanceclub.com/time-the-market-game/

Anonymous

Sorry, but I’m just not buying into the market right now with valuations higher than they were the peak of the dot-com bubble.

How are you coming to this conclusion?

The Buffett Indicator, or the market cap of the total stock market compared to the GDP of the country, was made famous by Warren Buffett, who said it is the best measure of stock valuations. It is currently higher than in 2000 pre-crash, and this chart doesn't even fully capture the 27% increase in the S&P that took place in 2021.

Putting up a chart does not provide the necessary economic analysis for your conclusion. Try again.

Where can I find this analysis?

Do you think stocks are fairly valued?