Why don’t people understand that low rates work against them?

Anonymous

Ah, glad the sexism came out right away. Bravo. |

Anonymous

This. |

Anonymous

| I don’t agree with any of this. Sure if rates go up you (specifically) may buy less house (to keep monthly pmt the same) but it’s not like there won’t be a buyer for the $1.5 mil house that sold when rates were lower. It just may be a different person. In some areas of the country, the distribution of buyers may be degenerate (no pun intended) but probably not here in the DMV. A richer person will buy that house at a higher rate just like you’ll buy a cheaper house too. |

Anonymous

Very well said! |

Anonymous

Ta-da!

|

Anonymous

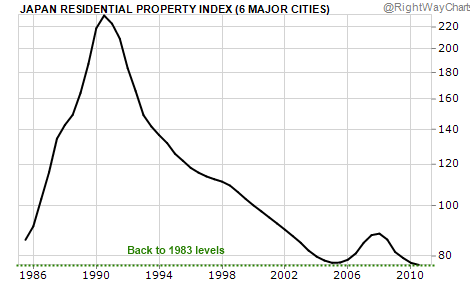

Your evidence is that Japan cut interest rates in the early 1990s and yet prices continued their steep decline for another decade? |

Anonymous

| OP is dumb. Low supply with high demand leads to increased prices. It's a supply issue, not an interest rate issue. But OP is too enamored with himself to look beyond his middle school reasoning. |

Anonymous

This is another of those unconvincing insult posts. It's clearly both a supply AND interest rate issue. Cheap mortgages is one of the whole reasons for Fed policy to lower interest rates in the first place. It is widely accepted that cheap mortgages has led to inflated real estate prices. The question is really whether those prices will stay inflated as interest rates rise. Maybe the supply crunch will keep home prices up, but interest rates will always be a factor in home purchase decisions. |

Anonymous

That math is pretty simple. |

Anonymous

I don’t know why this response made me laugh so hard. |

Anonymous

Dumb or not, I’m saying the truth. You’re so scared by that truth that you resort to bullying. You clearly have middle school mentality and development. Maybe you are just a tween. Best I not deal with minors such as yourself. |

Anonymous

And who told you I’m a ‘he’? You in love with your daddy? |

Anonymous

Wow, the "higher interest rates don't matter" posters are wild. Who knew. |

Anonymous

+1! |

Anonymous

I don’t think they’re wild, just bad actors. Every real estate agent I know would tell you ‘it’s a great time to buy! Rates are so low!’ |