Moco - no appreciation in the last 10 years

Anonymous

They don't? That house was built last year. What's so special about it? |

Anonymous

|

NP:

I purchased my NoVa house with my MoCo sales profit. Purchased a MoCo property pre-bubble. Sold at top of bubble (dumb luck 5 yrs later) and used down payment to get SFH in Nova. MoCo property flat-lined. zillow says Nova property is up 400K over 10 years. I'm guessing, based on comps, it's up 200-300K. I'm not trolling; this is my lived experience. |

Anonymous

| you are probably a bored SAHM mom in VA |

Anonymous

|

I purchased my MOCO house with my DC sales profit. Purchased a DC property pre-bubble. Sold at top of bubble (dumb luck 5 yrs later) and used down payment to get SFH in MOCO. MoCo property declined. zillow says MOCO property is down 100K over 15 years. I'm guessing, based on comps, it's down more toward 200K less. If we had bought in McLean we would be ahead by a hundred thousand or more. |

Anonymous

| We live north of Chicago and very high end prices are well below their 2005 peak. The big homes near Lake Michigan that once sold for $5 million are now selling for $3 million. $1.5 million homes are unchanged in 15 years. |

Anonymous

That's a common narrative but hardly backed by any hard data. Mostly embraced by whiney entitled parents who enjoy complaining about everything. The truth is areas like Bethesda were overpriced and the schools aren't that great when you consider their demographics. |

Anonymous

I think part of this is areas like Potomac which had traditionally been the most expensive just aren't as desirable in today's market. Other parts of the county seem to be doing quite well. |

Anonymous

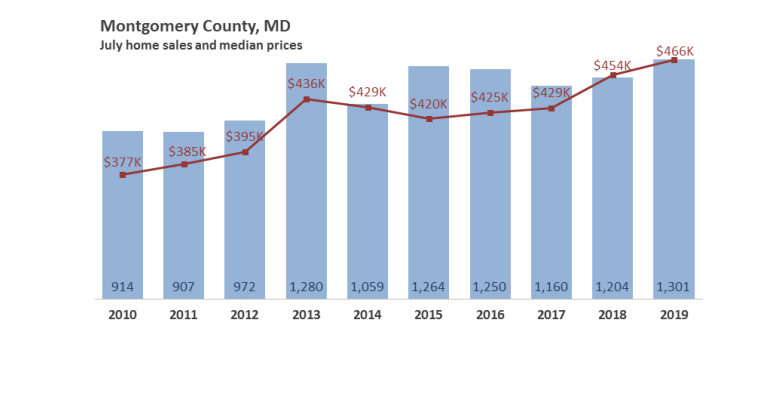

Let me post this again since so many people just ignore it. If a picture is worth a thousand words, then this is worth at least about $90K, so not flat. I will say, though, I don't understand the 2013 spike.

|

Anonymous

| PP you need to show the peak years from 2005-2007 and 2008-2009 change in market conditions. Otherwise this is a bit incomplete. |

Anonymous

Need to also subtract out inflation though. |

Anonymous

Pp Also, $377 in 2010 would be equal to $444 in 2019 if you believe the quick online tool to get an estimate. Congrats, you made only about $20,000 on a $377k investment over almost 10 years. That's a pretty awful rate of return and you could have done wayyyyyy better on the stock market. |

Anonymous

|

I would like to just point out the data from this (which shows median home prices and sales from 2006-2015).

http://montgomeryplanning.org/wp-content/uploads/2016/11/Housing-Trend-Sheet-2015-Final.pdf Moco Median. sale prices: 444k in 2007. Now it's at 439k. (http://marketminute.longandfoster.com/Market-Minute/MD/Montgomery-County.htm) FFX Avg.: 538K in 2007. Current average is 568k. Our current median is 535k. https://www.insidenova.com/news/arlington/n-va-real-estate-market-ebbs-and-flows-but-trend/article_5a867294-e248-11e6-804c-b3124640c2f3.html https://marketminute.longandfoster.com/Market-Minute/VA/Fairfax-County.htm https://www.nvar.com/realtors/news/market-statistics/market-statistics-march-2019 Note that I am not comparing the median of Moco with the average of Fairfax. I just can't find the numbers from 2007 to fairfax. HOWEVER: FFX average cost has surpassed the peak at 2007 by 5%. MoCo hasn't seem to do that (and I'm not sure the analysis is fully accurate). |

Anonymous

Just figured it out: MOCO average in 2007 was 550K. So the home sales average was comparable between the two counties in 2007. I'm not sure how it would be now (I can't find a current average, but I just want to clarify that the economics were not too different at 2007.) |

Anonymous

Much of the % increases in Arlington and Fairfax are due to tear downs/new builds, not equity increasing. I live on. DCUM “top district” in McLean and our “sh1tshack”. House has appreciated from about $750k to about $850k in that time period. |

Anonymous

|

We bought just off of H Street NE in 2009 for 430k and sold in 2016 for 780k. We used that equity to buy a SFH on the Orange Line in Arlington for 930k. We've sunk about 150k into improvements as the house was in rough shape. Neighbors just sold their impressively similar house in September for 1.3M.

I'm really surprised to hear that anywhere in the DMV is stagnant. That hasn't been our experience. |